CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Despite all the talk about repatriation, hybrid and multicloud opportunities, and cloud as an increasingly expensive option for customers, the data continues to show the importance of public cloud to the digital economy.

Moreover, the two leaders, Amazon Web Services Inc. and Microsoft Corp.’s Azure, are showing signs of accelerated momentum that point to those two giants pulling away from the pack in the years ahead. Each of these companies is demonstrating broad-based momentum across its respective product lines. It’s unclear if anything other than government intervention or self-inflicted wounds will slow these two companies down this decade.

Despite the commanding lead of the two leaders, a winning strategy for companies that don’t run their own clouds continues to be innovating on top of their massive capital investments. The most notable example of this approach in our view continues to be Snowflake Inc.

In this Breaking Analysis, we provide our quarterly market share update of the big four hyperscale cloud providers. We’ll share some new data from Enterprise Technology Research based on the most recent survey, drill into some of the reasons for the momentum of AWS and Azure, and drill further into the database and data warehouse sector to see what, if anything, has changed in that space.

We heard from Amazon: AWS has seen a re-acceleration of revenue growth as customers have expanded their commitment to the cloud and selected AWS as their cloud partner. Notably, AWS revenues increased 39% in the third quarter of 2021. That’s a 1,000-basis-point increase in growth relative to 2020’s third quarter: an astounding milestone for a company we expect to surpass $60 billion in revenue this year.

Further, AWS touted the adoption of its custom silicon and specifically its Graviton2 processors. AWS is fond of emphasizing Graviton’s 40% price/performance improvements relative to Intel Corp. x86 processors. AWS is investing in custom silicon and encouraging independent software vendors to port their code to the platform so that customers will experience little or no code changes when they migrate. As we’ve previously reported, we believe this is a secret weapon for AWS because its cost structure will continue to improve at a rate faster than competitors that don’t have the resources or skills to develop such capabilities.

Microsoft for its part also saw astoundingly good growth of 48% this past quarter for Azure. This is for a company we forecast will approach $40 billion in infrastructure-as-a-service and platform-as-a-service public cloud revenue this year. Microsoft Chief Executive Satya Nadella on the earnings call emphasized the changing nature of cloud, expanding in a distributed fashion to the edge. He referenced Azure as the world’s computer, building on his statements last year that Microsoft is building out a powerful, ubiquitous, intelligent, sensing and predictive cloud.

It does feel like we’re entering the so-called metaverse, doesn’t it?

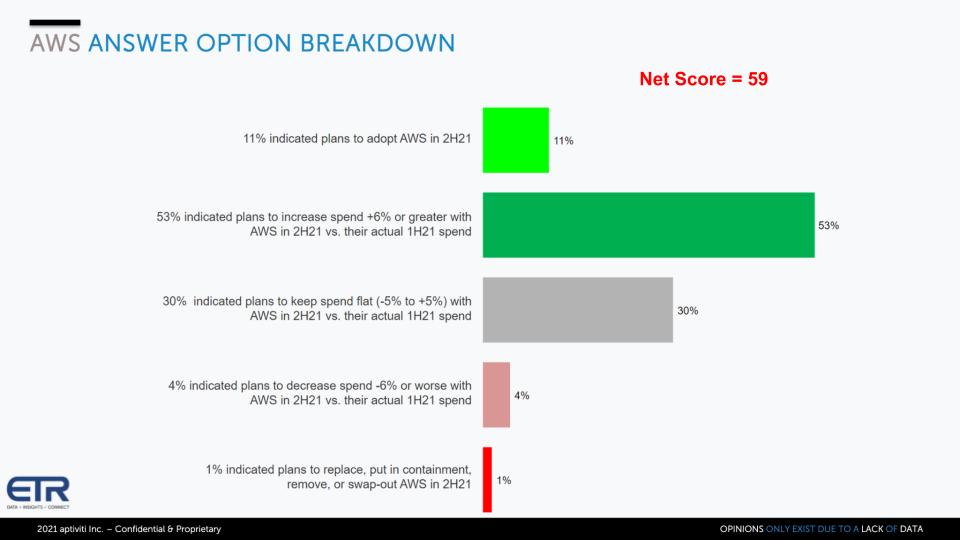

To underscore the momentum of these two companies, let’s look at the ETR breakdown of Net Score, which measures spending momentum.

