CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Despite all the chatter about cloud repatriation and the exorbitant cost of cloud computing, customer spending momentum continues to accelerate in the post-isolation economy.

If the pandemic was good for the cloud, it seems that the benefits of cloud migration remain lasting in the late stages of COVID-19. And we believe this stickiness will continue.

We expect infrastructure-as-a-service revenue for the Big 4 hyperscalers to surpass $115 billion in 2021. Moreover, the strength of Amazon Web Services Inc. specifically, but also Microsoft Azure, remain notable. Such large organizations showing elevated spending momentum, as shown in the Enterprise Technology Research survey data, is perhaps unprecedented in the technology sector.

In this Breaking Analysis we’ll share some fresh July survey data that indicates accelerating momentum for the largest cloud computing firms. Importantly, not only is this momentum broad-based, but it’s also notable in key strategic sectors, namely artificial intelligence and databases. In this post, we’ll pay particular attention to AWS, with a further drill-down into the database spending for both AWS and Microsoft.

There’s plenty of buzz about repatriation and the “cloud tax,” but other than wildly assumptive valuation models and some small pockets of anecdotal evidence, you don’t see the supposed backlash hurting cloud momentum.

Our forecast calls for the Big 4 hyperscalers, AWS, Azure, Alibaba Cloud and Google Cloud Platform to surpass $11 billion in IaaS revenue this year.

The latest ETR survey shows that AWS Lambda has retaken the lead as the cloud service with the most spending momentum among all major cloud services that are tracked in the dataset.

Microsoft Azure overall, Azure Functions, VMware Cloud on AWS and AWS overall also demonstrate highly elevated spending performance, all above the momentum of Google Cloud Platform.

Impressively, AWS’ momentum in the all-important Fortune 500, where it has always shown strength, is actually accelerating.

One concern in the most recent survey data is that the on-premises clouds and so-called hybrid platforms, which we had previously reported as showing an upward spending trajectory, seem to have cooled off a bit. But it’s mixed and a bit too early to draw conclusions. Nonetheless, while hyperscalers are holding steady, the spending data appears to be somewhat tepid for the on-prem players’ cloud platforms. We’ll study that further after ETR drops its full results on July 23.

The AWS cloud is showing strength across its entire portfolio and we’ll show you that shortly. In particular, we see notable strength relative to others in analytics, AI and the all-important database category.

Aurora and Redshift are particularly strong, but several other AWS database services are showing elevated spending velocity, which we’ll quantify in a moment.

All that said, Snowflake continues to lead all database suppliers in spending momentum – by a wide margin, which again we’ll quantify in this post.

Before we dig into the survey data, let’s take a look at our latest projections for the Big 4 hyperscalers in IaaS.

As most of you know, we regularly track quarterly revenues for the largest four hyperscalers. Remember AWS and Alibaba IaaS data is pretty clean and reported in their respective earnings reports. We have to extrapolate Azure and GCP and strip out all the apps and certain other revenue to make an apples-to-apples comparison.

As you can see, we have the 2021 market exceeding $115 billion worldwide. That’s a torrid 35% growth rate on top of 41% in 2020 relative to 2019. Aggressive, yes, but the data continues to point us in this direction. Until we see some clearer headwinds, this is the call we’re making.

AWS is perhaps losing a share point or so this year, but it is so large that its annual incremental revenue is comparable to Alibaba’s and Google’s respective IaaS businesses in total. The Big 3 U.S. cloud companies all report end of July, while Alibaba is set for mid-August, so we’ll update these figures at that time.

