AI

AI

AI

AI

UPDATED 00:09 EST / MARCH 31 2024

AI

AI

BREAKING ANALYSIS by Dave Vellante with Andy Thurai

Adobe Summit 2024 put individualized digital experiences on full display.

Personalization at scale is exceedingly difficult. By applying artificial intelligence, Adobe Systems Inc. showed off its ability to bring custom experiences to the masses and do so with trusted, enterprise-grade content. Moreover, Adobe highlighted an expanded total available market for its three major business segments and is now pursuing a TAM approaching $300 billion.

We believe Adobe represents a leading example of AI monetization beyond the two most commonly discussed segments: 1) The picks and shovels of silicon, large language models and core AI infrastructure; and 2) Microsoft copilots. Its vision is to become a $30 billion revenue player, but the timeframe for such an achievement remains aspirational with no specific timeframe committed by Adobe.

In this Breaking Analysis, we welcome our friend and theCUBE contributor, Andy Thurai, vice president and principal analyst at Constellation Research, to review the action from Adobe Summit and give our perspective on the prospects for the company.

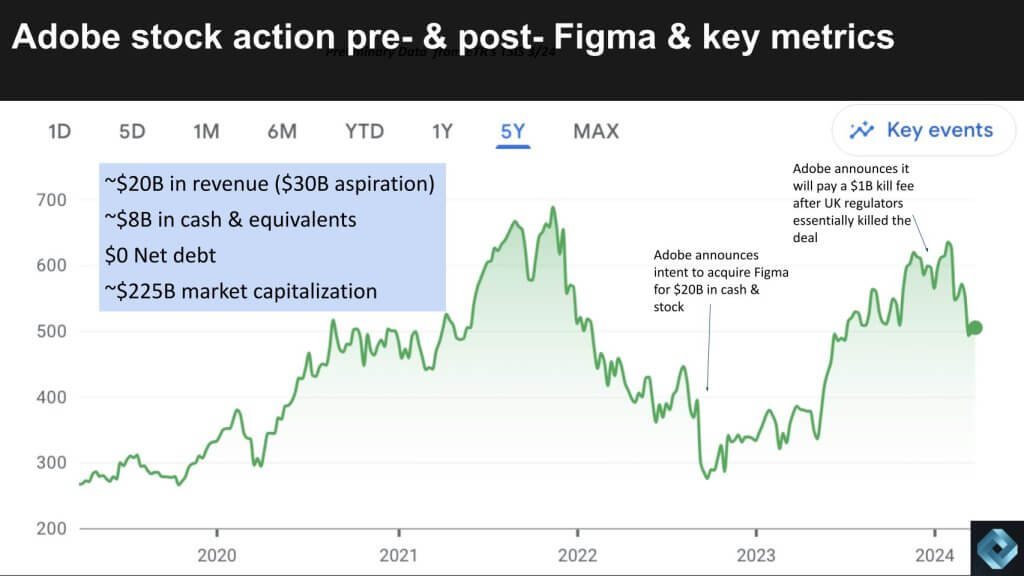

Let’s take a look at Adobe’s stock performance in recent years.

Adobe is a roughly $20 billion revenue company with nearly $8 billion in cash and equivalents on the balance sheet, no net debt and a more than 10X revenue multiple. Two months prior to the launch of ChatGPT, Adobe announced its intent to acquire Figma for $20 billion, split almost evenly between cash and stock.

You can see the outstanding performance of Adobe coming out of 2022’s tech downturn. The Figma deal made some sense because Adobe was unable to compete with Figma with its own product. Whether $20 billion post-ChatGPT was a good price was always a question, but it didn’t matter, because the U.K. competition committee essentially killed the deal.

In a way, this was a blessing in disguise. We asked Thurai for his thoughts on the loss of Figma which we summarize as follows.

Thurai noted that Wall Street liked the deal and it would have been a good marriage in terms of the value Figma could’ve added to Adobe. Figma has strong collaborative tools and browser-based interfaces popular with creators, making it a valuable asset in any tech merger. Despite his initial shock at the $20 billion valuation, which seemed exorbitant to Thurai, the subsequent rise in stock price suggested the market saw things differently.