This chart will be familiar to our audience. It shows the breakdown of Net Score for AWS with the lime green showing new adoptions at 11%, the forest green is spending more than 6% relative to the first half of 2021 – at a very robust 53%. The gray is flat spending – 30% on a very large base. The pink is spending declines of 6% or worse at 4%, and the bright red is defections – i.e. those leaving AWS – at 1%: virtually nonexistent. Subtract the reds from the greens and you get a Net score of 59. Remember, anything over 40 we consider elevated.

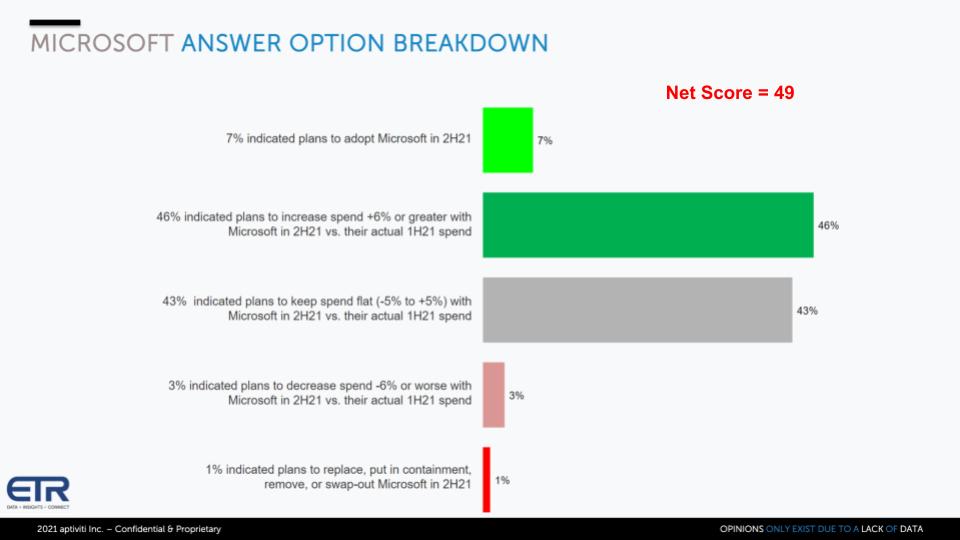

Let’s look at the same data for Microsoft.

Again, you have some new adds at 7%, but the forest green at 46% of customers spending more is an incredible figure for a company with revenues that will, in the near term, surpass $200 billion. And the reds are in the low single digits.

Buffered by its enormous personal computer software profits over the years, Microsoft has navigated through its Windows dogma and transitioned to a cloud powerhouse.