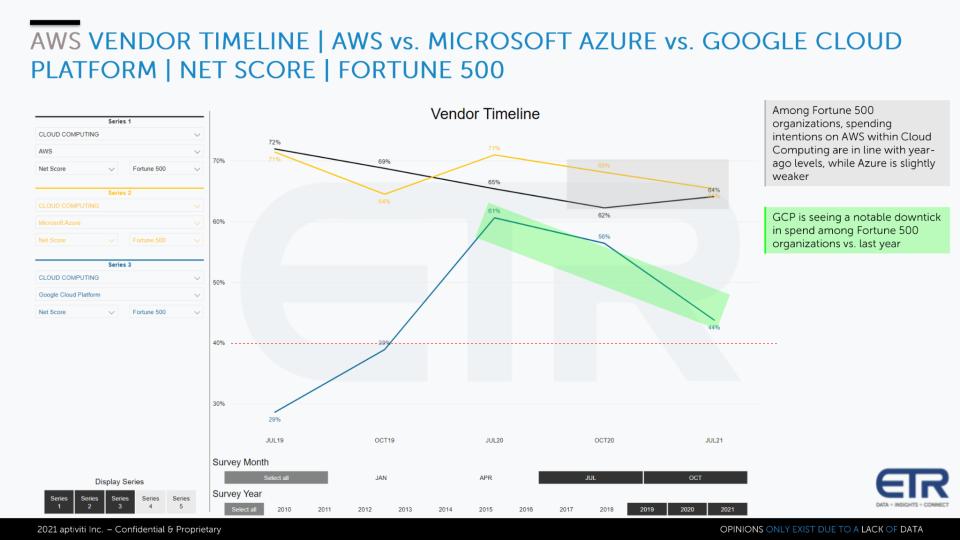

We don’t have enough survey sample yet on Alibaba and we’re limited as to what we can share until ETR drops its research update on July 23, but below is a look at the Net Score timeline in the Fortune 500 for the Big 3 U.S. cloud computing players. Azure is the yellow, AWS is black and GCP is blue.

Two points here stand out: 1) AWS and Microsoft are converging. And remember the customers who respond to the survey probably include a fair amount of application software spend in their cloud answers, so it favors Microsoft in that respect; and 2) GCP is showing notable deceleration in this important sector relative to the two leaders. The green call-out by ETR should be interpreted in the context of an AWS point of view. In other words, GCP declines are positive for AWS.

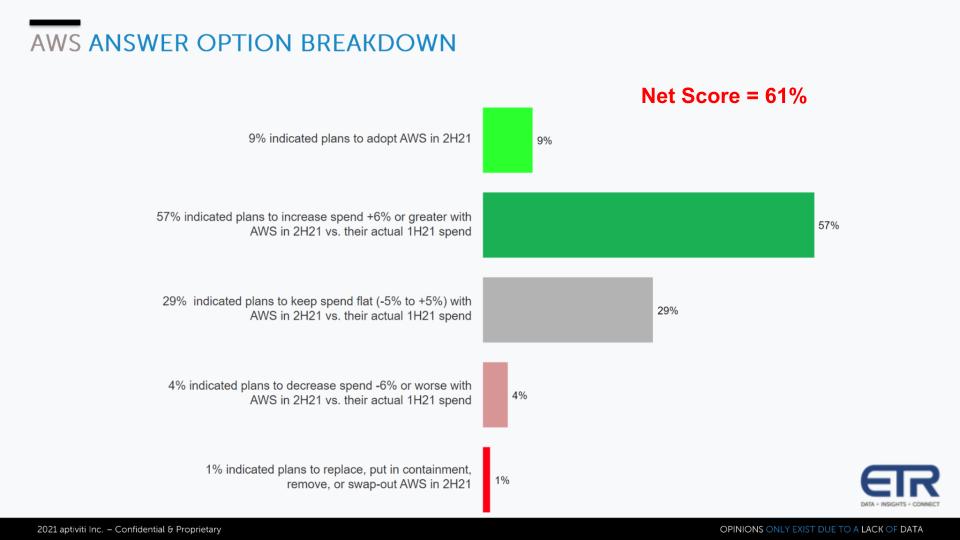

One of the fundamental metrics of the ETR methodology is Net Score. Below is the data granularity for AWS.

