CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Cloud repatriation is a term often used by technology companies that don’t operate a public cloud. The marketing narrative most typically implies that customers have moved work to the public cloud and, for a variety of reasons – expense, performance, security – are disillusioned with the cloud and as a result are “repatriating” workloads back to their safe, comfy and cost-effective on-premises data center.

Although we have no doubt this does sometimes happen, the data suggest that this is a minor, single-digit phenomenon.

Some have written about the repatriation myth, but in this Breaking Analysis, we’ll share hard data from ETR and other sources that we feel debunks the repatriation narrative as it’s currently being promoted. We’ll also take this opportunity to do our quarterly cloud update and share our latest figures for the Big 4 cloud providers.

Let’s start by acknowledging that the definition and concept of cloud is absolutely evolving and, in this sense, much of the vendor marketing is valid. In particular, no longer is cloud a distant set of remote services that lives “up there in the cloud.” Cloud is increasingly becoming a ubiquitous, sensing, thinking, acting set of resources that touches nearly every aspect of our lives.

The cloud is coming on-premises to a data center near you, and work is being done to connect clouds to each other while the cloud is also extending to the near and far edge. The bromide “The cloud is not a place, it’s an operating model” is becoming reality.

Today’s cloud is not just compute, storage, connectivity and spare capacity. Increasingly it’s a variety of services to analyze data, predict and anticipate changes, monitor and interpret streams of information, and apply machine intelligence to data to optimize business outcomes, along with tooling to share data, protect data, visualize data and bring data to life, supporting a new breed of innovative applications.

Notice a theme? Data. Increasingly, the cloud generally, and Amazon Web Services Inc.’s S3 and other object stores specifically, are the universal place where lots of data lives from a variety of sources. Now, that data may be coming from on-prem systems, but the cloud is where organizations increasingly go to store, analyze and share data because the cloud vendors have the best platforms for data.

This is part of why the repatriation narrative is dubious: because the volume of data in the cloud is growing at rates faster than data on-prem – at least by 2000 basis points annually by our estimates. So cloud data is where much of the data action is happening, notwithstanding that plenty of transactions still occur on-prem.

The edge is the new Wild West of tech. We’ll talk about edge in a moment because that presents a large opportunity.

But a new era of application development is emerging with containers at the center. The concept of “write once, run anywhere,” in theory, allows developers to take advantage of systems such as transaction systems that run on-prem and tap data from multiple sources in various locations, in clouds and at the edge. Combined with the immense, cheap processing power we’ve discussed in previous episodes, a new breed of apps powered by AI is hitting the market.

This is not a zero-sum game. The big cloud vendors have given the world an infrastructure gift by spending like crazy – more than $100 billion in capital spending last year, for example. In our view, the players that don’t own a cloud should stop being so defensive about it, thank the hyperscalers and lay out a vision of how they will create a new abstraction layer on top of the public cloud.

And that’s what they’re doing and will all claim to be actively working on, but consider the pace of play between the hyperscalers and the traditional on-prem providers. We believe the innovation gap is widening– meaning the public cloud players are accelerating their innovation lead and will 100% compete for hybrid applications. And they have the resources, developer affinity, custom silicon expertise and total available market expansion goals that loom large.

So although it’s not a zero-sum game, and hybrid is definitely real, we think the cloud vendors continue to gain share most rapidly, unless the on-prem crowd can move faster.

Now, of course, there’s the edge and that’s a wildcard. But it seems that again, the cloud players are well-positioned to innovate with custom silicon, programmable infrastructure, capex buildouts at the edge and new thinking around systems architectures.

You hear many marketing messages that call into question the public cloud. At its recent Think conference, IBM Corp. Chief Executive Arvind Krishna said that only about 25% of workloads had moved into the public cloud. And he made the statement that this might surprise you – implying you might think it’s much higher.

We are not surprised by that figure, especially if you narrow it to mission-critical work, which IBM does in its annual report. Regardless, we think there are other ways to measure adoption.