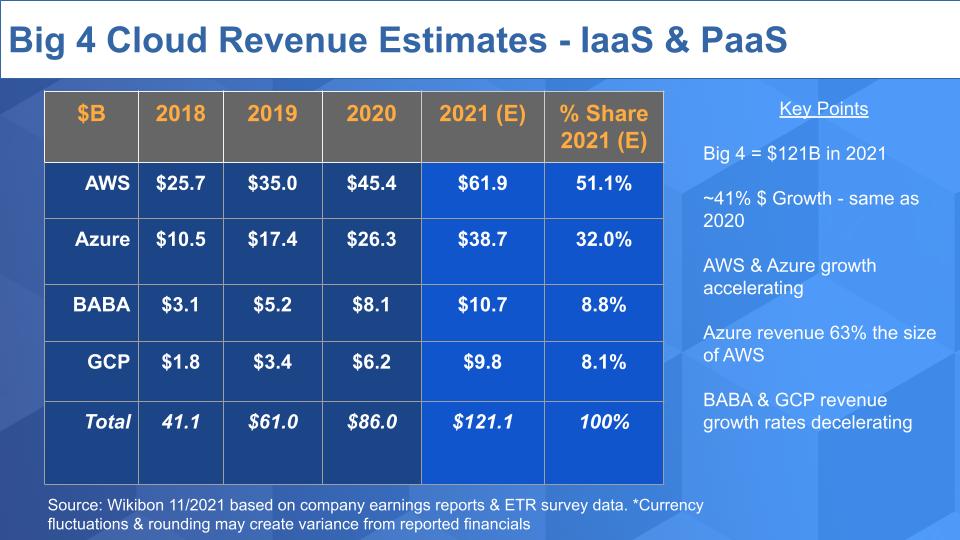

Below we show our latest numbers for the Big Four hyperscale players: AWS, Azure, Alibaba Cloud and Google Cloud.

We show data for these companies from 2018 and our estimates for 2021. This data includes our final third-quarter figures for AWS, Azure and GCP, with Alibaba yet to report. Remember, only AWS and BABA report clean IaaS revenue. Microsoft and Google don’t want to telegraph AWS’ lead, so they give breadcrumb nuggets on Azure and GCP that allow us to triangulate with our survey data and other intelligence. This view is our attempt at showing an apples-to-apples comparison for these four companies in IaaS.

In the third quarter, AWS reported more than $16 billion in revenue. We estimate Azure at $10 billion, Alibaba at just under $3 billion and GCP at $2.5 billion for the quarter. With three quarters of data in (with the exception of BABA), we’re forecasting the following for the full year:

AWS will capture 51% of the Big Four revenue, surpassing $60 billion, with Azure just under $40 billion, Alibaba approaching $11 billion and Google coming in just under $10 billion for the year.

We forecast these four will account for $120 billion in 2021 revenue. That’s a 41% increase over 2020 and the same collective growth rate as 2020 relative to 2019. We expect Azure to be 63% the size of AWS revenue. Both of those companies saw accelerated growth this past quarter, with Alibaba and GCP’s growth rates decelerating relative to last year.

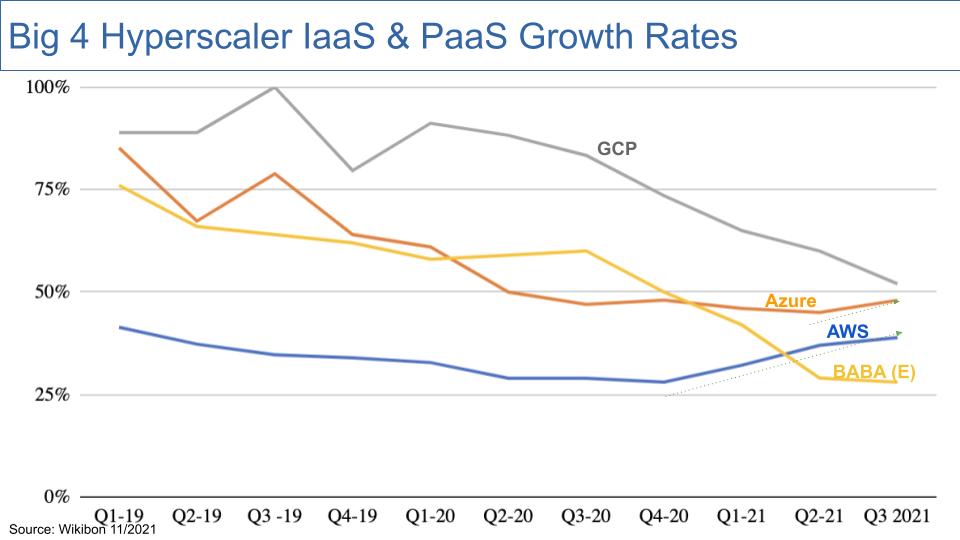

Let’s take a closer look at the IaaS revenue growth rates for these four companies.