Net Score is calculated by asking customers if they are adding a platform new – that’s the lime green bar above. In this current survey, are you spending 6% or more in the second half relative to the first half of the year – that’s the forest green. Is spending flat – that’s the gray. Are you spending less – the pink — or are you replacing the platform – e.g. a proxy for repatriating.

As you see, there’s not much spending going to replacements. In fairness, 1% of AWS is $500 million, so we can see where some folks would get excited about that. But in the grand scheme of things, it’s a wafer-thin sliver of the pie.

Back to Net Score: Subtract the reds from the greens and you get Net Score, which in the case of AWS is 61%. Just for reference, our subjective elevated Net Score level is 40% – anything above that is really impressive based on our observations over the years. To have a company of the size of AWS be so elevated is notable. The same is true for Microsoft, by the way, which is consistently well above the 50% mark in Net Score. That’s perhaps even more impressive given that Microsoft’s overall revenue is approximately triple that of AWS.

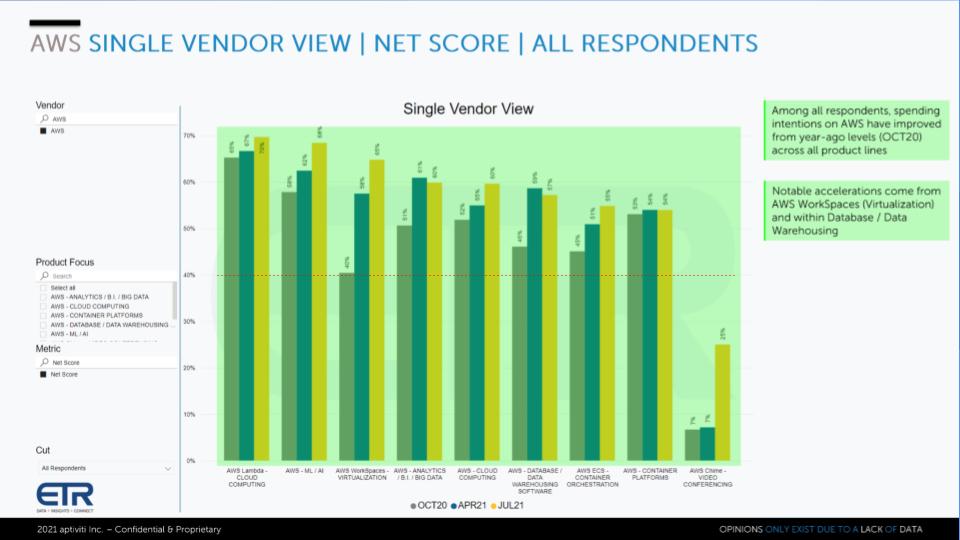

The chart below shows Net Score for the past three surveys.

Serverless is on fire – not just at AWS but at Azure and GCP as well. But look at the AWS portfolio above: Every category is well above the 40% elevated red line. The only exception is Chime and even Chime is showing an uptick– and Chime as a product can best be described as “meh.” Every other category is well above 50% Net Score.

As we’re frequently reported, AI is one of the four biggest focus areas from a spending velocity standpoint, along with cloud, containers and RPA. So it stands to reason that the company with the best AI and machine learning and the greatest momentum in that space has an advantage, as AI is being embedded into apps, data, processes and machines.

