CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

In the year 2020, it was good to be in tech. It was even better to be in the cloud as organizations had to rely on remote cloud services to keep things running.

We believe tech spending will increase 7% to 8% in 2021, but we don’t expect investments in cloud computing to attenuate as workers head back to the office. This is not a zero-sum game and we believe that pent up demand in on-premises data centers will complement those areas of high growth that we saw last year, namely cloud, artificial intelligence, security, data and automation.

In this Breaking Analysis we’ll provide our take on the latest Enterprise Technology Research COVID-19 survey and share why we think the tech boom will continue well into the future.

Fitch ratings has upped its outlook for global GDP to 6.1% from January’s 5.3% projection. We’ve always expected tech spending to outperform GDP by at least 100 to 200 basis points and we think 2021 could see 8% growth for the sector. That’s a massive swing from last year’s 5% contraction and it’s being powered by spending in North America, a return of small businesses and the massive fiscal stimulus injection from the U.S.-led central bank actions.

As we’ll show you, the ETR survey data suggests that cloud spending is here to stay and a dollar spent back in the data center doesn’t necessarily mean less spending on digital initiatives generally and cloud specifically. Moreover, we see pent up demand for core on-prem data center infrastructure, especially in networking.

One caveat: We continue to have concerns for the macro on-prem data storage sector. There are pockets of positivity — for example, Pure Storage Inc. seems to have accelerating momentum — but generally the data suggests the cloud and flash headroom continue to pressure spending.

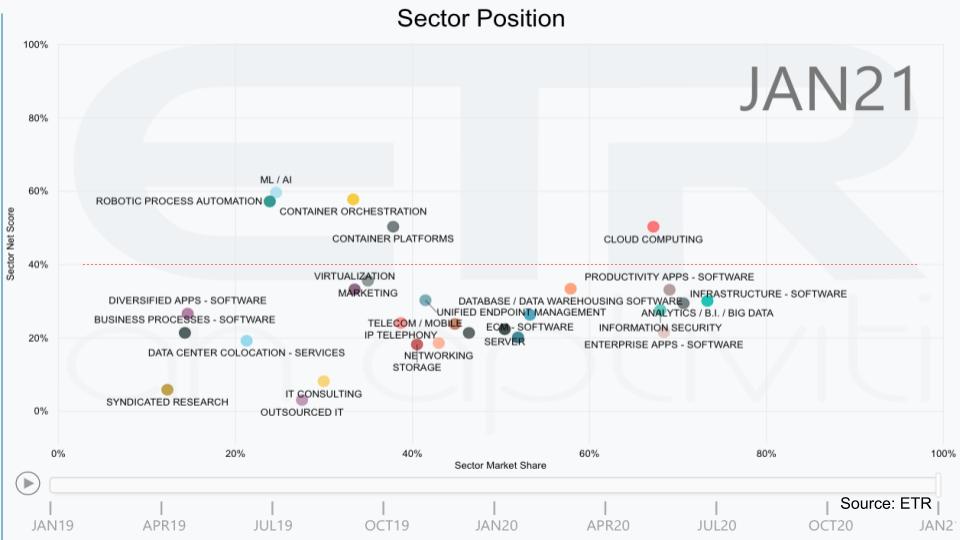

We don’t expect the stock market’s current rotation out of tech changes the fundamental spending dynamic. We see cloud, AI and machine learning, and robotic process automation still hovering above the 40% Net Score line, which measures spending momentum. As well, information technology buyers cite cybersecurity and collaboration investments as high priority initiatives. And we see continued spending on application modernization in the form of containers.

If you’ve been following the market, you know that the rate on the 10-year Treasury note has been rising. This is important because the 10-year is a benchmark and affects other interest rates. As interest rates rise, high-growth tech stocks become less attractive and that’s why there has been a rotation out of the big tech highflier names of 2020.

Why do high-growth stocks become less attractive to investors when interest rates rise? It’s because investors are betting on the future value of cash flows for these companies. And when interest rates go up, the future values of those cash flows shrink, making the valuations less attractive.

