CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Multicloud computing has emerged as one of the hottest trends in enterprise technology over the past couple of years as companies increasingly adopt a range of public cloud platforms to host their workloads.

The trend is accelerating because cloud is winning in the marketplace. It no longer makes sense for a company to invest millions of dollars building data centers in a day and age when they can simply pay for what they use. The public cloud is slowly killing off on-premises workloads for a whole host of different reasons, and multicloud is just the next evolution of that trend.

But what exactly do we mean by “multicloud” anyway and what is it good for? What problems does it create? And what’s the next step in this evolution and who will be the winners and losers? These are just some of the questions that Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon and co-host of SiliconANGLE Media’s video studio theCUBE, set out to answer in his latest Breaking Analysis video.

Multicloud is the next step up from hybrid cloud. Whereas hybrid cloud is all about connecting public clouds to on-premises workloads and ensuring a substantially similar experience, multicloud is all about connecting public clouds to other public clouds as well as to on-premises workloads.

“While all this hybrid action is getting wired, customers are putting work into AWS, Azure, Google and also other clouds, including IBM Cloud, the Oracle Cloud and SaaS clouds,” Vellante said. “And those customers are wanting to connect across clouds with a substantially similar experience, which reduces costs and speeds outcomes. This is multicloud.”

And multicloud is not going away. The major public cloud giants, including Amazon Web Services Inc., Microsoft Corp. and Google LLC are very aware of the realities, and have been working hard to connect their infrastructure. Some prominent examples include the partnership between AWS and VMware Inc., Microsoft’s alliance with Oracle, and IBM Corp. buying Red Hat Inc. and leveraging Red Hat’s OpenShift across clouds.

Meanwhile, smaller players are innovating too. Qumulo is focusing on cross-cloud file management, CrowdStrike Inc. is specializing in new security solutions for multicloud environments, and Clumio Inc. is offering backup services for public, hybrid and multicloud use cases.

Although everyone agrees that multicloud is a thing, tracking the winners and losers is a tricky task because it’s hard to know what metrics to use to gauge their success. Still, there are several indicators and proxies we can use from Enterprise Technology Research’s latest spending surveys to get an idea whom the major players are.