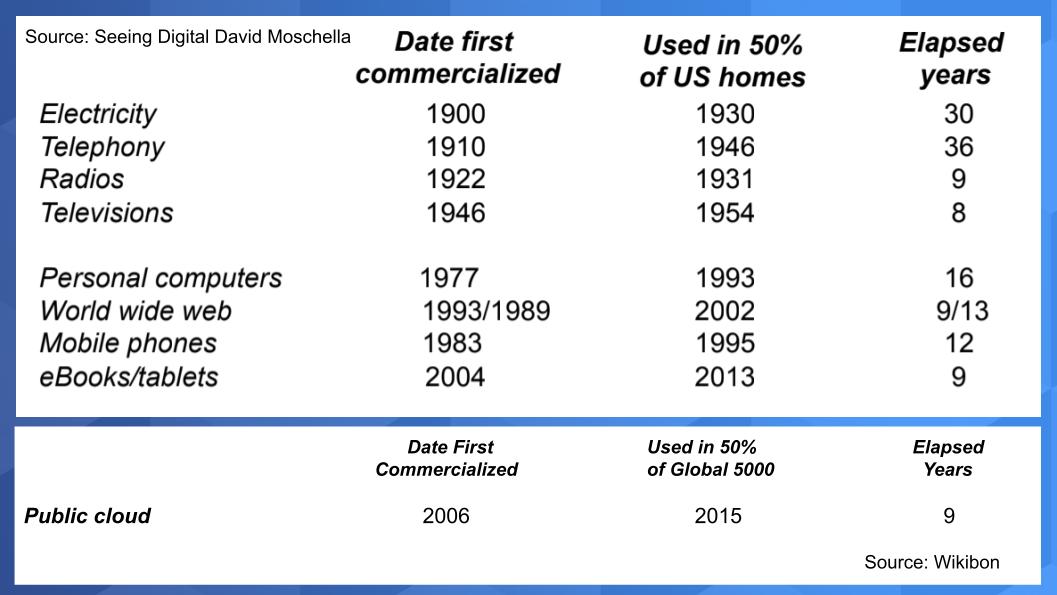

The chart above from David Moschella’s book “Seeing Digital” shows the adoption rates for major innovations over the past century and the number of years it took to get to 50% household adoption. Electricity took a long time, as did telephones, with the need for last-mile infrastructure. Radios and TVs were much faster given the lower infrastructure requirements. Personal computers actually took a long time and the Web around nine years from when the Mosaic browser was introduced.

We took a stab at the bottom of the chart, estimating the pace of adoption of public cloud, and within a decade it reached 50% adoption in top enterprises. Today that figure is easily north of 90%.

We’ve updated our quarterly cloud figures and share the results below.

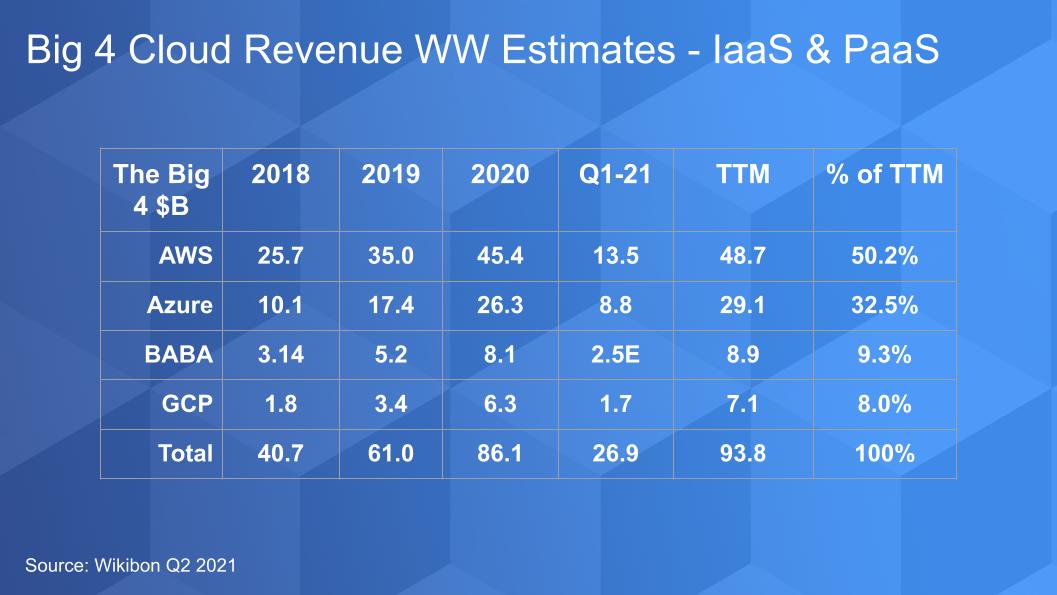

The chart above shows our latest estimates for the Big 4 cloud players, with updated Alibaba Cloud figures based on its earnings report from May 13 after the market close. These final figures are generally in line with the preliminary projections we conveyed in the video below, which was recorded prior to Alibaba’s earnings release. Alibaba’s March-quarter growth rates came in slightly lower than we expected but did not materially change these figures.