For example, take Snowflake Inc., a company with a higher revenue multiple than pretty much any other tech stock. Its revenue is growing at more than 100% and the company is projected to have revenue of a billion dollars next year. On March 8 Snowflake was valued at around $80 billion, trading at about 75 times forward revenue. Today, Snowflake is valued at about $50 billion or roughly 45 times forward revenue. The downward pressure can largely be explained as investors calculating that, with rising interest rates, the future value of Snowflake’s cash flows should be discounted.

Moreover, lower-growth companies that throw off more cash today become more attractive in a rising rate climate because the cash they throw off today will be more valuable than it was in a low-rate environment.

So the point is this is math, not fundamental changes in the technology industry. We saw those fundamentals shift last year and we believe the digital business play has a long way to go.

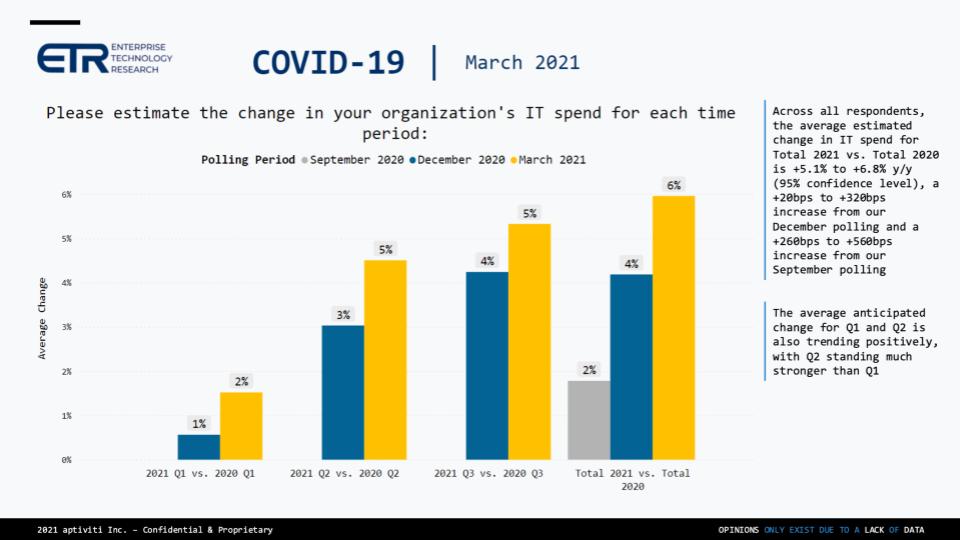

The chart above shows the progression of chief information officer expectations for spending relative to previous years. You can see the steady growth in expectations each quarter, hitting 6% growth in 2021 versus 2020 for the full year. ETR estimates with a 95% confidence level that spending will be up 5.1% to 6.8%. We are even more optimistic, accounting for recent upward revisions in GDP and spending outside the purview of traditional IT, which we think will be a tailwind thanks to digital initiatives and shadow tech spend.