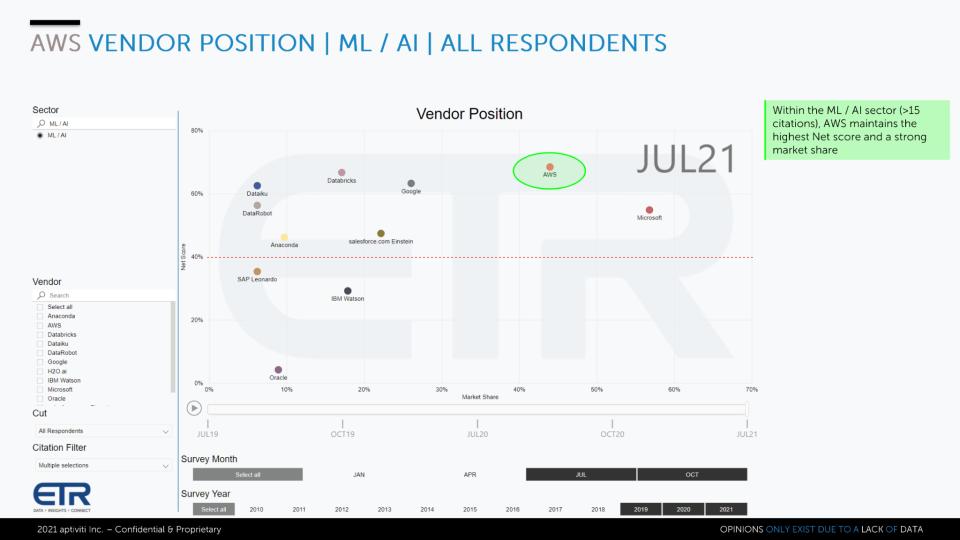

The chart above compares AI players along two dimensions – Net Score on the vertical axis and Market Share or presence in the data set on the horizontal axis. We’ve stripped out companies with fewer than 15 citations in the survey. For companies with more than 15 citations, AWS has the highest Net Score.

What’s notable is the presence on the horizontal axis. Databricks Inc., a company we’re high on, also shows elevated scores above both Google and Microsoft, which are showing strength in their own right. And you can see Dataiku Inc., DataRobot Inc., Anaconda Inc. and Salesforce.com Inc. with Einstein all above the 40% mark.

And you can see the position of SAP SE, IBM Corp.’s Watson and Oracle Corp., which is well below the 40% line.

Let’s take a closer look at the all-important database category and see what the spending data tells us.

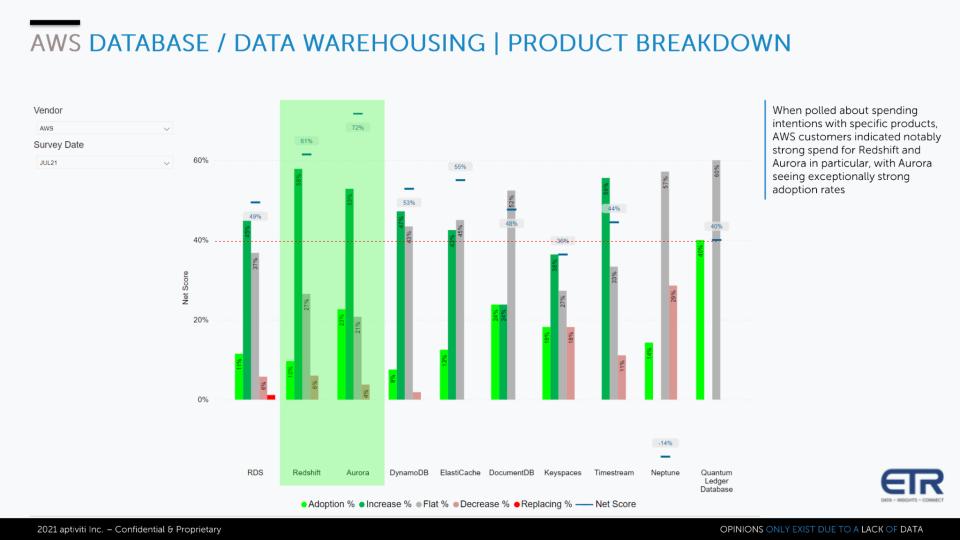

The chart above shows the services in the AWS database portfolio. It breaks down the Net Score components with the total Net Score calculation superimposed on the top of the bars.