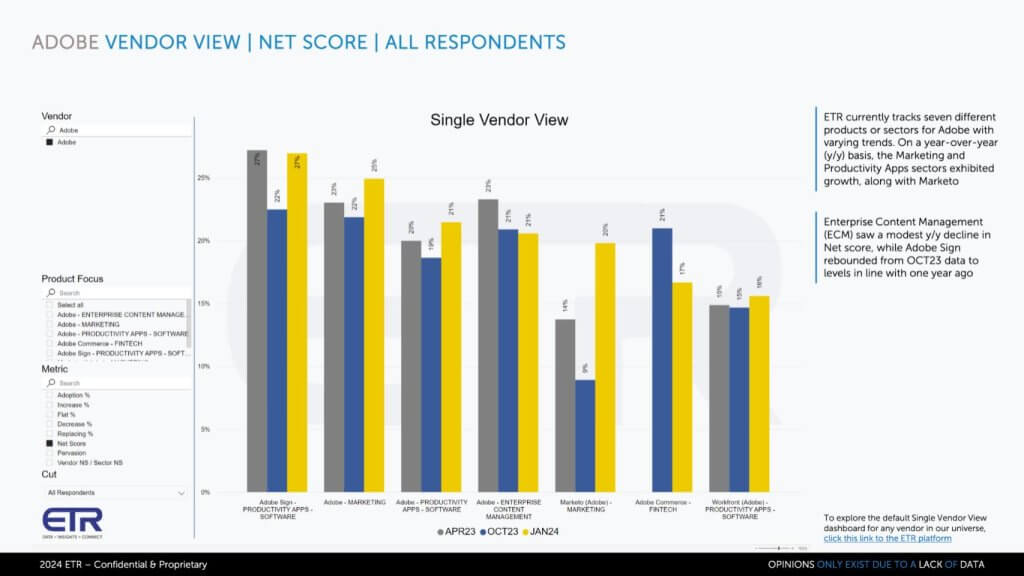

Let’s take a look at the Enterprise Technology Research data to see how the spending momentum looks for Adobe across its portfolio.

This is data from ETR’s TSIS survey and it shows the spending momentum or Net Score in three time periods – April 2023, October 2023 and January 2024 in the gray, blue and yellow bars respectively. This is a survey of around 1,700 technology buyers and in the data set there are 872 Adobe customers, a significant N.

You can clearly see the breadth of the portfolio across Adobe Sign, which competes with DocuSign, its marketing platform, content management, Marketo, which Adobe acquired for almost $5 billion from private equity firm Vista, Fintech and Workfront, Adobe’s workflow management software. Remember, this data maps to the ETR taxonomy, not to how Adobe views its business. But the point is there are a number of areas in the yellow that are showing accelerating momentum or are holding steady.

Most firms in the data set show softer momentum from the macro headwinds.

Thurai’s comments on this data are summarized as follows:

Thurai shared insights from Adobe Summit, where the focus was on Adobe’s position in the creators market. According to Thurai, Adobe demonstrated a strong foothold with creators and marketers. Although it took some time to get traction with Firefly, Adobe’s gen AI model, the conference celebrated Firefly’s one-year anniversary and the product has significant momentum. The advent of OpenAI and other LLMs posed a significant challenge to Adobe and the company has responded.

Thurai highlighted the importance of Adobe’s strategy from an investment perspective. By ensuring that new features and tools are readily available or soon to be, Adobe not only retains its current user base but also attracts new users, thereby enhancing its monetization potential.

Bottom line, Thurai views Adobe’s recent moves as a strong response to the gen AI opportunity. By swiftly integrating new, competitive features into its offerings and making them available to users, Adobe is not only addressing past criticisms but is also positioning itself for continued success in the highly competitive creative software market.

