INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Wall Street threw a party today, but IBM Corp. ended up with the hangover.

On a day when the Dow Jones soared more than 500 points, IBM shares fell more than 4 percent in immediate after-hours trading on fiscal second-quarter earnings results that missed in nearly every category. Update: In Wednesday trading, shares were falling more than 6 percent.

The company broke its three-quarter string of revenue growth with a 2 percent drop in total revenue to $18.76 billion, down from $19.15 billion a year ago. Analysts had been expecting $19.1 billion. IBM blamed the shortfall on exchange rates, but analysts had already factored that variable into their equations.

IBM breaks out its revenues by category of product, and the news was bad in most of them. Most notably, Cognitive Solutions revenues fell 5 percent, to $4.15 billion, against analyst estimates of $4.3 billion. That division, which includes IBM’s analytics business as well as the Watson cognitive computing platform, was pulled down by weakness in some horizontal categories such as collaboration, commerce and talent management, said Chief Financial Officer James J. Kavanaugh.

Despite declaring analytics and big data as being essential to its future, IBM has struggled to show much growth in the business. But Charles King, president and principal analyst at Pund-IT Inc., said those markets are still in early stages. “The company’s focus on industry-specific offerings should deliver solid results as the markets and demand for those solutions grow,” he said.

Weakness in analytics is a concern, but IBM’s services organization and large customer base can compensate, said David Vellante, chief analyst at research firm Wikibon and co-chief executive of SiliconANGLE Media Inc. The company has failed to package Watson effectively as a product and still delivers its capabilities primarily through its services organization, Vellante said. Its analytics portfolio, which includes many acquired products, “might fit together in an IBM PowerPoint but it’s sometimes confusing and difficult to understand,” he said.

Technology Services & Cloud Platforms, which makes up nearly half of IBM’s revenue, slipped 2 percent, to just under $8.3 billion. Analysts were expecting $8.43 billion. Global Business Services and systems revenue edged up slightly, but both missed analysts’ forecasts.

