INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. said today its proposed $35 billion all-stock deal to acquire its industry peer Xilinx Inc. is now expected to close in the first quarter of 2022, having missed its target of the end of this year.

“We continue making good progress on the required regulatory approvals to close our transaction,” the companies said in a joint statement.

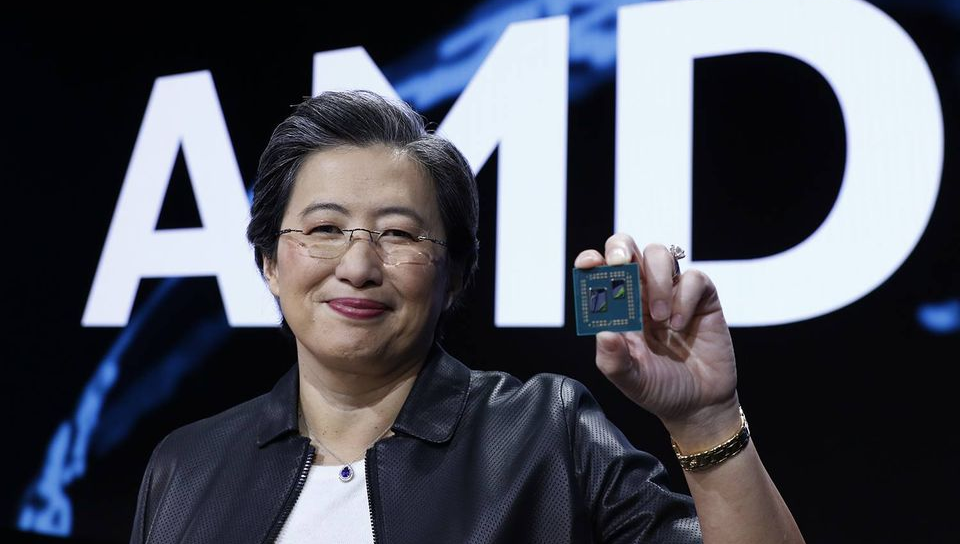

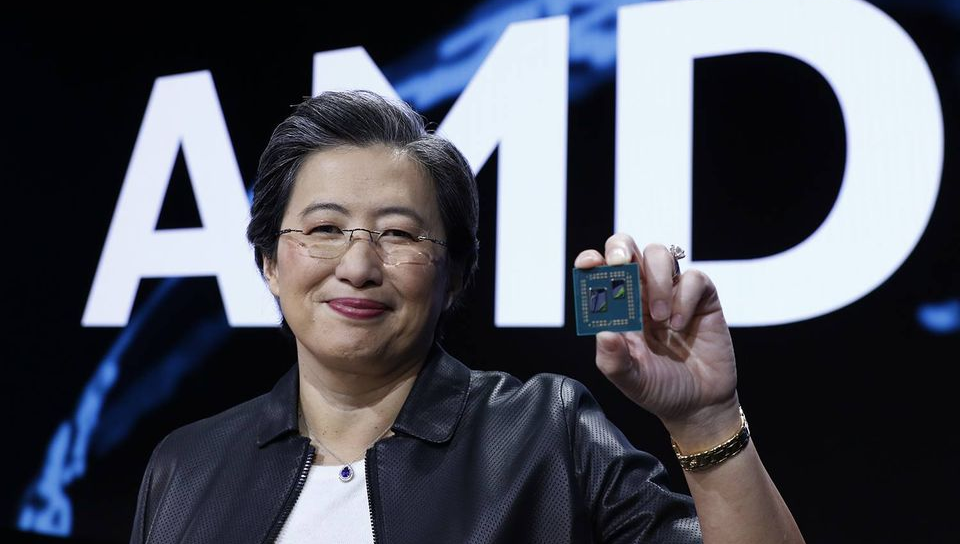

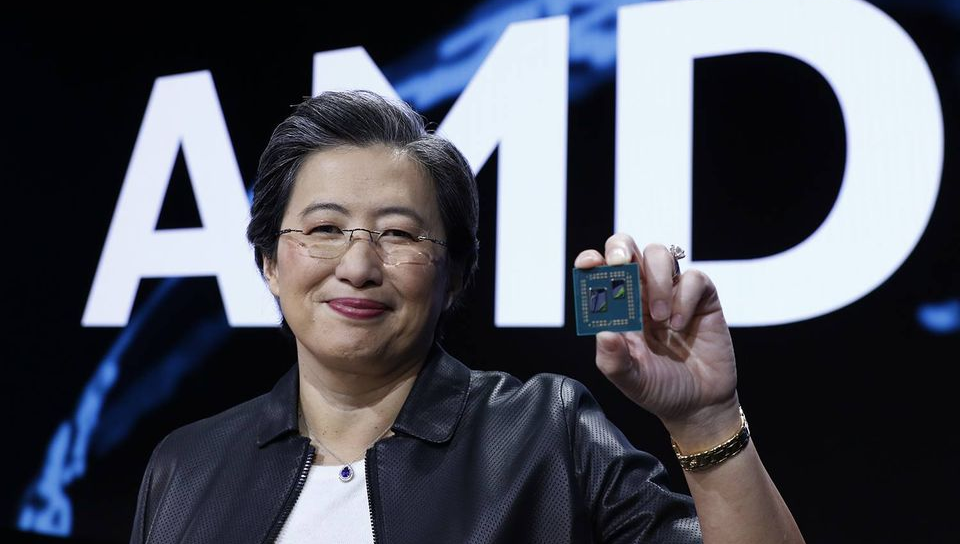

AMD, led by Chief Executive Lisa Su (pictured), announced its intention to buy Xilinx in October 2020. It’s buying Xilinx for the smaller firm’s strong presence in the rapidly growing telecommunications and defense markets. Xilinx is a maker of specialized computer chips called field-programmable gate arrays that are primarily used in wireless communications, data centers and in the automotive and aerospace industries.

Unlike regular computer chips, FPGAs can be reprogrammed after they’ve been built. That means they’re more flexible and can be reassigned to different tasks, which in turn makes them especially useful for rapid prototyping and in fast-moving industries where companies have little time to waste developing processors for specific use cases. Xilinx’s FPGAs are notably a key component in new 5G network deployments.

AMD is interested in buying Xilinx because it’s more focused on building standard central processing units and graphics processing units that are used in personal computers, data center servers and games consoles. It doesn’t have any presence in the FPGA market, whereas its chief rival Intel Corp. does.

The companies had previously been saying they would secure all of the approvals needed to conclude the deal by the end of 2021, but that hasn’t happened.

“We now expect the transaction to close in the first quarter of 2022,” they said in a statement. “Our conversations with regulators continue to progress productively and we expect to secure all required approvals.”

AMD’s stock was up marginally following the report, while Xilinx’s shares fell 3.6%.

Amid U.S.-China tensions and the ongoing global semiconductor supply issues, chip deals have struggled to win approval from regulators of late. AMD’s rival Nvidia Corp. has been struggling to persuade authorities in the U.S., the U.K. and China to give its proposed $40 billion acquisition of Arm Ltd. the go-ahead.

Earlier this month, the U.S. Federal Trade Commission filed a lawsuit to block that deal over fears Nvidia might try to undermine its competitors. The trial isn’t expected to take place until August 2022.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.