The chart above shows the quarterly growth rates for each of the four going back to the beginning of 2019. Both GCP and Alibaba are showing dramatic declines in growth rates, whereas this past quarter Azure saw accelerated growth and AWS has now seen an increased growth rate for the past two quarters. In fact, AWS’ growth is about where it was at in 2019, when it was about half its current revenue size. Note that in 2019, AWS’ growth was decelerating through the quarters, whereas today that trend is reversed. Quite amazing.

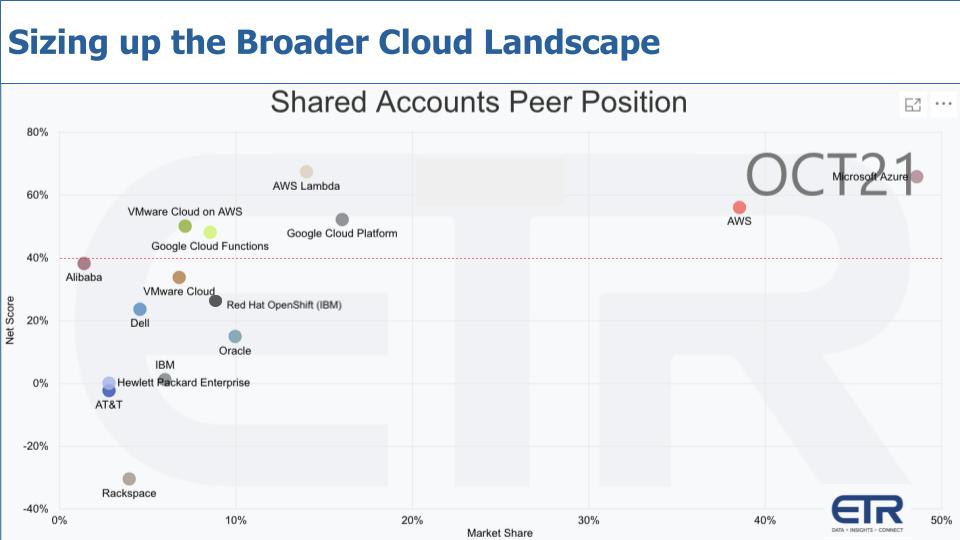

This chart below is derived from survey data and shows Net Score or spending momentum on the vertical axis and Market Share or presence in the data set on the horizontal axis. Note the red dotted line – anything above that is considered elevated.

As when we’ve previously shared this data – AWS and Microsoft Azure are up and to the right. Now remember this is not just IaaS and PaaS – it depicts the customer’s definition of cloud. It’s very likely respondents include Microsoft’s software-as-a-service offerings in their answers, which is why they’re larger than AWS, despite what we showed you earlier.

Nonetheless, these two are well ahead of the pack in terms of maturity and building out a global, distributed, general purpose cloud platform with an expansive (and expanding) set of use cases. The growth rates, combined with their size, execution and resources, are all indicators that they’re pulling away from the pack.

For context, we’ve added some of the other players. Most notably, VMware Cloud on AWS is showing momentum, as is VMware Cloud, which is VCF and other on-premises cloud offerings. Even though the latter is below the red line, it’s respectable. Ditto for Red Hat OpenShift, which we’ve superimposed, as it’s really a container orchestration platform within the ETR taxonomy – but we like to put it next to the cloud players because it’s an enabler for hybrid cloud and multicloud app development.

Alibaba has a small sample in the ETR data set. Dell Technologies Inc. and Hewlett Packard Enterprise Co. have started to show up in the cloud taxonomy as buyers are associating their private clouds (Apex and GreenLake, respectively) with cloud. So that’s a positive. And there’s Oracle Corp., which of course has OCI, and IBM Corp. with its public cloud.