Remember, AWS and Alibaba report relatively clean infrastructure-as-a-service figures, so we use survey data, community input and financial analysis to estimate the actual numbers for Microsoft Corp.’s Azure and Google Cloud.

In the first quarter of 2021, we estimate that the Big 4 IaaS and platform-as-a-service revenue approached $27 billion, as shown in the highlighted column. That figure represents about 40% growth relative to Q1 2020. So our trailing-12-month calculations put us at $94 billion and we’re now on a roughly $108 billion run rate. As you may recall, we’ve predicted that figure will surpass $115 billion by year end when it’s all said and done.

AWS remains the leader among the Big 4 with just over half the market, down from about 63% for the full year 2018. Unquestionably, as we’ve reported, Microsoft is everywhere in the market and continues to perform exceptionally well. Anecdotally, customers and partners in our community continue to report to us that the quality of the AWS cloud is noticeably better in terms of reliability and overall security. But it doesn’t seem to change the trajectory of the share movements as Microsoft’s software dominance makes doing business with Azure really easy.

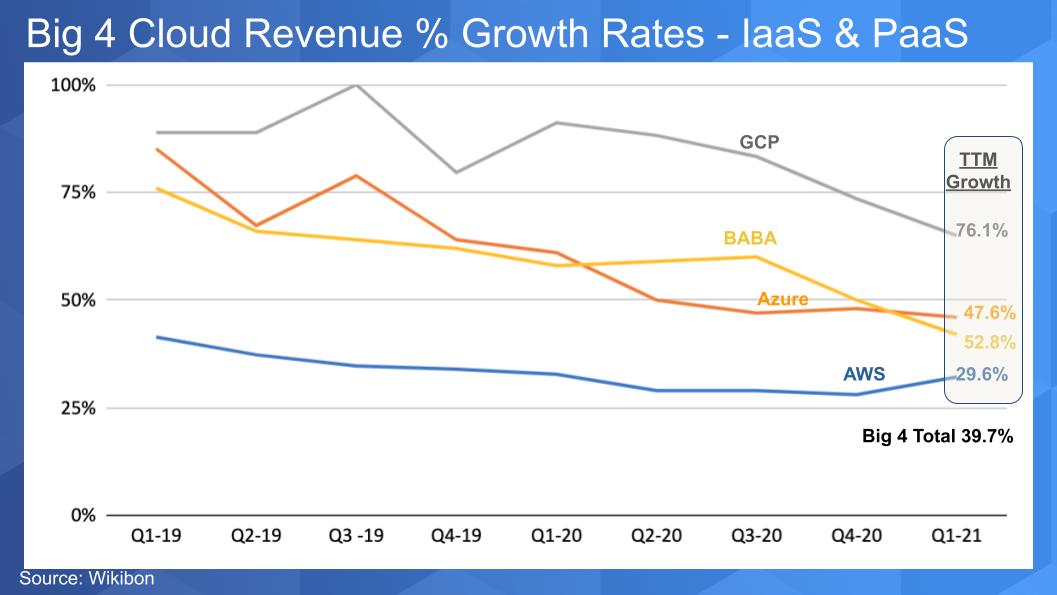

Let’s dig into growth rates associated with these revenue figures and make some specific comments. The chart below shows the growth trajectory for each of the Big 4:

Google trails the pack in revenue but is growing faster than the others from a smaller base. Google is being very aggressive on pricing and customer acquisition. Google needs to grow faster, in our view, and it most certainly can afford to be aggressive.

As we stated, combined the Big 4 are growing revenue at 40% on a trailing-12-month basis and that compares with low single-digit growth for on-prem infrastructure. And we don’t see that delta changing in the near- to mid-term. Like storage growth, revenue for the big public cloud players is expected to outpace spending on traditional on-prem platforms by at least 2000 basis points for the foreseeable future.

