APPS

APPS

APPS

APPS

APPS

APPS

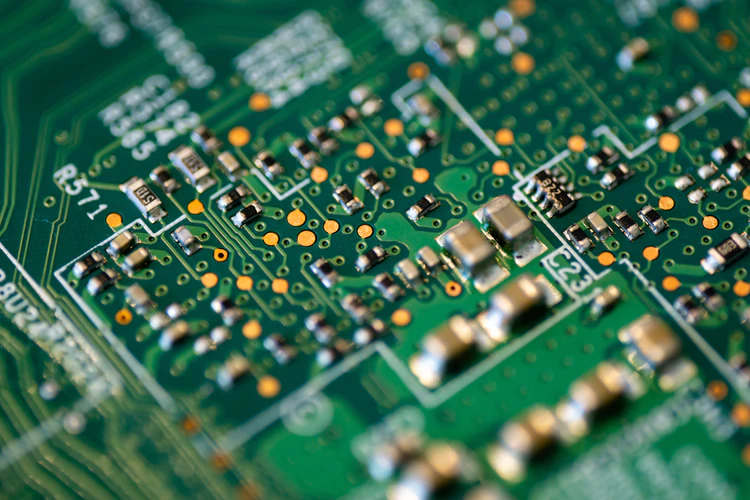

Dialog Semiconductor Plc., a British chipmaker whose silicon is used in devices ranging from iPhones to car infotainment systems, today announced that it has agreed to be acquired by Japan’s Renesas Electronics Corp. for 4.9 billion euros.

The sum equals about $5.9 billion. It values Dialog at a 20% premium to its Friday closing price.

Tokyo-based Renesas is a major chip supplier to the auto sector. The company sells compact microcontrollers that can function as the main processor of vehicle subsystems such as dashboard displays. Renesas also provides other types of chips, including memory units, sensors and radio components, among many other products.

Dialog likewise maintains a presence in multiple parts of the semiconductor market. The company makes power management and wireless networking chips, as well as mixed-signal integrated circuits, a type of multipurpose processor used for tasks such as powering a smartphone’s display. One of Dialog’s biggest clients is Apple Inc., which uses the company’s silicon in its iPhones.

The proposed acquisition of Dialog would enable Renesas to secure an important role in Apple’s hardware supply chain. The iPhone maker in late 2018 announced a $300 million, three-year deal with Dialog for power management chips and other semiconductor products. Last month, the British firm boosted its revenue guidance for the current quarter to between $436 million and $441 million on account of “stronger-than-expected consumer demand for 5G phones and tablets.”

Besides growing Renesas’ mobile industry presence, the acquisition is also set to give the company a boost in its core focus area: the auto sector. Dialog’s chips are used not only in mobile devices but also infotainment systems, instrument panels and other vehicle subsystems. Before becoming an independent company in 1998, Dialog was a subsidiary of Mercedes-Benz parent company Daimler AG.

Automakers are increasingly adding smart car services and partially automated driving features to their vehicles in bid to create new revenue streams. All those new capabilities are creating bigger demand for chips. Dialog’s technology could put Renesas in a better position to make money from the trend.

Yet another major trend that the acquisition addresses is the so-called “industrial internet of things.” Companies such as manufacturers are adopting artificial intelligence to automate tasks such as equipment maintenance. Dialog, thanks to the 2019 purchase of industrial chip specialist Creative Chips GmbH, has a presence in that market as well.

Renesas is aiming to close the acquisition by year’s end. The chipmaker expects to achieve incremental revenue growth of about $200 million within four to five years of the deal’s completion, partially by cross-selling its products to Dialog customers and vice versa. Moreover, Renesas projects operational cost savings of approximately $125 million per year.

The acquisition continues a recent trend of consolidation in the semiconductor industry. Nvidia Corp. last year made a $40 billion offer for British chip designer Arm Ltd., while Qualcomm Inc. last month inked a $1.4 billion deal to acquire Nuvia Corp., a chip startup founded by Apple’s former top central processor unit engineer.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.