INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Cloud communications platform provider SendGrid Inc., best known for its email distribution services, saw its shares rise in early trading by 16 percent from their initial offering price as the company sold shares publicly for the first time today.

The stock ended the day at an even $18 a share, up almost 13 percent. Listing under the symbol “SEND,” SendGrid raised $131 million late Tuesday as it sold 8.2 million shares of common stock at $16 a share in an initial public offering. That was above its expected range of $13.50 to $15.50 a share.

The offering and the rise in the stock price are yet another sign of investors’ growing appetite for business-oriented tech IPOs. The last major one, database company MongoDB Inc., saw its shares jump 34 percent on the first day of trading in mid-October, and cybersecurity firm ForeScout Technologies Inc. floated late October to a receptive market. Earlier in the year, MuleSoft Inc.’s shares popped 44 percent the first day.

So far, 2017 has been a relatively healthy year for IPOs after a much-publicized IPO drought last year. However, the enthusiasm has been focused more on enterprise tech companies than consumer-oriented ones such as those from Snap Inc. and Blue Apron Inc., which have seen shares fall or stay relatively flat following their IPOs.

The flurry in IPOs is credited by some to be representative of positive global economic fundamentals, with one research firm predicting that IPOs worldwide will hit a staggering $3.2 trillion in 2018.

But others believe that this activity is a sure sign that the market is experiencing a bubble that is bound to burst. A record 48 percent of investors polled in the Bank of America Merrill Lynch’s November Fund Manager Survey said that they believed that the market was currently experiencing a bubble, but likewise most continue to invest is the same markets despite their skepticism.

As for SendGrid, Will Conway, chief executive officer at Mailgun Inc., told SiliconANGLE that its float of demonstrates how email is “still the most trusted form of business communication,” which is why it continues to grow despite the popularity of in-app messaging and SMS.

“It’s one of the last immediate forms of asynchronous communication not requiring a gateway,” Conway said. “Anyone can send me an email regardless of their communication platform, and I can choose to discard it, reply to it, or notify my provider that it’s spam. How many messaging platforms are as regulated as email while still remaining industry and technology agnostic?”

“What’s exciting about SendGrid’s IPO is that it’s validating the developer SaaS market and, more specifically, the email developer SaaS market,” Conway added.

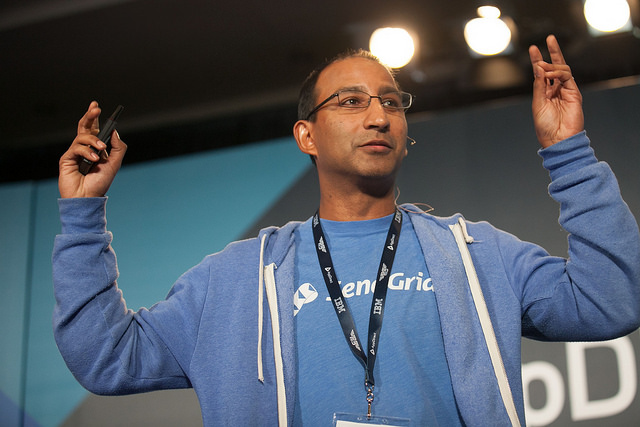

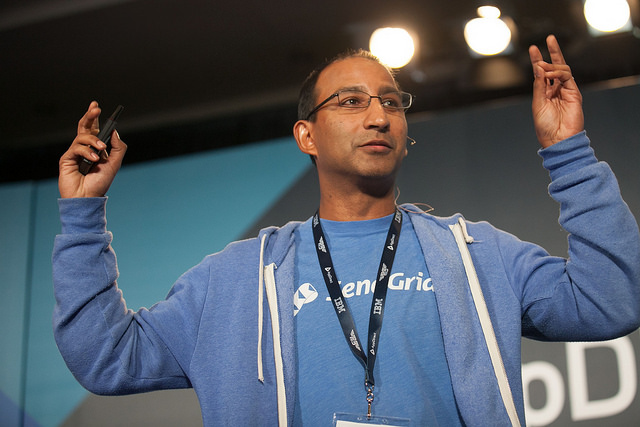

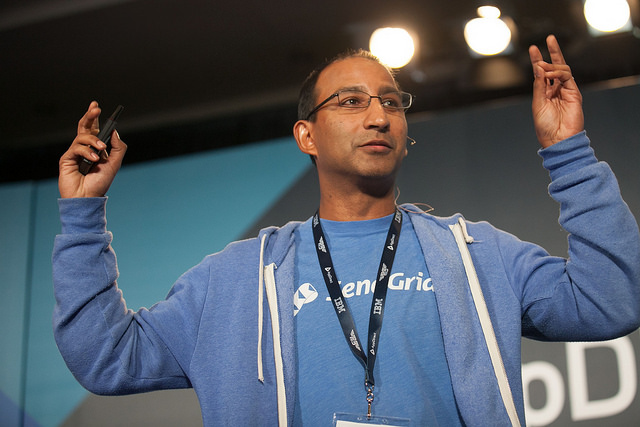

SparkPost Inc. CEO Phillip Merrick was also positive on the float despite, or perhaps because, SendGrid is a competitor, wishing SendGrid CEO Sameer Dholakia (pictured) and his team well. “Software touches every part of our lives — from enterprise work apps, to social networks, to buying a home or finding a job,” he said. “As our use of these services increases, so too does our reliance on email updates and notifications.”

Morgan Stanley & Co. LLC and J.P. Morgan Securities LLC are leading the SEND offering, with William Blair & Co., KeyBanc Capital Markets Inc., Piper Jaffray & Co. and Stifel, Nicolaus & Co. acting as co-managers.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.