INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Computer chip maker Advanced Micro Devices Inc. delivered strong fourth quarter revenue and profit today, easily beating analysts expectations.

The company reported a profit before certain costs such as stock compensation of 52 cents per share on revenue of $3.24 billion. Wall Street had been modeling a profit of 47 cents per share on $3.03 billion in sales.

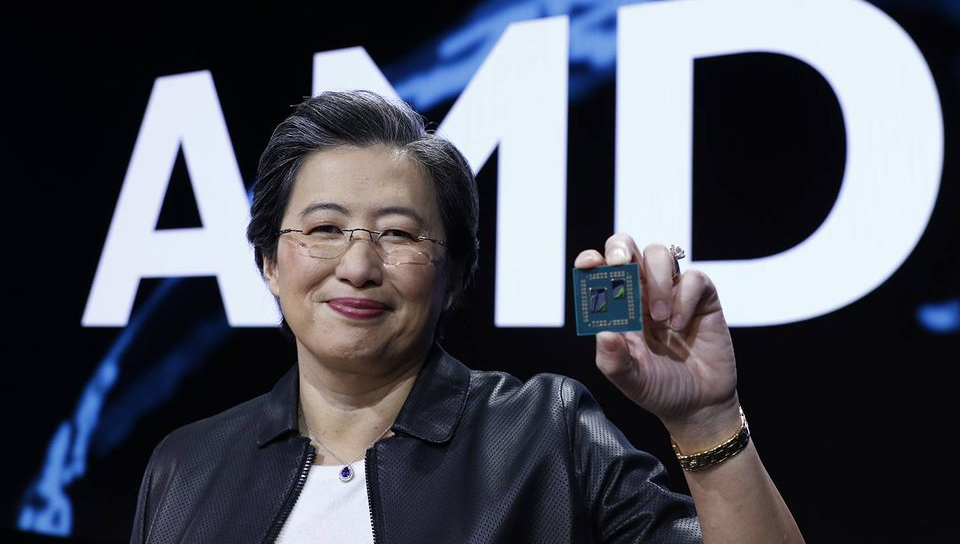

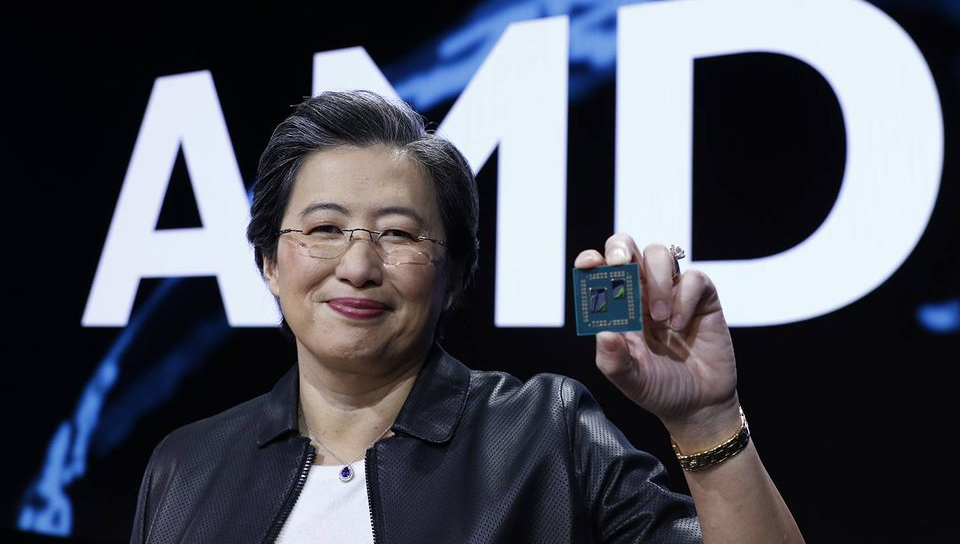

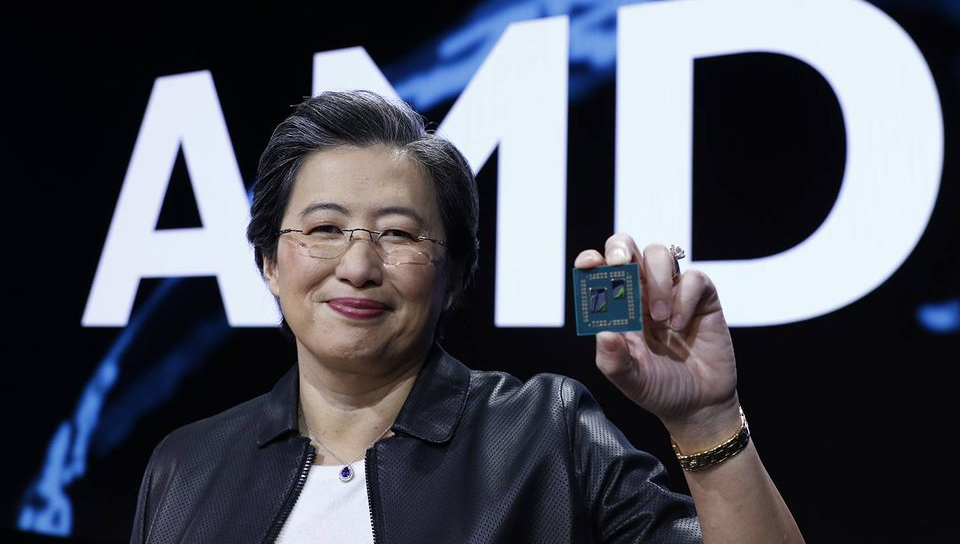

AMD Chief Executive Lisa Su (pictured) said the company “significantly accelerated our business in 2020, delivering record annual revenue while expanding gross margin and more than doubling net income from 2019.”

A breakdown of AMD’s revenue by business segment reveals strong sales across the board. Its Computing and Graphics business reported revenue of $1.96 billion, up 18% from the year before, thanks to strong sales of its Ryzen processors. Meanwhile sales of server and semicustom chips, including AMD’s EPYC server chips, rocketed 176% from a year ago, to $1.28 billion.

Su said in a conference call that the gaming business got a huge boost from the release of Microsoft Corp.’s and Sony Corp.’s new Xbox and PlayStation 5 games consoles.

“Our semicustom sales are ramping faster than the last console cycle, and we expect sales to be better than typical seasonality in the first half of this year, based on the current strong demand,” Su said.

As for servers, Su said both cloud and enterprise sales were strong during the quarter. “Google, Microsoft, Tencent and others continue expanding their use of Epyc processors to power larger portions of their critical internal infrastructure and the number of AMD powered cloud instances expands,” she said.

AMD has taken advantage of the turmoil at its main rival Intel Corp., which has lost market share after repeated delays with its next-generation manufacturing process. Earlier this month Intel announced that its incumbent CEO Bob Swan would step down in favor of VMware Inc. boss Pat Gelsinger.

