BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Securitize LLC, a blockchain investment platform that tokenizes assets and provides compliance for digital securities, continued expanding its footprint into private market investments with an announcement Thursday that it acquired Onramp Invest LLC, a digital asset wealth management platform.

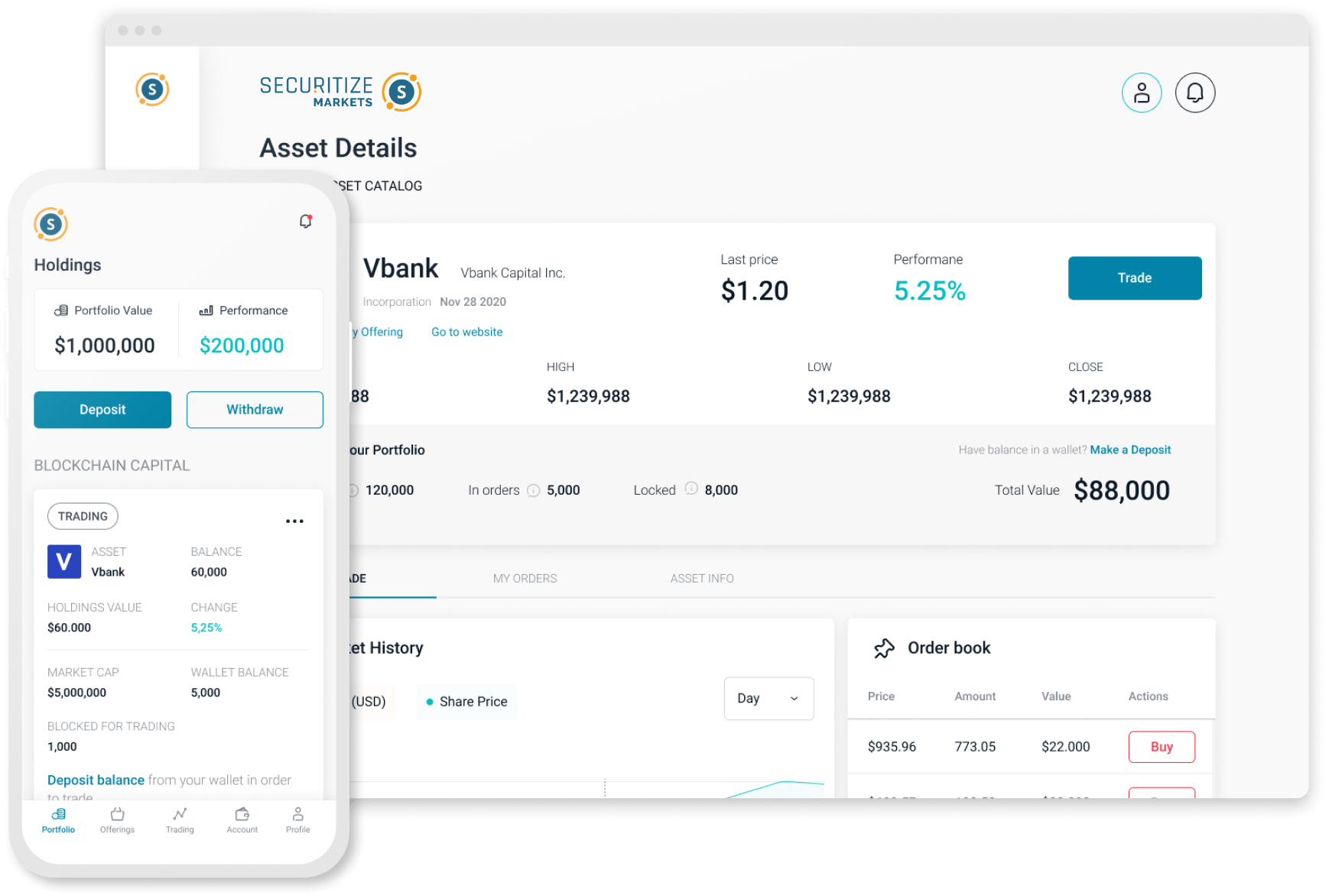

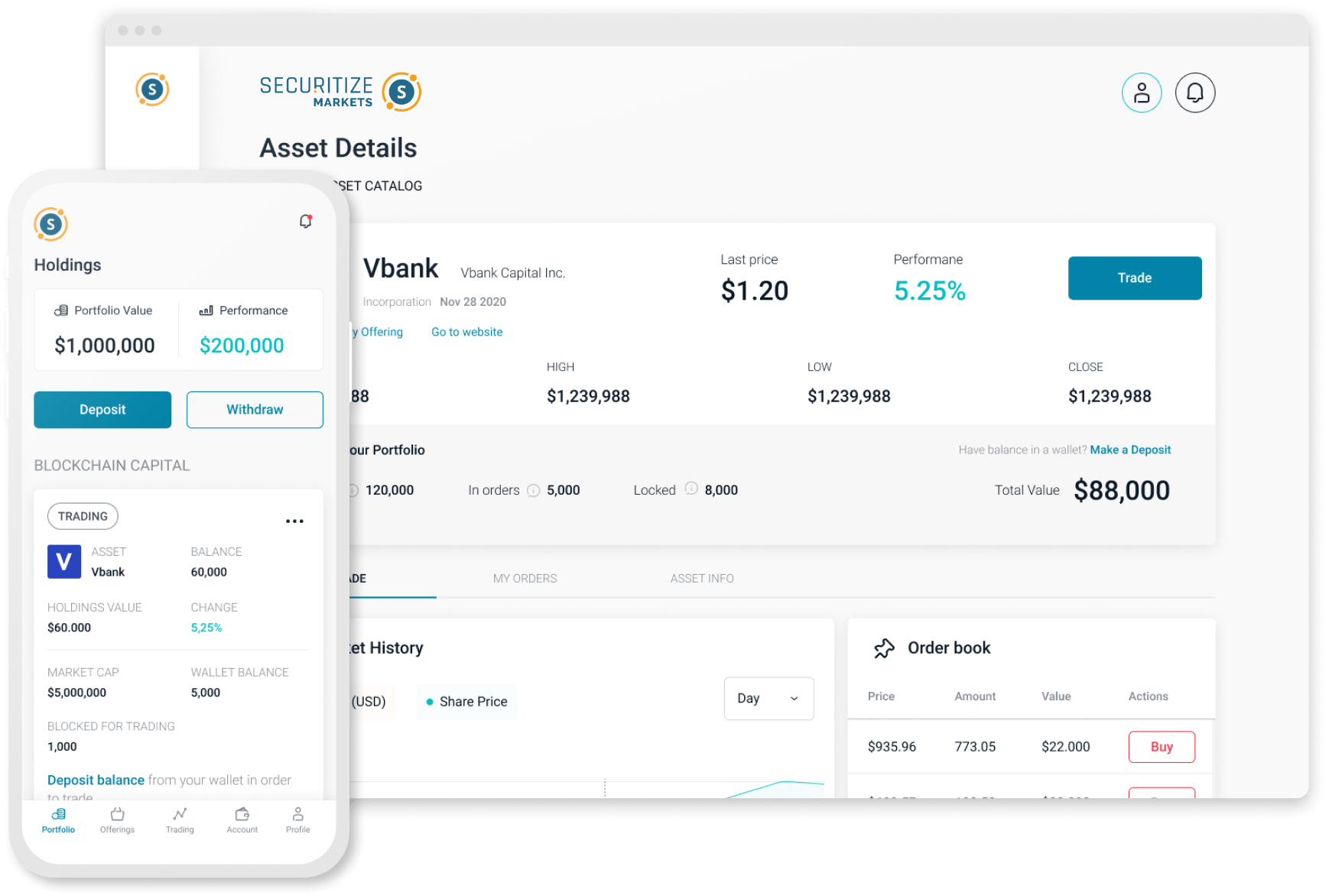

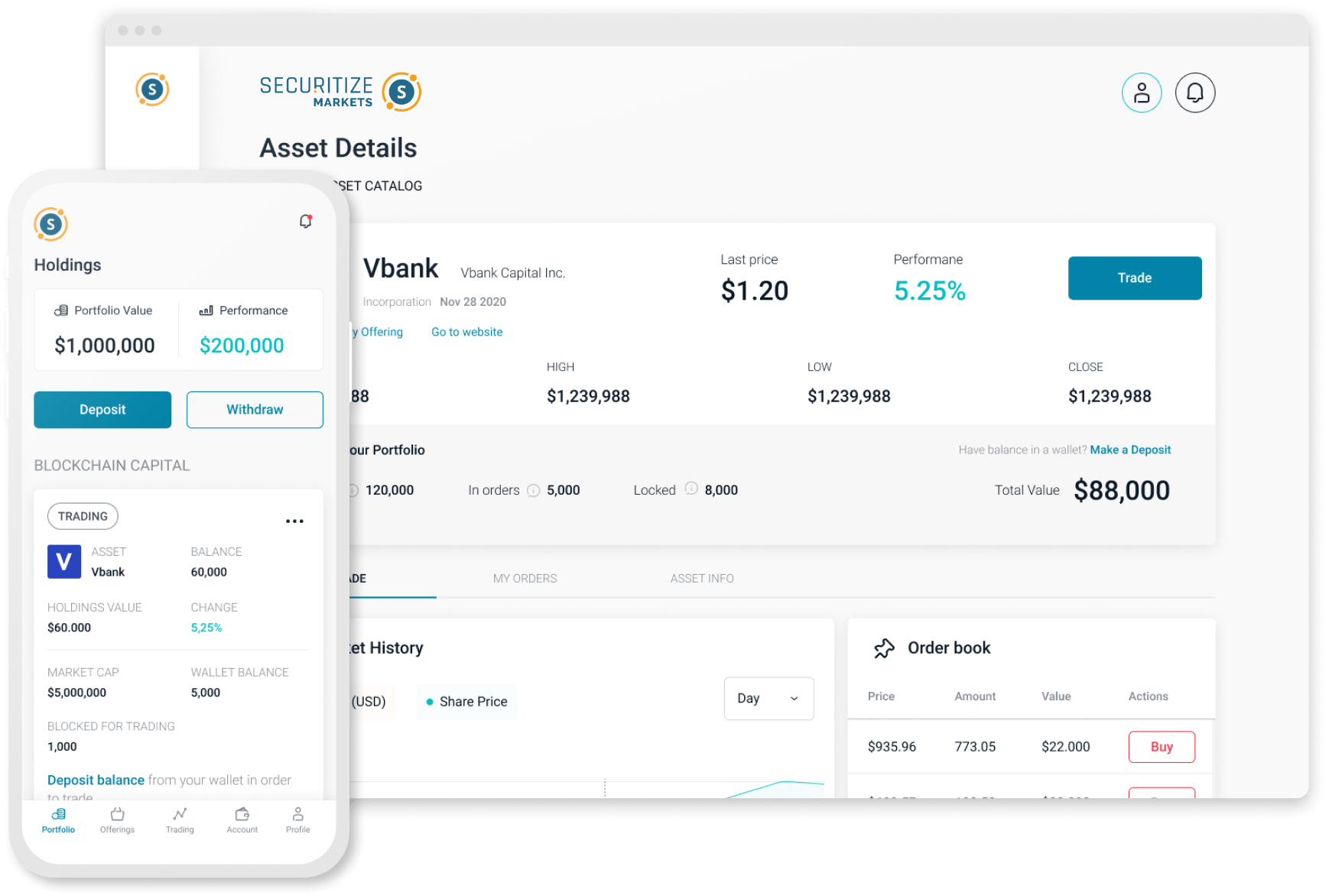

Using blockchain technology, it’s possible to create digital asset representations of securities, such as stocks and bonds as blockchain tokens on different networks such as Ethereum, Algorand and Avalanche. These tokenized representations are registered on the blockchain and gain the benefit of provable ownership and reduced transaction risk. They use transparent and immutable ledger technology for increased auditability and security for transactions.

The acquisition brings more than $40 billion in cumulative assets under management on board from Onramp, which the company manages for a customer base of registered investment advisers, or RIAs, in the United States. Onramp’s community includes WisdomTree Inc., CoinDesk Inc., Global X and Valkyrie Invest, which it collaborates with to create crypto indexes. The platform integrates with existing RIA technology stacks such as Orion, Advyzon, Wealthbox and AssetBook.