So it’s a positive that the on-prem players are showing up in this data, but the reality is that the hyperscalers are growing collectively at 40% annually and on-prem players are growing in the low single digits. And if you carve out the IaaS businesses of AWS and Azure, they’re larger than most of the on-prem infrastructure players.

It’s encouraging that all the on-prem players are moving toward an as-a-service model. Undoubtedly hybrid, multicloud and edge will present opportunities for the likes of Dell, HPE, Cisco Systems Inc., VMware Inc. and IBM/Red Hat. But they also present opportunities for the public cloud players – which have vibrant ecosystems and marketplaces, much more diverse and deep than the traditional vendors.

As it pertains to hybrid and multicloud, we have a clearer picture of Microsoft’s strategy because the company has an enormous legacy on-prem business. It’s obvious that Amazon is going after hybrid with its on-prem offerings (Outposts, Local Zones, “Snow” offerings and the like). What’s not clear is how or if it will approach multicloud opportunities (aka “that which shall not be named”).

We’ll be watching at the upcoming re:Invent how new CEO Adam Selipsky will talk about these trends. It will be good to hear how he’s thinking about the next decade and how AWS thinks about hybrid and edge. We guarantee that with its developer affinity and custom silicon capabilities, AWS is thinking about it differently from traditional enterprise players.

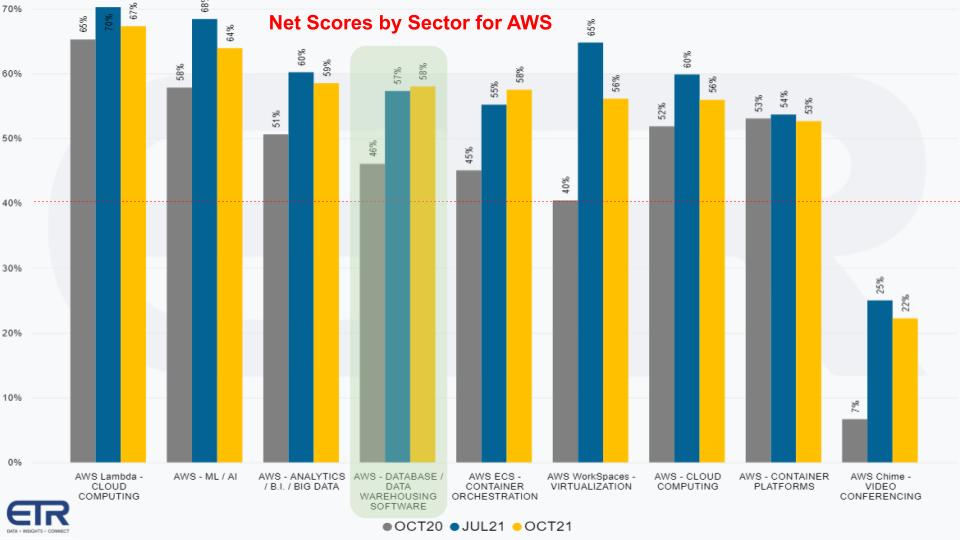

The chart above shows AWS’ Net Scores in the areas where AWS participates in the ETR taxonomy. Again, note the red line at 40% – that’s the elevated watermark. We’re showing data from last October, this past July and the latest Oct. 21 survey (the yellow bar). What’s notable is the yellow versus the gray bars,up across the board for the most part. And other than Chime, everything is above – well above – the 40% mark.

Now we’ve highlighted database because we feel it’s one of the most strategic sectors and we want to drill into that a bit.