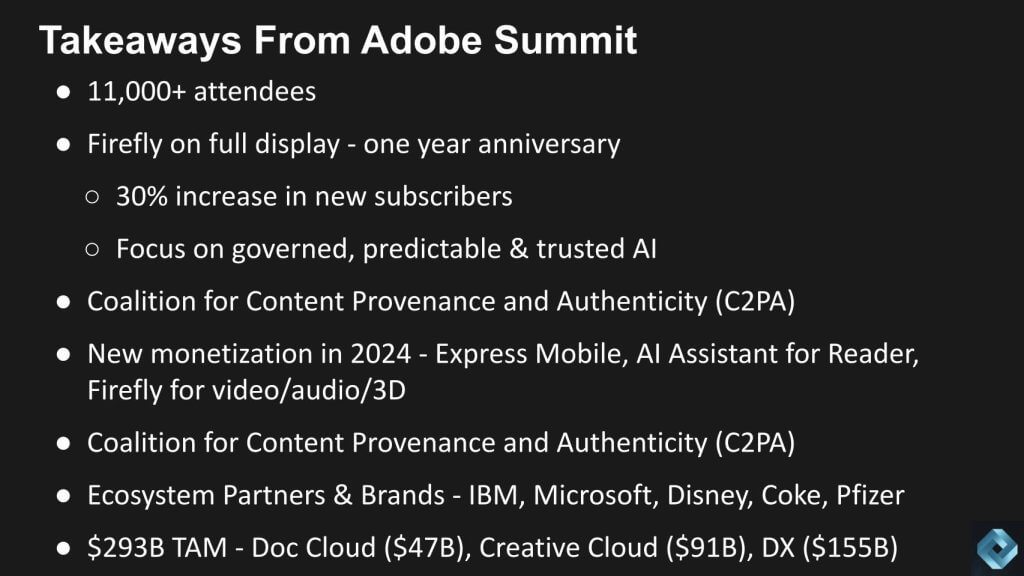

Let’s look at the takeaways from Adobe Summit. Below are the key points we discussed and a curation of the conversation follows.

The Adobe Summit was attended by more than 11,000 people. During the event, a significant focus was placed on Adobe’s AI initiatives, particularly Firefly. Management indicated during its financial analyst meeting that Firefly was a key contributor to Adobe’s growth. The company claims it saw a 30% increase in new subscribers thanks to Firefly, which bolsters Adobe’s business model.

This type of subscriber growth underscores a shift toward AI-driven value rather than its legacy credit-based model. Our analysis delves into several key aspects of Adobe’s strategy and product offerings based on the discussions from the summit:

Bottom line: We believe that Adobe’s strategic positioning of Firefly, along with its commitment to responsible AI and customer-centric innovation, has not only contributed significantly to its subscriber growth but also sets a strong example in the industry for ethical AI development.

Adobe’s efforts in promoting content authenticity and combating misinformation were also a major theme, highlighted by its lead in the Coalition for Content Provenance and Authenticity, or C2PA. This initiative, aimed at establishing content provenance, is pivotal in the era of deep fakes and misinformation. Additionally, Adobe’s advancements in AI have enabled unprecedented levels of personalization at scale, through initiatives like GenStudio, which democratizes marketing across various channels.

Bottom line: Our opinion is that Adobe’s leadership in content provenance and personalization strategies not only enhances its product offerings but also elevates its role in setting industry standards for responsible and effective AI use.

A critical component of Adobe’s strategy involves ecosystem partnerships and new avenues for monetization. Adobe’s collaborations with technology giants and brands, such as IBM, Microsoft, Delta, Pfizer, Coca Cola, Disney and others were on display at the summit, underscoring an integrated approach to AI.

Specifically, Adobe’s tools are becoming deeply embedded in the operational workflows of its partners and customers. We see significant AI monetization opportunities for Adobe in the near-to-midterm, including mobile applications, AI assistants and advancements in video, audio and 3D content creation.

Bottom line: In our view, the failure of the Figma deal has forced Adobe’s hand to step up its organic innovation. Generative AI presented a timely opportunity for Adobe to double down on key strategic partnerships and focused innovation initiatives in AI. These in our view will be key drivers for its future growth and expansion in the digital experience sector. The company’s ability to monetize AI technologies and integrate them into a broad range of products and services positions it favorably for sustained monetization and leadership.

Adobe’s strategies, as demonstrated during its conference, highlight a winning posture that embraces AI across its product lineup and operational philosophy. The company’s emphasis on responsible AI, content provenance, personalization at scale, ecosystem partnerships, and innovative monetization approaches are key indicators of its commitment to maintaining a strong position in the creative and marketing technology sectors. We believe that Adobe is well-positioned to capitalize on the opportunities presented by AI, driving both market growth and operational efficiency for itself and its partners.