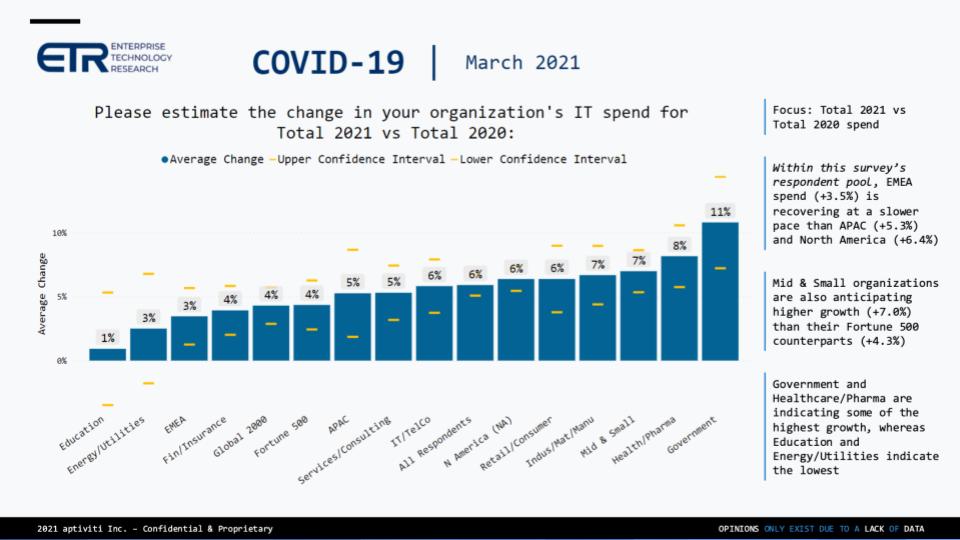

As shown in the chart below, government spending leads the pack by a wide margin, which probably gives you a bit of heartburn. I know it does for us. Health care is notable, perhaps because of pent-up demand. Healthcare has been so busy saving lives that it has some holes to fill. But look at the sectors at 5% or above. Only education lags, and even energy, which got crushed last year, is showing a rebound.

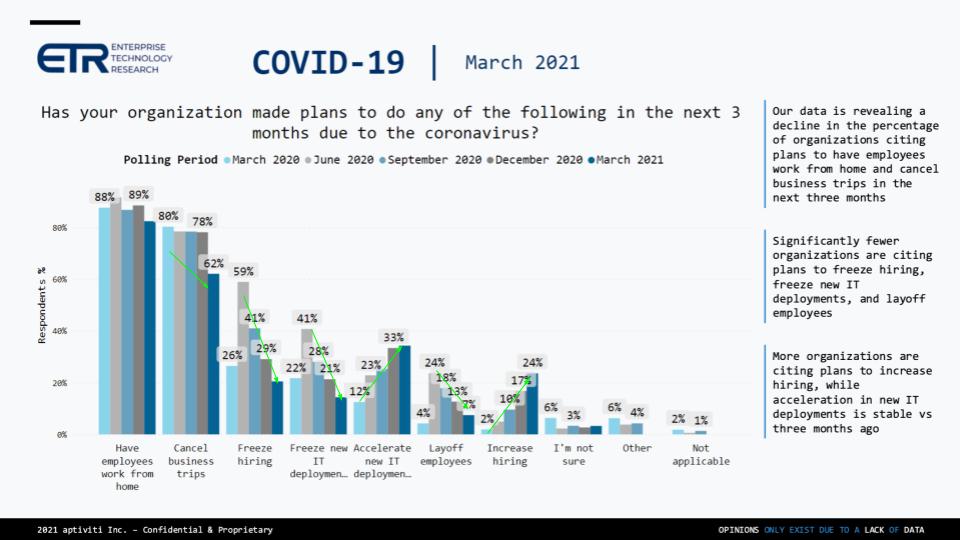

The picture below is quite positive in our view. It shows the responses over five survey snapshots starting in March of 2020. After a second-quarter 2020 spike in caution, the outlook has steadily improved for tech spending.

Most people are still working from home – that really hasn’t changed. But we’re finally seeing some loosening of the travel restrictions imposed last year. There’s a notable drop in cancelled business trips – still high but promising.

Quick related aside: It looks like Mobile World Congress is happening in late June in Barcelona. The host of the conference just did a show in Shanghai and 20,000 attendees showed up. SiliconANGLE’s video studio theCUBE is planning to be there along with TelcoDR, which took over Ericsson’s 65,000-square foot space when it tapped out of the conference. We’re going to lay out the future of the digital telco in a hybrid physical/virtual event with the ecosystem of telcos, cloud, 5G and software communities. We’re very excited to be at the heart of reinventing the event experience for this decade.

OK, back to the data: Hiring freeze data — way down. New IT deployments – flat from last quarter but big uptick from a year ago. Layoffs way down, along with hiring momentum. So there are really positive signs for tech here.