Last October, AMD said it would acquire the programmable chip specialist Xilinx Inc. for $35 billion, a move that may help it to steal more customers away from Intel. Xilinx specializes in manufacturing field-programmable gate arrays that can be reprogrammed for different computing tasks on the fly, and Intel is its main rival in that market.

Su gave analysts an update on that acquisition during the call, saying that it has passed “several important regulatory milestones” already and remains on track to close by the end of the year.

Constellation Research Inc. analyst Holger Mueller said AMD is firing on all cylinders with its annual revenue falling just shy of the $10 billion mark.

“Good cost management while growing has allowed AMD to more than double its operating income,” Mueller noted. “It’s also good to see that its investments in R&D outpaced the growth in sales and marketing costs, which shows it’s managing those costs well while investing in its future product pipeline. With the acquisition of Xilinx just around the corner, all the signs point to more growth for AMD in 2021.”

That should become apparent fairly soon. AMD said it sees first-quarter revenue of between $3.1 billion and $3.3 billion, way above Wall Street’s forecast of $2.7 billion.

For the full year, AMD is forecasting revenue of $13.37 billion, which would amount to growth of 37%. Wall Street had forecast full-year revenue of $12.26 billion.

“Our 2021 financial outlook highlights the strength of our product portfolio and robust demand for high-performance computing across the PC, gaming and data center markets,” Su said.

AMD’s stock initially rose 4% in after-hours trading but lost those gains later.

Pund-IT Inc. analyst Charles King said the lost gains may have been due to investors deciding that it’s wise to take some profits now rather than bet on the future.

“The company’s strong performance in the past quarter and positive outlook for the future were gratifying,” he said. “But continuing uncertainties about the pandemic are still sparking concerns about the months and year ahead.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.