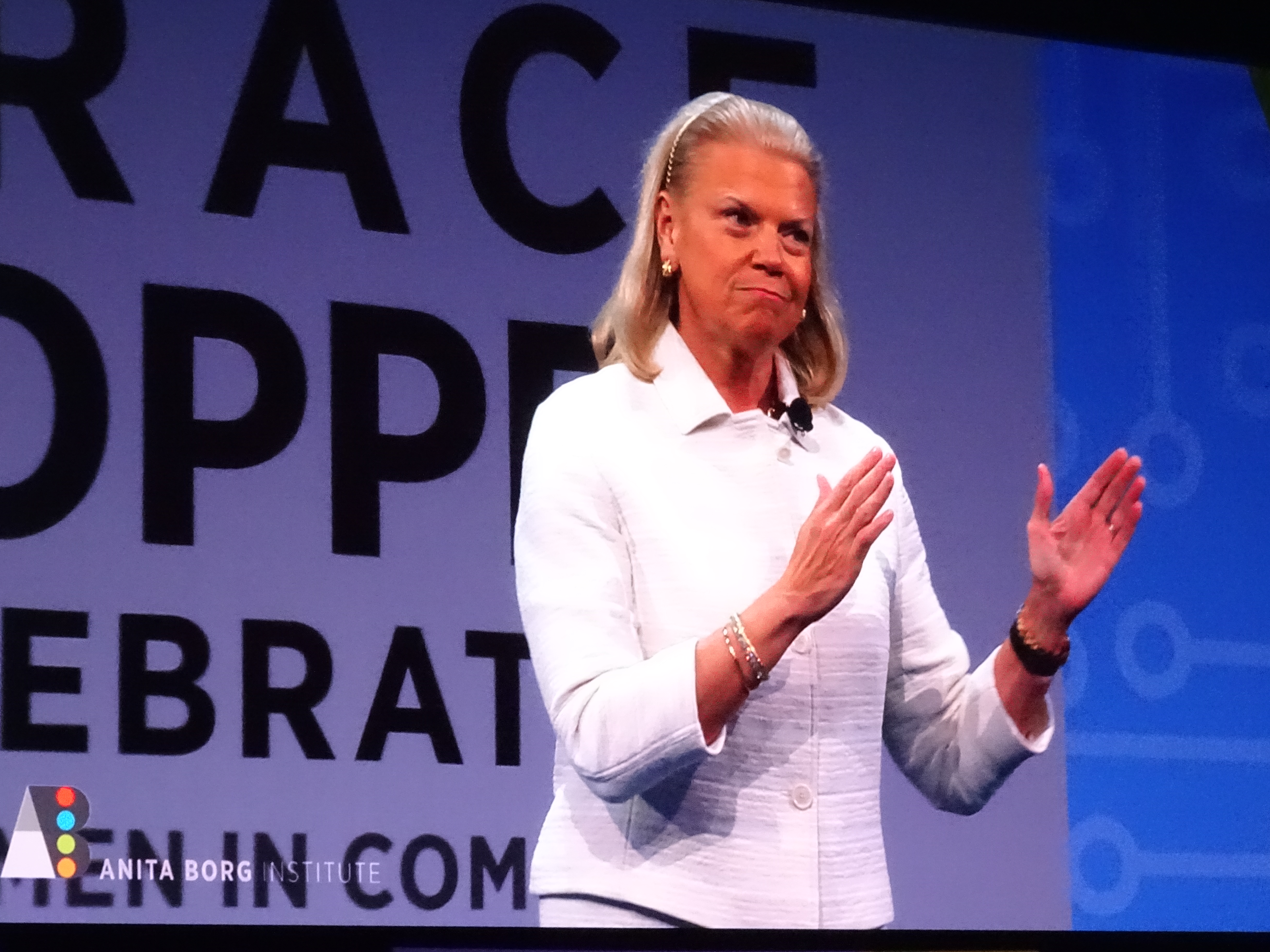

There was some good news. Adjusted earnings per share of $3.42 came in slightly above estimates of $3.40, gross margins improved and revenues for the company’s “strategic imperatives” of analytics, cloud and software-as-a-service are up 11 percent in constant currency, to $39.5 billion, over the past 12 months. “Our leadership in the technology and services that deliver hybrid cloud, AI, blockchain, analytics and security has helped drive our overall performance,” CEO Ginni Rometty (pictured) said in a prepared statement.

IBM also said full-year cloud revenues rose 20 percent, to $19 billion, with nearly 60 percent of those sales coming from products delivered as a service, which provides an ongoing annuity stream. Free cash flow also rose, to $12 billion on an annualized basis.

But all eyes have been on the top line since the company broke a 22-quarter-long revenue decline in last year’s fourth quarter. “I think investors could be restless looking for overall revenue growth even though strategic imperative are up,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy Inc.

On the company’s conference call with analysts, Kavanaugh acknowledged that “we fell short in the third quarter on signings” but said the long-term outlook remains strong and “we expect that we will grow” this year. “We had a solid quarter,” Kavanaugh said. “We delivered $18.8 billion in revenue, but the headline overall is that we fundamentally took the actions to overhaul our business.”

For example, he said, IBM has responded to weakness in some of its software applications by “modernizing and infusing with AI.” As a result, “We’re starting to see some green shoots, but because the time to value in longer in SaaS, we will see this play out in 2019.”

The earnings news came a day after IBM introduced a trio of new products for managing multivendor artificial intelligence, cloud and security environments. Having failed to break into the top echelon of infrastructure-as-a-service providers, the company’s strategy is increasingly centered on selling services to its existing customer base.

“IBM hates it when people say this, but it’s true: The majority of revenue still comes from services,” Vellante said. “Services means helping clients get from point A to point B and that’s certainly multicloud.”

The numbers agree. IBM’s annual run rate of “as-a-service” cloud products hit $11.4 billion in the quarter, up 24 percent year-over-year in constant currency. Gross profit margins also expanded across the board in its services businesses.

“IBM was ahead of the game in recognizing and then adapting to its customers’ preference for using multiple cloud platforms,” Vellante said. “Positioning itself as the company that can best enable and ease the complexity of multicloud is a sensible place to be.”

Does all this add up to a resumption of growth? Vellante thinks it’s unlikely IBM can grow much faster than the economy as a whole, given its already massive reach. “It’s not in a great position to gain share,” he said.

THANK YOU