CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Computer networking giant Cisco Systems Inc. hosts its annual analyst meeting along with a major product announcement Wednesday, where it will face a number of tough questions on how it plans to evolve its business as it heads into a new era of cloud transformation.

In his latest Breaking Analysis video, Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon and co-host of SiliconANGLE’s video studio theCUBE, notes that Cisco is one of several traditional tech firms that has found that its old way of doing business is coming under threat from the new cloud model.

As enterprises shift their information technology infrastructure to the cloud, there are fears that the likes of Cisco will be left out in the cold as its on-premises data center products are no longer required, or at least not in the volumes of past decades.

The good news for Cisco is that the latest spending data from Enterprise Technology Research shows that this transformation is a slow one, and that it’s generally managing to hold its own even as more money goes to cloud providers such as Amazon Web Services Inc.

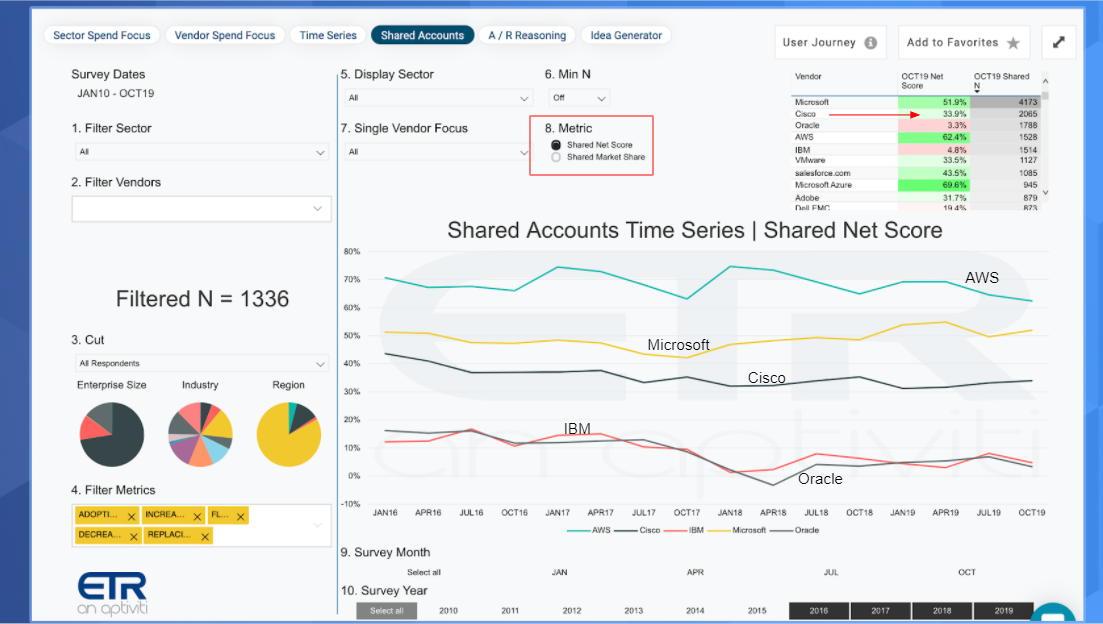

“Cisco generally has held up from a pervasiveness perspective despite the steady rise in AWS’ market share,” Vellante said. “So Cisco is clearly a leader and is maintaining its leadership position.”

Not only does it remain a leader, but Cisco also continues to show reasonable spending momentum, with a 34% Net Score according to ETR’s data. Net Score is an important metric to look at because it’s a simple but effective way to gauge spending momentum on a specific company, by essentially subtracting the percentage of customers spending less from those spending more.

“[Cisco’s] not nearly as high as AWS and Microsoft but it’s still very respectable and holding fairly strong,” Vellante said. “It’s notably ahead of IBM and Oracle, which are both in the red area, signaling caution.”

That’s all well and good, and should give Cisco the breathing space it needs to shift its business away from its traditional on-premises networking market.