Interestingly, although AWS is growing more slowly than the others, from a much larger $54 billion run rate, we actually saw sequential quarterly growth in Q1 from AWS, which breaks a two-year trend where AWS’ Q1 growth rate dropped sequentially from its Q4. AWS was the only member of the Big Four to show accelerated sequential revenue growth rates.

At AWS, we’re also watching the changing of the guard, with Andy Jassy becoming CEO of Amazon overall, Adam Selipsky boomeranging back to AWS from a very successful stint at Tableau Software Inc., and Max Peterson taking over AWS Public sector, replacing Teresa Carlson, who is now president heading go-to-market efforts at Splunk Inc. So there are lots of changes at AWS and we think these changes actually are a real positive for AWS as it promotes from within, taps previous Amazon DNA from Salesforce/Tableau and moves the head of AWS to run all of Amazon. That’s a signal to us that Amazon will dig in its heels and further resist calls to split AWS from the mothership.

Digging in a bit more to this repatriation theme, the revenue numbers don’t tell the full story, so it’s worth drilling down a bit. Let’s look at the demand side of the equation and pull in some ETR survey data.

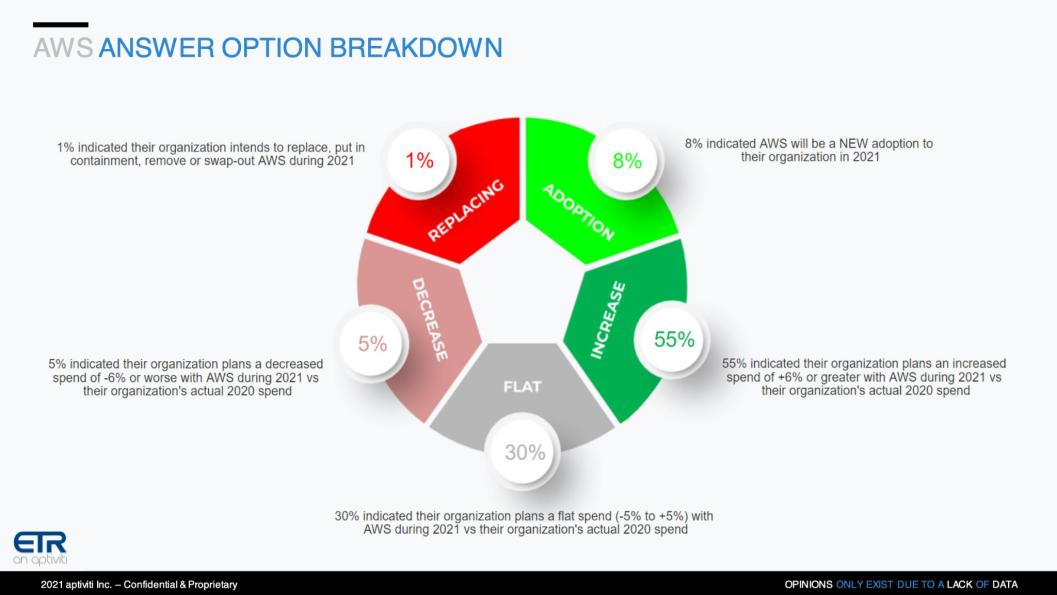

To set this up, we want to explain a fundamental method used by ETR around its Net Score metric as shown above. Net Score measures spending momentum and assesses five factors as shown on this wheel chart. It depicts the breakdown of spending for the AWS cloud.

Specifically, the approach measures the percentage of customers within a platform that are doing one of the following: 1) adopting the platform new – that’s the lime green in the chart; 2) increasing spend by more than 5% – that’s the forest green; 3) leaving spending flat plus or minus 5% – the gray; 4) decreasing spend by 6% or more – the pink; or 5) replacing the platform that’s the bright red. Dare we say the bright red is a proxy for or at least an indicator of… repatriation?

Net Score is derived by subtracting the reds from the greens. Anything above 40% is considered by us to be elevated. AWS is at 57% – so very high and not much sign of leaving the cloud nest. We know it’s nuanced and you can make argument for corner cases of repatriation, but the numbers just don’t bear out the narrative.