Securitize said that building on this acquisition, RIAs will now be able to offer access to nontraditional stocks and bonds that are not usually listed on private markets through its platform by tokenizing them using its blockchain-based platform. These alternative investment classes include private equity, private credit and secondaries markets.

Opening up these markets, Securitize Chief Executive Carlos Domingo said, will provide a new avenue for RIAs and investors to gain access and grow their portfolios. For example, private credit is currently in high demand, consisting of loans or debit investments extended by nonbank lenders, which in the second quarter of this year alone attracted $7.2 billion in capital from investors.

“Our acquisition of Onramp is another big step forward in expanding investor access to top-performing alternative assets and in democratizing private capital markets,” said Domingo. “Onramp already offered RIAs easy access to digital assets, so it is a very natural extension to offer them tokenized alternative assets to complement their portfolios.”

The acquisition follows Securitize’s expansion of its services into Europe with the tokenization of real estate investments in Spain in July. The company began offering tokenized securities governed under the European Union’s Distributed Ledger Technology Pilot Regime.

Crypto asset tokenization has been explored by multiple blockchain companies as a means to provide investment opportunities for securities as well as commodities. Examples include tokenizing wine by Fine Wine Capital AG, which used Syngum’s digital ledger solution to produce blockchain tokens to track wine assets in Swiss markets. RealBlocks similarly has developed a blockchain-based real estate investment platform that tokenizes properties to turn them into tradable securities.

After the acquisition, Onramp will continue operating as a subsidiary of Securitize and integrate Securitize products into its existing products as an offering to the company’s customers over time. The deal is expected to close within the next few days.

“More advisers would choose alternatives for their clients because the benefits are clear, but challenges like illiquidity and restricted access were previously significant problems to overcome,” said Eric Ervin, founder and CEO of Onramp Invest. “Securitize solves for this through offering lower minimums, lower fees and potential for exit liquidity through secondary markets.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.