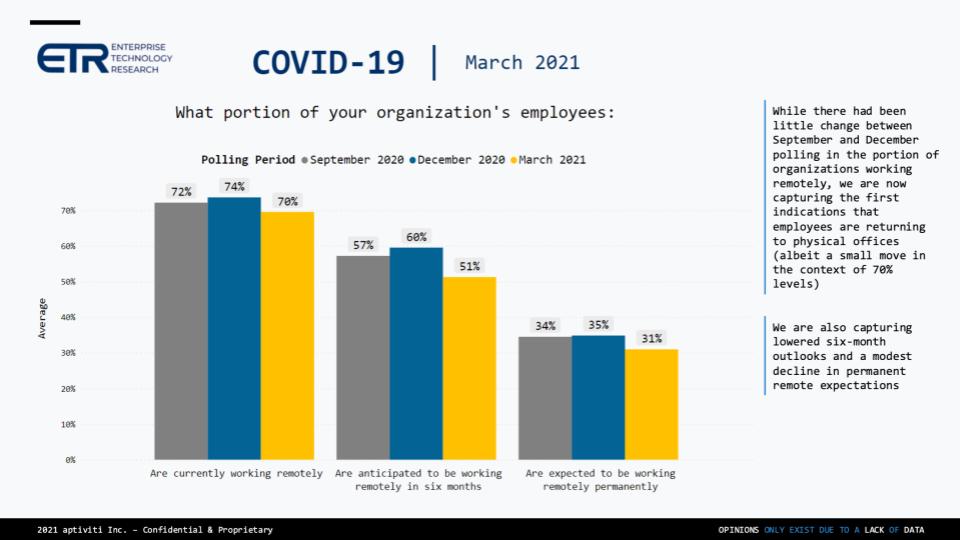

We’ve been sharing this data for several quarters now. Remember the earlier projections showed pre-pandemic remote worker levels to be around 15% to 16%.

We shared previously that CIOs expected the figure to slowly decline from the 70%+ pandemic levels and eventually settle in the mid-30s. The current survey as shown above indicates 31%, so exactly double from pre-COVID levels. We think the figure could go higher and land in the upper 30s because, across the board, organizations report big increases in productivity as a result of remote work practices and infrastructure that have been put in place. And many workers are expecting to stay remote.

So we’re a bit out on the limb here with our “cake and eat it too” scenario – meaning pent-up demand for data center infrastructure on-prem, combined with the productivity benefits of cloud and the digital imperative, will mean technology budgets will get a bigger piece of the overall spending pie, relative to other corporate initiatives. At least for the near term.

In other words, the rising tide of the post isolation economy will lift both cloud and on-prem boats.

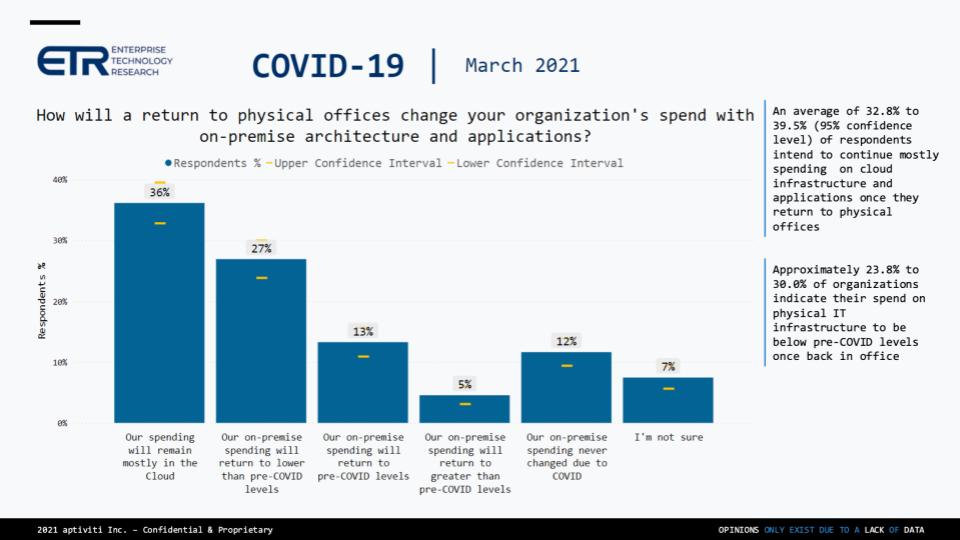

In the data shown above, ETR asked respondents about how the return to the office will impact on-prem architectures and applications.