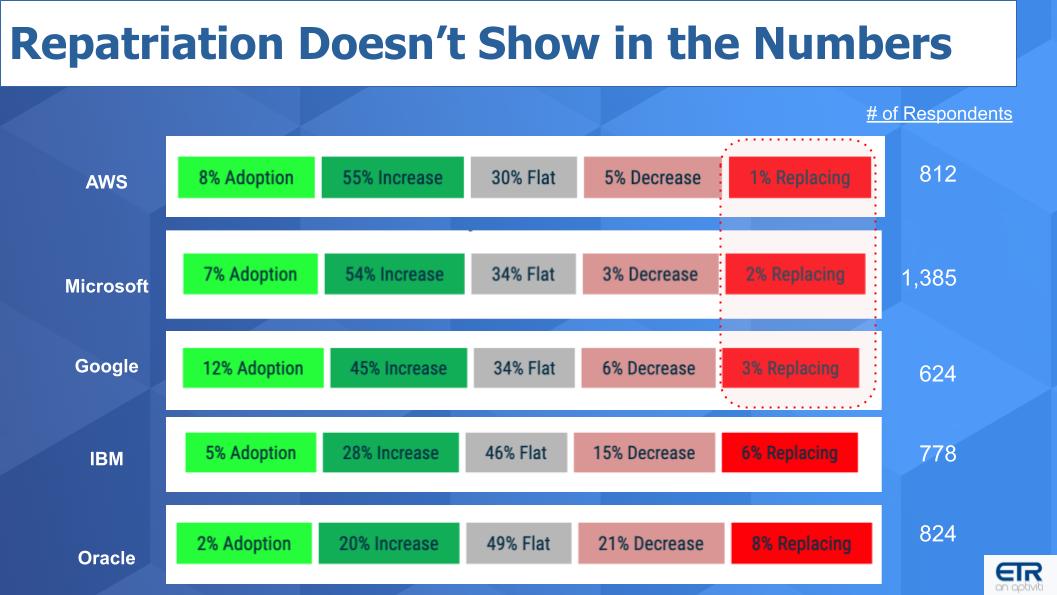

The chart below lines up the Net Score granularity for AWS, Microsoft, Google, IBM and Oracle Corp.:

Other than AWS and Google, these figures include the entire portfolio for each company, but let’s make an assumption that cloud defections are lower than the overall portfolio average. So just stare at the red bars for a moment. The three cloud players show 1%, 2% and 3% replacement, respectively.

But IBM and Oracle, while still in the single digits, show noticeably higher replacement rates, and meaningfully lower new adoptions in the lime green. As well, the “spend more” in the forest green is much higher within the cloud companies and the “spend less” in the pink is notably lower for the cloud vendors.

And you can see the sample sizes on the righthand side of the chart — many hundreds and more than 1,300 in the case of Microsoft. If we put Hewlett Packard Enterprise Co. or Dell Technologies Inc. on the chart, it would look similar to IBM and Oracle, where you have higher reds, a bigger fat middle of gray and lower greens. It’s just the way it is for mature companies with huge on-prem exposure, and it shouldn’t surprise anyone.

They’re actually quite respectable. Just not nearly as attractive relative to cloud plays. So if customers are repatriating, there’s little evidence in the ETR data.

We believe one scenario of what’s really happening is that vendor marketing people are talking to customers purposefully spinning up test and dev work in the cloud, with the intent of running a workload or portions of the workload on-prem. And when they move into production, they’re counting that as “repatriation.” And they’re taking liberties with the data to inject fear, uncertainty and doubt into the market.

OK, that’s fair game, but that’s really not repatriation. That’s experimentation or sandboxing or testing and deving. It’s not “I’m leaving the cloud because it’s too expensive or less secure or doesn’t perform for me.” We’re not saying that doesn’t happen, but it’s certainly not visible in the numbers as a meaningful trend that should factor into buying decisions.

Now we perfectly recognize that organizations can’t just refactor their entire application portfolios into the cloud and migrate. We also recognize that lift-and-shift without a change in operating model is not the best strategy. And real migrations take six months to two years. I used to have these conversations with my colleague Stu Miniman all the time and I spoke to him recently about these trends. I wanted to see if his six months at Red Hat/IBM had changed his thinking on all this, and the answer was no.

But he did throw a little Red Hat Kool-Aid my way, saying the way they think about the cloud blueprint is from a developer perspective. Start by containerizing apps and then the devs don’t need to think about where the apps live – in the cloud, on prem, at the edge. According to Miniman, Red Hat’s compelling value prop is OpenShift is an open source and designed specifically as an application development platform that brings consistency of operations for developers, operators, admins, the security team and the like.