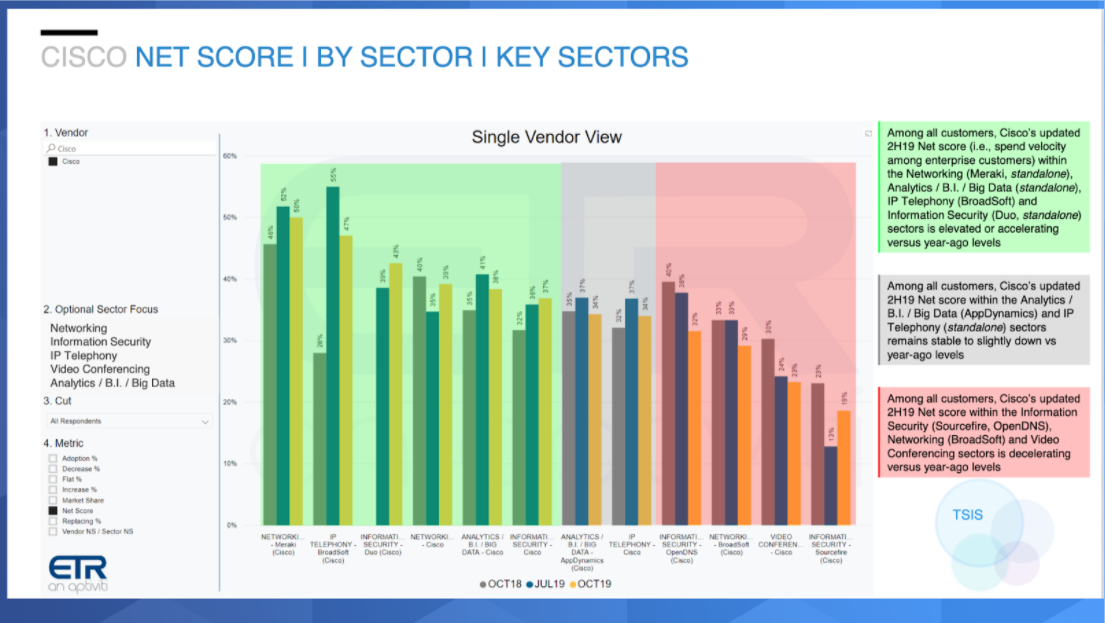

Cisco does still need to move quickly, but it hasn’t been standing still. Indeed, ETR’s data shows that Cisco has diversified into a number of new business segments including analytics, security and telephony. This diversification, along with its continued strength in its core markets of networking, servers, storage, video conferencing and virtualization, has helped Cisco to expand its total available market while maintaining its leading position in the data center.

“Meraki, which includes Cisco’s wireless business, the telephony business, security, core networking, they are all showing strength,” Vellante said. “Parts of its security portfolio, like OpenDNS and Sourcefire, and its voice and video assets are showing slower momentum. But overall, Cisco’s spending momentum is holding on pretty well.”

Cisco’s main strategy with cloud has been to transform itself into more of a software company, with a focus on selling more licenses and subscriptions, Vellante said. The company sees a big opportunity for itself in multicloud in particular, though it faces tough competition from the likes of Google LLC, Microsoft Corp., VMware Inc. and IBM Corp.’s Red Hat.

“Cisco is coming at this opportunity from its networking strength and has a more than a fighting chance,” Vellante said. “That’s because Cisco is in the best position to connect multiple clouds to on-prem infrastructure and convince buyers that it’s the best partner to make networks higher performance, more secure and the most cost-effective.”

Vellante noted that Cisco has missed some big opportunities along the way — most notably in virtual machines, where it lost out to VMware — and in acquiring Nicira, which VMware also snagged. That has created cracks in Cisco’s armor.

Still, he said, Cisco is extremely well-placed to compete in the emerging edge computing market. The reason is that Cisco is pretty much the only traditional company that has a solid developer strategy through its DevNet initiative to make all of its products programmable.

“What Cisco is doing is taking Cisco Certified Engineers and retraining them and teaching them how to code on Cisco products,” Vellante said. “Cisco products are designed to be programmable, so they have a developer play and I say the edge will be won by developers.”

Here’s Vellante’s full analysis:

THANK YOU