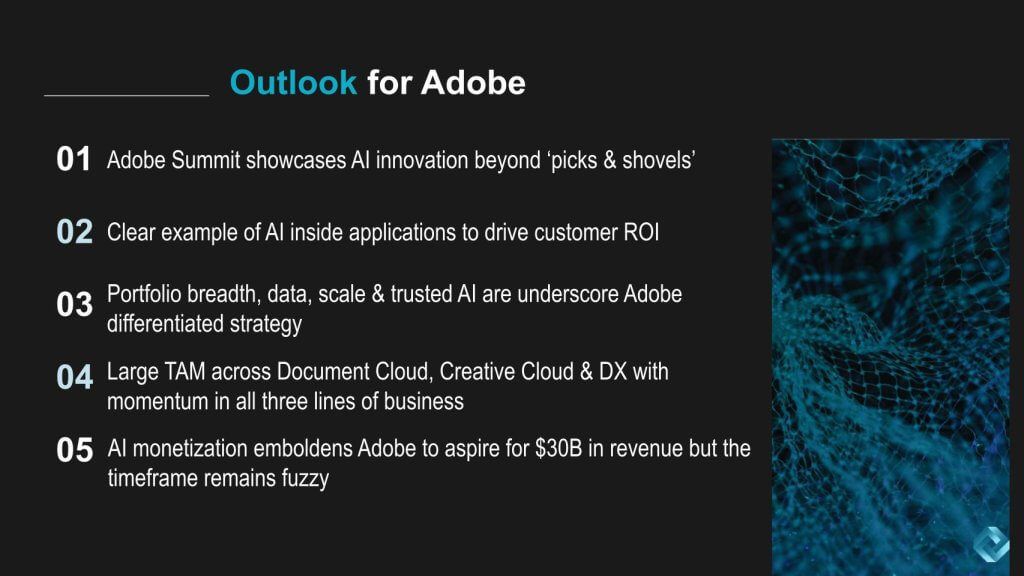

Let’s close by looking at how to think about Adobe going forward. The following summarizes the analysis we produced with Thurai.

The Adobe Summit provided a clear illustration of Adobe’s market momentum with a differentiated strategy led by AI innovation. This wasn’t just about the technology itself but how Adobe embeds AI into applications to drive tangible return on investment. A broad spectrum of consumption models, from freemium to paid services and layered tiers, highlights Adobe’s adaptability and its effort to cater to various customer types. This flexibility is crucial as Adobe aims for a significant revenue milestone of $30 billion.

Bottom line: We foresee Adobe’s continued leadership in integrating AI into its offerings, bolstered by diverse monetization strategies and a broad portfolio. These factors are pivotal in Adobe’s pursuit of $30 billion in revenue, marking a significant growth trajectory influenced by AI’s monetization potential. We’d note that no timeframe is being given to reach $30 billion and we’d like to see more clarity on this front.

Adobe’s path to increased monetization is potentially more significant than previously appreciated. The company emphasized this point at its financial analyst event. The summit demonstrated Adobe’s unique position to capitalize on content creation and authenticity which will drive additional revenue streams through a variety of content verification services.

Moreover, Adobe’s confidence in its AI models is underscored by its offer of full indemnity to customers using its models, a strong indication of its commitment to responsible AI use. We haven’t read the fine print and will, but this is a step in the right direction.

Bottom line: The potential for new monetization vectors, coupled with Adobe’s strong stance on responsible AI and user support, suggests Adobe is not only innovating within its product lines but also exploring broader market opportunities enabled by AI.

We discussed Adobe’s need for continued innovation, especially in the wake of the failed Figma acquisition. The loss of Figma has seemingly catalyzed a more focused Adobe with an aggressive innovation strategy, using AI to distinguish itself and meet aspirational revenue targets. The summit was filled with buzz and featured high-profile personalities like Shaq O’Neal.

Bottom line: In our analysis, Adobe’s strategic pivot towards deeper AI integration and innovation signifies a robust pathway to achieving its ambitious growth targets. This strategic direction, amplified by market enthusiasm and Adobe’s commitment to expanding its AI capabilities, positions the company well for future success and market leadership. While Adobe provided no specific timeframe for its $30 billion revenue milestone, we believe it’s achievable before the end of the decade.

Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on theCUBE Research and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from theCUBE Research and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai or research@siliconangle.com.

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of theCUBE Research. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.

Anthropic launches Claude Marketplace with third-party cloud services

OpenAI introduces Codex Security to help developers fix software vulnerabilities

Anthropic says it’s in ‘productive’ discussions with Pentagon about Claude but still plans to sue on ban

Uncovering innovation amidst the noise of MWC

Telcos' last chance: Why the edge becomes hyperconverged

Telcos try to hop on the AI train, Anthropic wars with the Pentagon, and agents threaten Microsoft

Anthropic launches Claude Marketplace with third-party cloud services

AI - BY MARIA DEUTSCHER . 9 HOURS AGO

Uncovering innovation amidst the noise of MWC

INFRA - BY GUEST AUTHOR . 14 HOURS AGO

Telcos' last chance: Why the edge becomes hyperconverged

INFRA - BY GUEST AUTHOR . 17 HOURS AGO