And it can be used with any other platform – that is, you don’t have to lock into another platform and bring that everywhere with you. There’s a strong story there and this is how Krishna plans to win the architectural battle for hybrid cloud.

Of course, VMware Inc. can also offer Tanzu as a development platform — and reasonable people can debate the pluses and minuses of VMware’s open-source-“aligned” versus Red Hat’s approach.

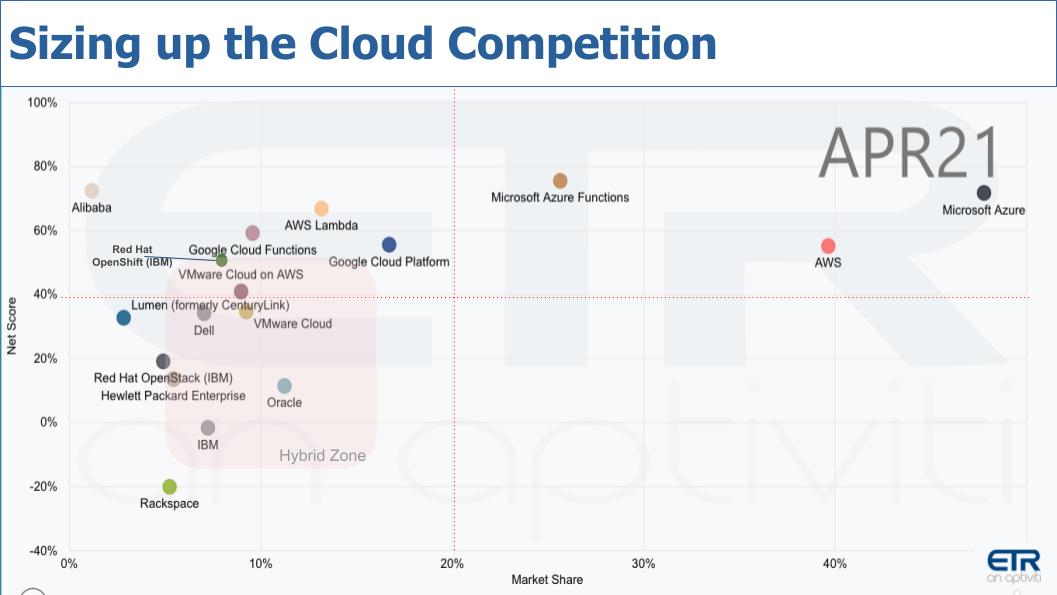

The chart below shows one of our favorite ETR views, plotting Net Score or spending velocity on the vertical axis and Market Share or pervasiveness in the data set on the horizontal axis:

The red shaded area is what we call the “hybrid zone,” and above the dotted red line at 40% is where the elite live. Anything above 40% Net Score we consider elevated. Anything to the right of 20% on the horizontal axis implies strong market presence.

By those key performance indicators, it’s really a two horse race between AWS and Microsoft. As we suggested, Google still has a lot of work to do and if it’s buying market share, that’s a start– buy more, we say. Alibaba is shown in the upper lefthand corner – high spending momentum but from a small sample size since ETR’s China respondent level is much lower than in the U.S., Europe and rest of APAC.

The hybrid zone is interesting. The data in our view gives credence to another narrative from the noncloud-owning vendors – namely that not everything will move into the public cloud and the world is hybrid. Over the past several quarters we’ve seen this hybrid zone performing well. Examples include VMware Cloud on AWS, VMware Cloud, which would include VCF, and Dell’s cloud – which is heavily based on VMware.

We superimposed Red Hat OpenShift, which lives in the container bucket within ETR’s taxonomy. Red Hat leads with OpenShift in all of its cloud discussions and is perhaps most interesting given its ubiquity. You can see it’s very highly elevated on the Net Score axis, right there with all the public cloud guys. Red Hat is the Switzerland of cloud, which in our view puts it in a very strong position.

And then there’s a pack of companies hovering around the 20% vertical axis level that are hybrid. Note that OpenStack actually has presence in telcos building their own clouds. HPE, Oracle and IBM are also shown.

Notably, IBM’s position in cloud just tells you how important the Red Hat acquisition is to IBM’s future. Without Red Hat, IBM would be far less interesting in cloud and would have much more limited developer affinity.

Oracle is Oracle and actually has one of the strongest hybrid stories in the industry within its own little – or not so little – world of the Red Stack.