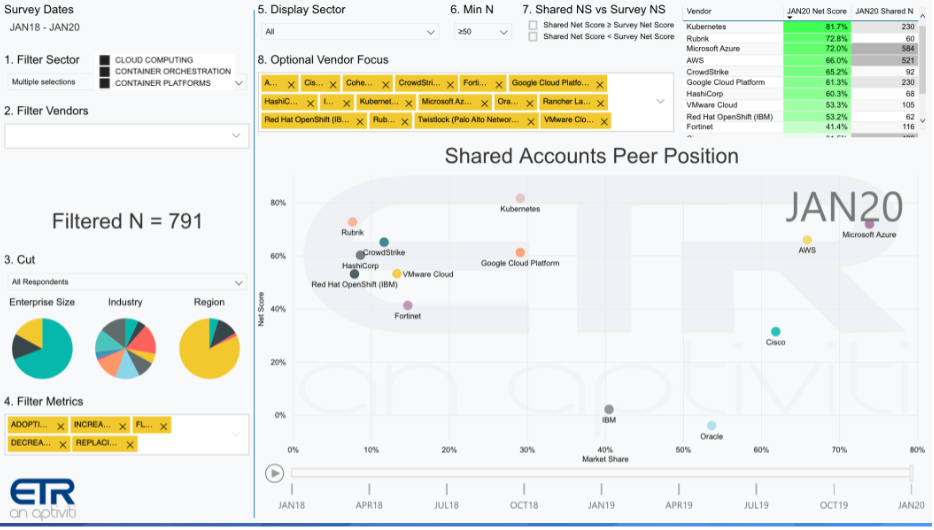

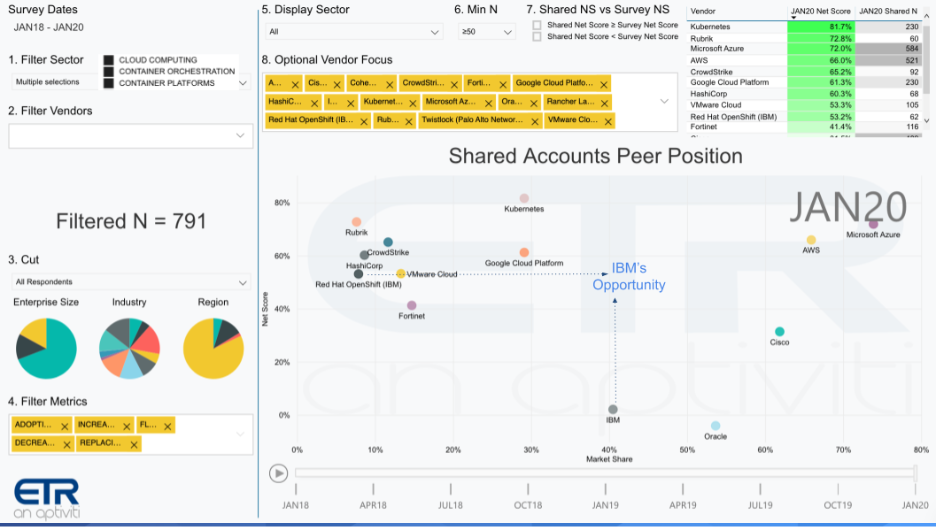

The following chart, for example, shows the relative position of several of the major companies participating in the multicloud arena. Their respective net score, used to gauge spending momentum, is on the Y axis, and their market share, which is a measure of pervasiveness, is on the X axis. To simulate multicloud progress, we cut the ETR data by customers spending on cloud computing and containers for each provider.

It’s no surprise to see that AWS and Azure enjoy a clear lead at the moment. Even though AWS may not have an explicit multicloud offering, the company has clearly worked to ensure that its cloud plays nicely with a large ecosystem of partners. Google is also showing a strong net score and thus is well-positioned to become a major player in multicloud with its Anthos offering.

The other main players are showing strong momentum too. Cloud data management provider Rubrik Inc. and security firm CrowdStrike both have strong net scores and well-defined multicloud offerings in their respective niches. Hashicorp Inc. also gets a mention thanks to the developer tooling it sells that makes it easier to secure and deploy apps across cloud platforms.

“VMware Cloud is right there in the mix,” Vellante said. “You also see Fortinet in there as well, executing from a security position with a nice cloud portfolio.”

Another notable multicloud player is IBM and its recent acquisition Red Hat. Interestingly, IBM’s net score is low compared with its rivals, but Red Hat’s is still fairly strong.

“This is new IBM CEO Arvind Krishna’s opportunity, to leverage IBM’s large installed presence, shown here as market share or pervasiveness, to bring Red Hat to the right,” Vellante said. “He can also leverage OpenShift’s coolness to increase IBM’s relevance and elevate its spending velocity. If Arvind makes the kind of progress I show here, he may end up as CEO of the decade.”

Oracle and Cisco also merit a place among the multicloud players – Oracle thanks to its close alliance with Microsoft, which has great potential for apps running on Oracle databases, and Cisco thanks to its huge presence in the networking and security markets.

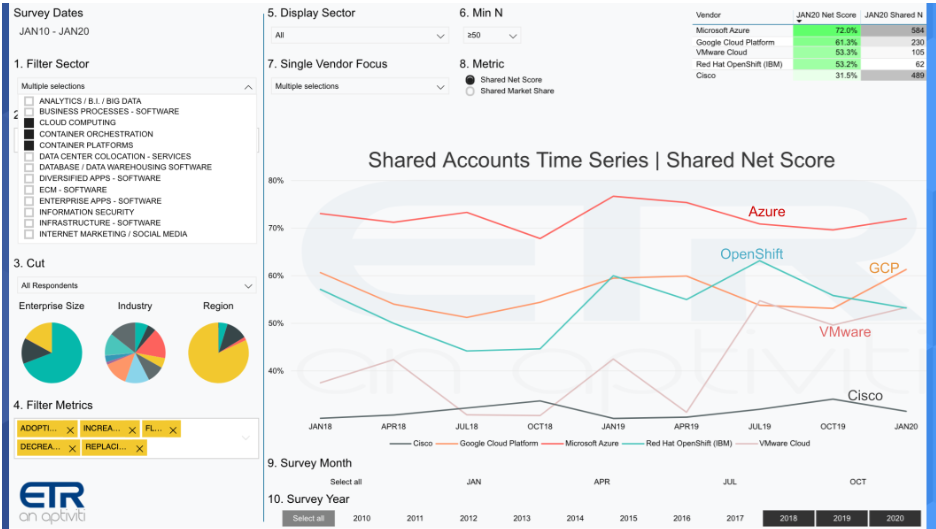

A third chart shows some similar proxy data to help us get an even better view of the multicloud picture. Once again, Azure and Google Cloud are both showing strong momentum, closely followed by Red Hat OpenShift and VMware, and Cisco maintaining a presence albeit with less spending momentum than the others.