Some 63% of respondents had a cloud-friendly answer as shown in the first two bars, whereas 30% had an on-prem-friendly answer as shown in the next three bars.

What stands out is that only 5% of respondents plan to increase their on-prem spend above pre-COVID levels.

In a Clubhouse session last week, Martin Casado and Ben Horowitz from Andreessen Horowitz were having a conversation about the coming cloud backlash and how cloud-native companies are spending so much money with Amazon Web Services Inc. that at some point, as they scale, they’re going to have to claw back technology infrastructure on-prem due to the AWS vig.

We’re skeptical. The spending data certainly does not suggest that is happening in the near term. So the cloud vendors will keep getting more volume, better prices and better economies of scale. And as we’ve pointed out, the repatriation narrative you hear from many on-prem vendors is dubious. In our view, if AWS, Microsoft Azure and Google Cloud can’t provide IT infrastructure and better security than we can on-prem, then something is amiss.

However, they are creating an oligopoly and limited competition could keep prices high. So they’d better be careful or they’ll become the next regulated utility.

So why are we optimistic that we’ll see a stronger 2021 on-prem spend if the cloud continues to command so much attention?

Well, first because nearly 20% of customers say there will be an uptick in on-prem spending. Second, we saw in 2020 that the big on-prem players — Dell Technologies Inc., VMware Inc., Hewlett Packard Enterprise Co., Oracle Corp. and SAP SE in particular — and even IBM Corp. made it through OK and has managed well through the crisis.

And finally, we think the lines between on-prem and cloud and hybrid and cross-cloud and edge will blur over the next five years, where traditional vendors will attack new opportunities to create value across clouds and hybrid systems.

Yes, there are risks to this scenario at the firm level, including Dell’s tough compares in personal computers, VMware’s management disruption, softness across the board in data storage and uncertainty related to IBM’s restructuring moves. Is there more to come? But although hypergrowth is not the operative description of these companies, we think they’re generally well-run and their managements are capable of executing.

And as the demarcation lines between cloud and on-prem become more gray, a hybrid world is emerging that will require hardware and software investments that reduce latency and are proximate to users, buildings and distributed infrastructure.

So we see spending in certain key areas continuing strong across the board that will require connecting on-prem to cloud and edge workloads.

The chart below shows where CIOs see the action.

Asked to cite the technologies that will get the most attention in the next twelve months, these seven technology domains stood out among the rest. It’s no surprise that cyber comes out as a top priority, with cloud pretty high as well. But interesting to see the uptick in collaboration and networking. Execs are seeing the importance of collaboration technologies for remote workers – no doubt lots of Microsoft Teams is in those numbers. But the pent-up demand for networking is notable too.

The chart below adds color to the spending dimensions. This data shows the Net Score or spending momentum on the vertical axis and the Market Share or pervasiveness in the ETR data set on the horizontal axis.

The big four areas of spend momentum are cloud, ML/AI, containers and RPA. These are results from the January survey and we don’t expect a big change in the upcoming April data – but we’ll see. These four stand out above the 40% red line that we’ve highlighted, which to us is an indicator of elevated spending momentum.

Note that on the horizontal axis, cloud is the only sector that enjoys both greater than 60% market share and is above the 40% Net Score line. So even though security is a top priority for CIOs, as we showed earlier, it competes with other budget items.

The rotation away from tech is not based on a fundamental change in spending; rather, it’s stock market valuation math. So there should be some good buying opportunities for you in the coming months as money moves out of tech into value stocks. But tech stocks are tricky right now. Last year it was easy to make money if you just bought high-growth and momentum tech stocks on dips. 2021 is not that simple, so do your homework and, as we like to stress, formulate a thesis and give it time to work for you. Iterate and improve on it, but stay current and be true to your strategy.

Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

THANK YOU