HPE is on the radar and we’ll see how the big GreenLake as-a-service pricing will impact its momentum in the cloud category.

Remember the definition of cloud here is whatever the customer says it is. So if a chief information officer says we’re buying cloud from HPE or IBM or Cisco or Dell or whomever, we take her or his word for it. And that’s how it works. Cloud is in the eye of the buyer.

So you have the cloud expanding into the domain of on-premises and the on-prem guys finally getting their proverbial act together with hybrid that they’ve been talking about since 2009 but it looks like it’s finally becoming real. And that crowd is correct, you’re not going to migrate everything into the cloud.

Nonetheless, the hyperscalers are in a very strong position. They are on the growth flywheel. They each have adjacent businesses that are data-based, disruptive and dominant. They are winning the data wars. And they have the leg up in enterprise AI in our view, despite that space still being wide open.

We can all agree that artificial intelligence is important, right? Machine intelligence is being infused into every application. Today much of the AI work is being done in the cloud as modeling, but in the future we see AI moving to the edge and real-time inference as a dominant workload. And that’s what makes the future so intriguing because, combined with the edge, it’s the new Wild West.

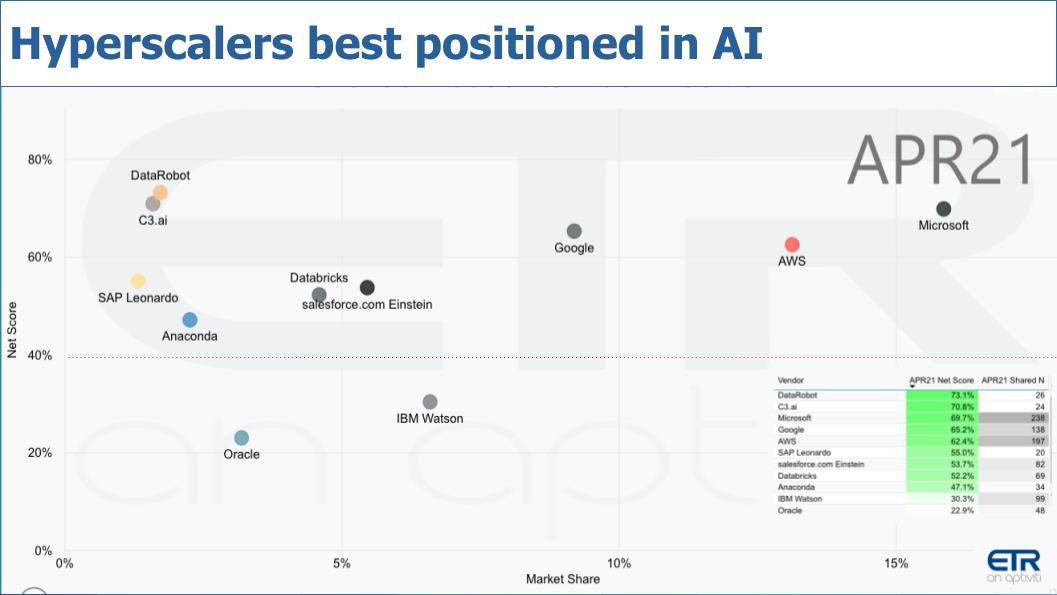

So who today has the momentum in AI?

The chart above uses the same XY construct with Net Score against Market Share. And look who has the dominant mind share and spending momentum: Microsoft, AWS and Google. You can see in the table insert in the lower right they are the only three in the data set of 1,500 respondents that have more than 100 N – and AWS and Microsoft are around 200 or more. And their Net Scores are all elevated above the 60% level. Remember that 40% red line indicates the high elevation mark, so the hyperscalers have both the market presence and the spend momentum.

They’re not alone – there are several companies above the 40% line. Databricks Inc. is bringing AI and data science to the world of data lakes with its managed services. Salesforce.com Inc. is infusing AI into its platform via Einstein.

Anaconda is kind of the gold standard platform for data science and you can see C3.ai Inc. is Tom Siebel’s company going after enterprise AI. DataRobot Inc., which like C3.ai has a small sample of the data set, is highly elevated. They simplify machine learning.

Now IBM Watson is actually doing OK. Sure we’d like to see it higher given that former CEO Ginni Rometty essentially bet IBM’s future on Watson, but it has a decent presence and a respectable Net Score. And IBM owns a cloud, so at least it’s a player – not the dominant one many had hoped for when Watson beat Ken Jennings in Jeopardy 10 years ago, but it’s in the mix.