Point one is that Aurora is highly elevated, with a Net Score above 70% due to heavy new adoptions. Redshift is also very strong, as are virtually all AWS database offerings with the exception of Neptune, which is its graph database. RDS, DynamoDB, ElastiCache, DocumentDB, Timestream and Quantum Ledger Database all show momentum above the 40% line.

So Although many criticize the fragmentation and excessive granularity of the AWS data portfolio and the “right tool for the right job” approach, the spending metrics tell a story that the strategy is working.

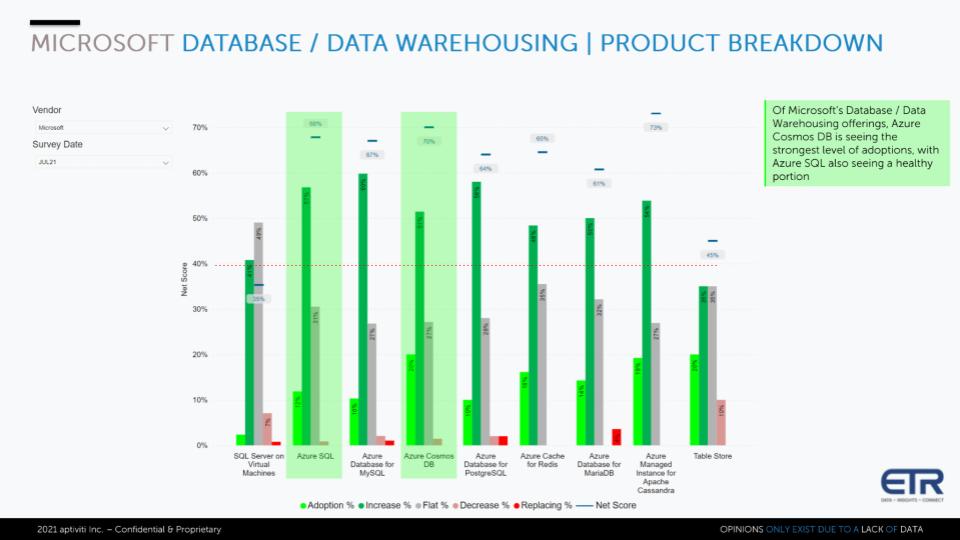

The chart below shows spending momentum across Microsoft’s cloud database portfolio. Azure SQL and Cosmos DB, Microsoft’s NoSQL distributed database are both very highly elevated, as are Azure Database for MySQL, PostgreSQL and MariaDB, including Azure Cache for Redis and Azure for Cassandra.

Microsoft is giving its customers lots of optionality. You know we’ve often said that Oracle’s strategy should be not just the cloud for Oracle databases but the cloud for all databases. It looks like Microsoft is beating Oracle to that punch… not that Oracle is going there but we think it should, in order to expand the appeal of its cloud.