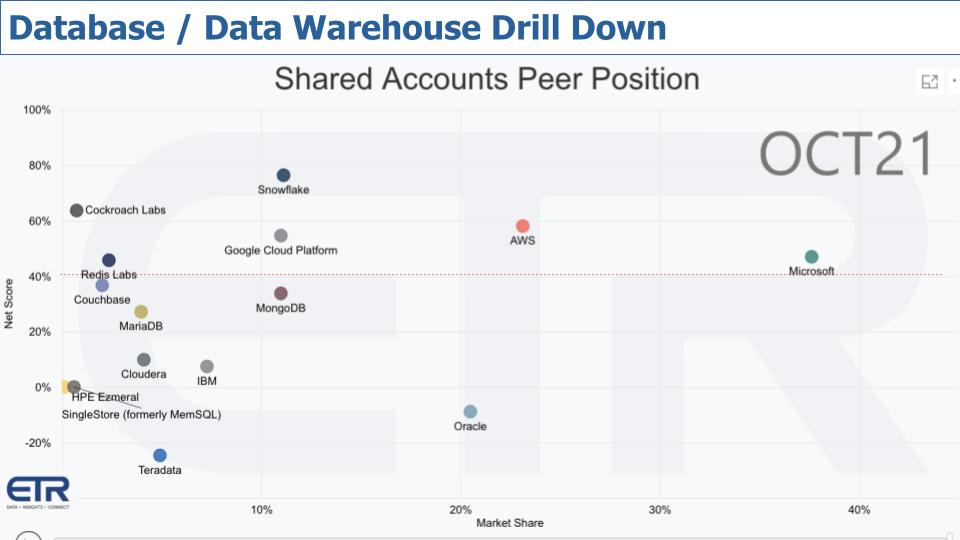

Above is our familiar XY graph showing Net Score or spending momentum on the Y axis and Market Share or pervasiveness in the survey on the horizontal axis. This data, by the way, includes on-prem and cloud database/data warehouse, so keep that in mind.

Let’s start with one of our favorite topics: Snowflake. We’ve reported again and again that we’ve never seen anything like this. The company’s Net Score has moderated ever so slightly but still is just below 80%. And Snowflake’s presence continues to grow as it gains share in the market. Snowflake is growing revenue in the triple digits – an insane pace. Hence its current $115 billion market cap.

That said, all three U.S.-based cloud players are above the 40% line as well, with AWS and Microsoft having a significantly larger presence than Snowflake. Cloud customers often cite the affinity of spinning up an AWS or Azure data store that they’ve already used. Nonetheless, Snowflake continues to grow at a faster pace than virtually any other database player with meaningful revenue.

Cockroach Labs Inc., Redis Ltd. and Couchbase Inc. are all elevated or highly elevated. Couchbase just went public, so that may help with its presence in the ETR data set. MongoDB Inc. has a $37 billion market cap as of this episode and the stock has been on a tear. You also see MariaDB Corp. in the mix.

And then of course you have Oracle, the database leader in the middle of the graphic. Remember this is not a revenue view, it’s an installation/customer citation metric. Oracle continues to invest in making its database and other software (including MySQL with Heatwave) the best solution for mission-critical workloads. And the company is investing in its public cloud.

But you can see overall it just doesn’t have the overall momentum of the others because the declines in Oracle’s legacy business are not yet fully offset by the growth in cloud database and cloud migration. But Oracle is a financial powerhouse with a $250 billion-plus market value and the stock has done very well this past year – up over 60%.

Cloudera Inc. never lived up to the lofty expectations promised by big data. The company sold to private equity for $5 billion-plus, which is no small feat. But Cloudera, having raised more than $1 billion prior to its initial public offering in 2017, never realized its aspiration of becoming the next great software company.

Cloudera is now a private firm so it can hide the pain of its transitions. The company is still navigating between the legacy installed bases of Cloudera and Hortonworks. It’s not an easy situation. When the two companies came together, Cloudera essentially had to dead-end each of those platforms and migrate their customers to a modern stack as part of its cloud strategy. That is always a difficult thing to do. So as a private company, it can get off the 90-day shot clock and buy some time to invest without getting hammered by the Street.