“The takeaway here is this is a wide-open race,” Vellante said. “You really can’t pick a winner yet and each will come at this from their own unique position of strength.”

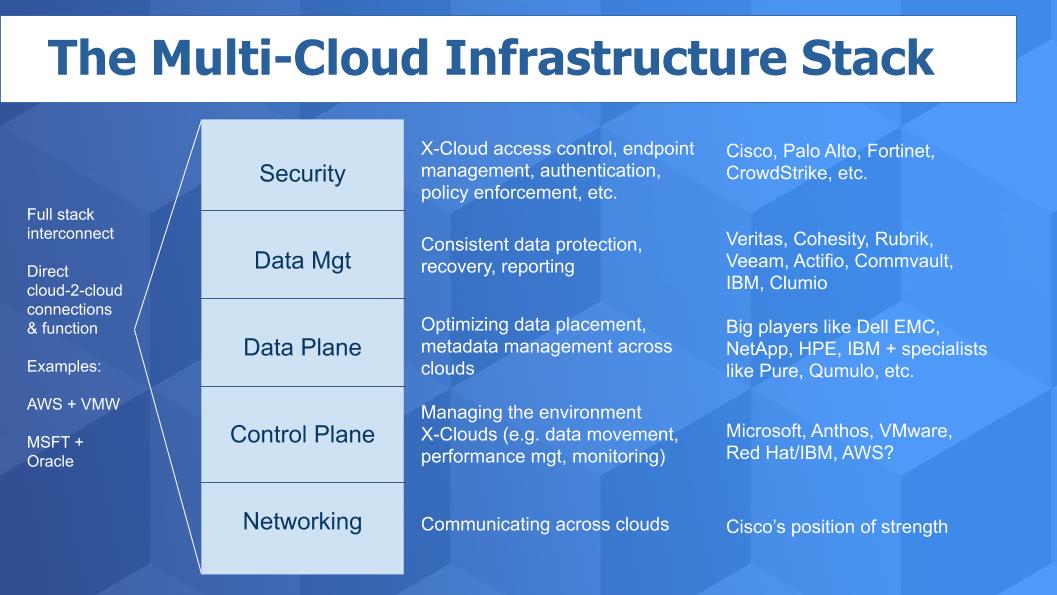

To get a better idea of who’s winning in multicloud, it helps to look at how the landscape is evolving. The next chart shows how Wikibon sees the multicloud infrastructure stack emerging, as well as some respective leaders in each space.

We identify five unique segments in multicloud, and most of them are wide open at this stage. Cisco, Palo Alto Networks Inc., Fortinet and CrowdStrike, among others, are leading in the security space, which relates to things like access control, endpoint management and policy management. Data management is just as competitive and is currently the domain of upstarts such as Cohesity, Rubrik, Veeam Inc. and Veritas Technologies LLC, though IBM is also in the mix.

As for the data plane, this is a battle between major players such as Dell EMC, NetApp Inc., IBM and Hewlett-Packard Enterprise Co., as well as specialist storage providers such as Pure Storage Inc.

The other important segment in multicloud is the control plane, which includes task such as managing data movement, performance management and monitoring. Microsoft, Google with its Anthos offering, VMware, IBM/Red Hat and AWS are all players there, while Cisco has a huge opportunity to dominate the multicloud networking market.

Networking sets the foundation at the bottom layer of the stack which is Cisco’s entry point to multicloud.

“The bottom line is we see a battle brewing between the big companies with large appetites gobbling up major portions of the market with integrated suites, and smaller, nimbler players that are delivering best of breed functionality and innovation,” Vellante said.

The good news is that multicloud is a trillion-dollar market, which means it’s large enough for multiple players to eat at the table. And that means there will be more than one winner, with established players such as AWS, Microsoft, Google, VMware, IBM and others all positioned to grab a piece of the pie, with smaller innovators racing to fill white space in the market.

“VMware, Red Hat and Cisco all come at this from respective positions of strength and have the added benefit of being cloud-agnostic, because generally they’re not wedded to a hyperscale cloud,” Vellante said. “The specialists will solve problems that are too small initially for the whales to see but will grow and some will reach escape velocity.”

Here’s the full video analysis for more:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.