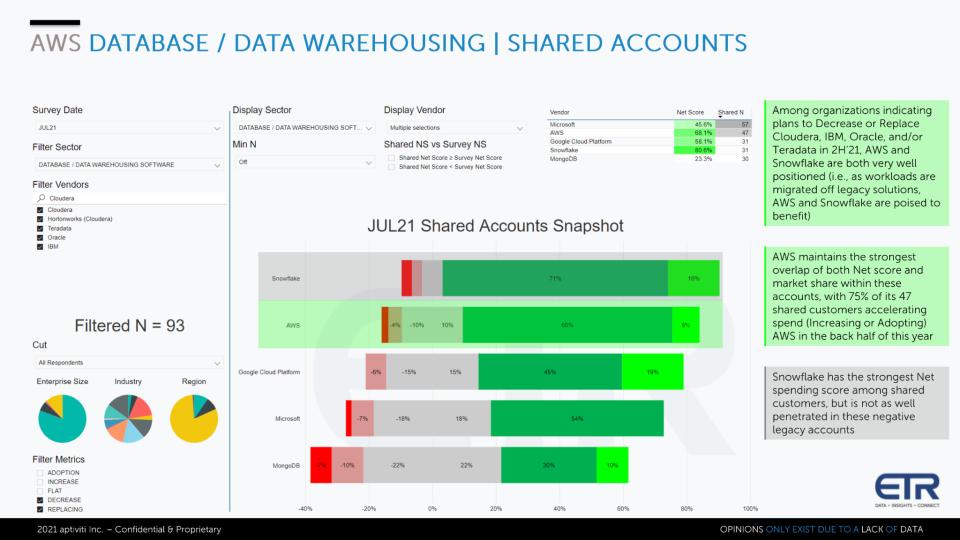

Despite the obvious momentum of both Microsoft and AWS cloud database offerings, Snowflake Inc. continues to impress. The chart below takes a look at the database market from a disrupter point of view. The data shows how the cloud database companies are performing in IBM, Oracle, Teradata Corp. and Cloudera Inc. accounts. The bars show the Net Score granularity as we described earlier for Snowflake, AWS, GCP, Microsoft and MongoDB Inc. within the accounts of these established, largely on-prem database platforms.

Note the table in the upper right of the chart. Snowflake has an 81% Net Score in these accounts, meaningfully higher than AWS’ highly elevated score of 68%. Followed by Google Cloud at 58%, Microsoft at 46% and MongoDB at relatively low 23%.

The Shared N column indicates the number of responses in these shared accounts. So with 47 responses, ETR rightly indicates that AWS is more deeply penetrated than Snowflake, but in our view, the presence of all six vendors, each with an N above 30, is relevant in that there’s enough sample to indicate a directional trend.

That is to say, Snowflake continues to outpace the competition and is marching onward toward its goal to get to $10 billion in revenue. In turn, the Big 3 cloud players have the market presence to compete effectively and continue to grow. Surprisingly, MongoDB spending momentum appears light in these legacy accounts.

One other note: We’re not sure Cloudera fits into the legacy database category with those others, but that’s how ETR cut the data so we’ll make some observations there. Cloudera is strongly positioning its CDP offering as a hybrid platform – as are most of the on-prem players with their respective platforms. One trend to watch is the moves of the cloud-native database players.

Snowflake, for example, has said it’s not straddling cloud and on-prem, rather it’s all-in on cloud. Microsoft clearly has feet in both camps. We’ll see how fast AWS moves its database services to the edge with offerings such as Outposts, which currently supports MySQL and Postgres via RDS, as well as Microsoft SQL Server. And Google appears to be relying on Anthos for its on-prem/hybrid strategy in an approach that’s quite different from Outposts.

The point is, there’s a big opportunity to connect on-prem to the cloud and across clouds, which Snowflake is pursuing, as are Cloudera, IBM, Teradata, Oracle and others. Snowflake is betting heavily on simplicity and incremental use cases that involve data sharing and federated governance, while traditional players are protecting their turf and at the same time trying to compete in cloud native and across clouds. We think there’s room for both approaches but clearly as we’ve shown, cloud has the spending velocity as a tailwind at its back.

We continue to watch the cloud repatriation trend – or lack thereof. Snowflake for its part has renegotiated cloud contracts to lower its costs so cloud expense is clearly an issue for such an independent software vendor. The question is: Will it someday in the future catalyze a change in strategy? Our current position is that’s doubtful in the near- to mid-term.

AWS, along with Microsoft, seem to be getting stronger, especially in the all-important categories related to machine intelligence or AI and database. To be an essential infrastructure technology player in the data era, it would seem obvious that you have to have database and/or data management intellectual property in your portfolio, along with AI, or you’ll be less valuable to customers and investors.

And AWS generally and the top cloud players remain in the driver’s seat from the perspective of their intellectual property portfolios and go-to-market execution.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

THANK YOU