Lastly, Teradata Corp. has consistently not shown well in the ETR data set. Its transition to cloud and cross-cloud hasn’t yet shown momentum in the data set.

So right now it’s looking like the rich get richer, with several database contenders looking to ride the next wave of data innovation.

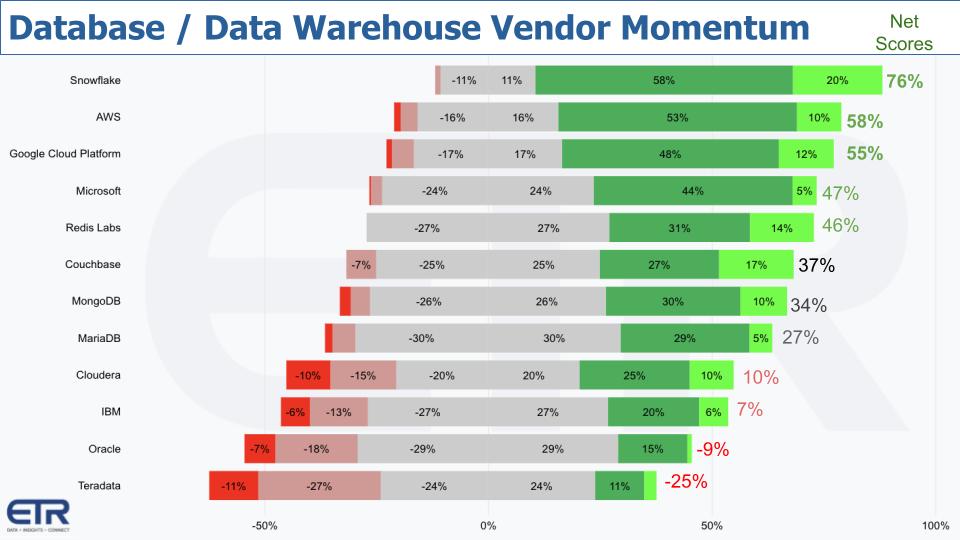

The chart below shows the momentum, or lack thereof, with the Net Scores or spending velocities, showing the granularity that we described before. Remember, green is spending more, red is spending less. Bright red is leaving the platform. Subtract the reds from the greens to derive Net Score.

Snowflake tops the list and you can compare the performance in a little different view to understand how these scores are derived. Snowflake has close to the ideal profile – a solid lime green, a big forest green, a not too large gray and ideally little or no bright red (aka defections).

As you go down the list, you can see the green funnel getting smaller and smaller. And the gray increasing in prominence as the vendor momentum declines. Interestingly, with the exception of Cloudera and Teradata, defections are all in the single digits or nonexistent in the case of Snowflake. Redis shows no red at all, nor Couchbase, and there’s very little defection for the giant Microsoft.

This speaks to how hard it is to migrate off a database — no matter how disgruntled you are. The more common scenario is to isolate the database and build new functionality on modern platforms. This is why database is so strategic to cloud vendors and those such as Snowflake that are building on top of the cloud.

AWS re:Invent is coming up later this month. It’s the first time someone other than Andy Jassy will be keynoting as CEO. Fifteen years of cloud and this is the 10th re:Invent, which is always a marker for the direction of the industry.

We’ve said many times that the last decade was largely about information technology transformation, powered by cloud. We’re entering an era of deeper business transformation where the cloud will play a pivotal role. But the notion of cloud is evolving from a set of remote services to an omnipresent platform on top of which many customers and technology companies can innovate. And virtually every industry will be affected by cloud, however it evolves, in the coming decade.

The question will be: How fast can you go? How will players such as AWS and Microsoft — and many others building on these platforms — make it easier for you to go fast? That’s what we’ll be watching for at re:Invent and beyond.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.