And Oracle is now getting into the game… like it always does – watching, waiting, investing in research and development and then diving in and making noise like it invented the concept. Oracle is infusing AI into its database with Autonomous Database and data warehousing and look – that’s what Oracle does. It applies best-of-breed industry concepts to make its products better. You have to give Oracle credit – it invests in real tech and it runs the most mission-critical apps in the world. Hate them if you want, but they’re No. 1 in the most difficult enterprise workloads.

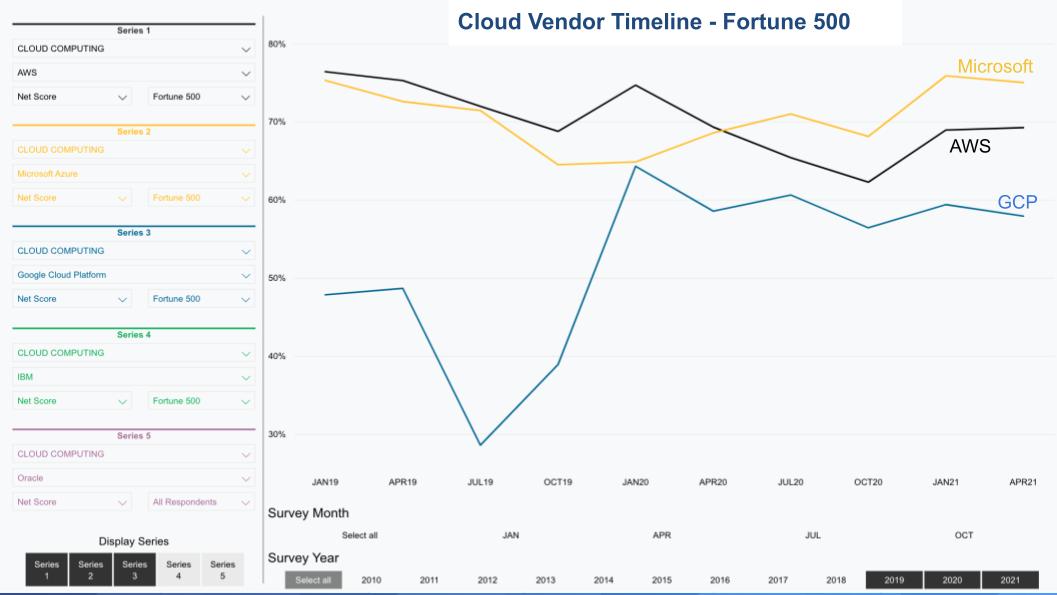

Let’s take one more view of the cloud players and see how they stack up where the big spenders live in the Fortune 500:

The chart above shows Net Score over time within the F500. AWS is particularly interesting because its Net Score overall is in the high 50% range, but in this large, big-spender sector, AWS’ Net Score jumps noticeably to nearly 70%. This is a strong indication that AWS has momentum not only with small companies and startups, but where it really counts from a revenue perspective – in the largest companies. We think that’s a positive sign for AWS in terms of maintaining its market momentum and continuing to grow its business.

The realities of cloud repatriation are clear in our view: Corner cases exist, but it’s not a trend to take to the bank.

Although many public cloud users may think about repatriation, most will not act on it. Those that do are the exception, not the rule and the ETR data shows that.

Test and dev in the cloud is part of the cloud operating model, even if the app will ultimately live on-prem. That’s not repatriation. That’s just smart development practice.

Not every workload will or should live in the cloud. Hybrid is real and the big cloud players know it. And they’re positioning to bring their stacks on-prem and to the edge. We believe they currently have specific advantages related to momentum, developer affinity, engineering resources, capital, custom silicon investments and TAM expansion incentives. But there’s plenty of room for others to innovate if they invest in the right places and build strong ecosystems.

Nonetheless, despite the risk of lock-in, higher potential monthly bills and concerns over control, the hyperscalers are well-positioned to compete.

To win in hybrid, the legacy vendors must embrace the cloud and build on top of the giants and add value where clouds aren’t, can’t or won’t. They must find places where they can move faster than the hyperscalers — and so far, they haven’t shown a clear ability to do that.

Let us know what you think. Remember these episodes are all available as podcasts wherever you listen. Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.