INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Dell Technologies Inc. had lots to cheer about today after beating expectations on earnings and revenue thanks to continued strong demand for its personal computers and notebooks.

The company reported a record fiscal first-quarter profit before certain costs such as stock compensation of $2.13 per share on revenue of $24.5 billion, up 12% from a year ago.

That was far ahead of Wall Street’s expectations, with analysts looking for a profit of just $1.61 per share on revenue of $23.4 billion.

Dell, led by founder and Chief Executive Officer Michael Dell (pictured), has seen business boom ever since the COVID-19 pandemic gripped the world, forcing people to work at home. Those people just can’t seem to get enough of the PCs, notebooks, laptops and other gear it sells that enable remote work.

In a statement, Dell Chief Operating Officer Jeff Clarke said “digital transformation” was leading to strong demand across the world for its products. “Now more than ever, customers are turning to Dell Technologies to help build their digital future,” he added.

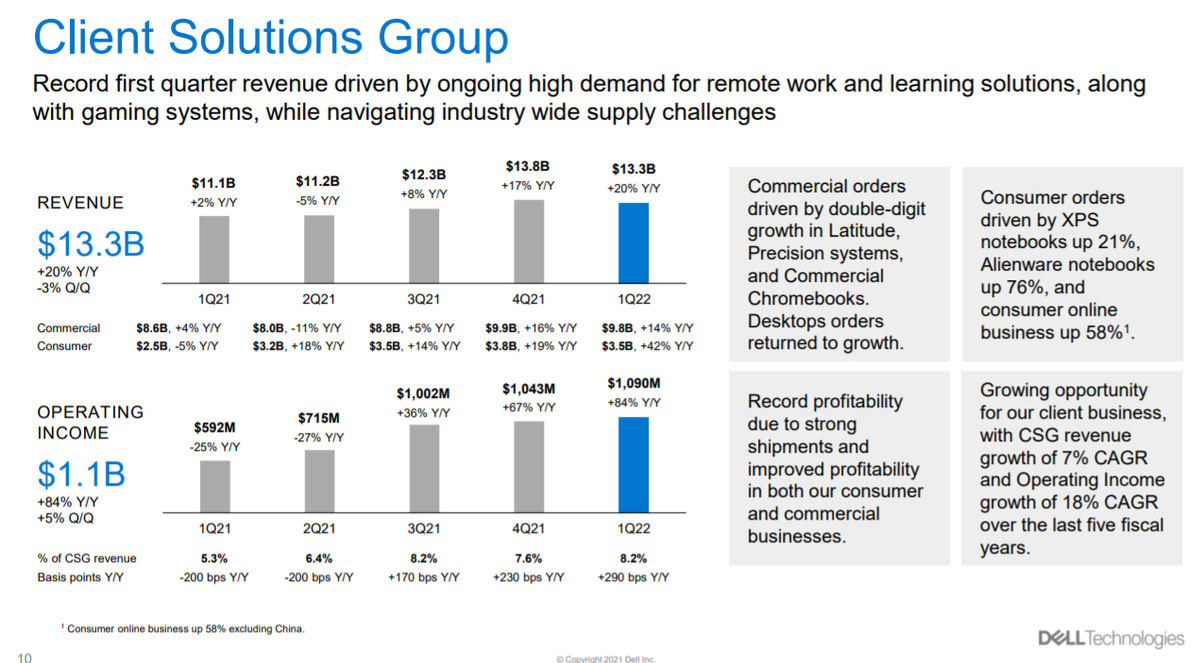

Dell’s PC business, now by far its largest unit, reported sales of $13.3 billion, up 20% from the same period last year. Operating income from PC sales came to $1.1 billion. Within the segment, revenue from consumer PC sales rose 42%, Dell said, while commercial PC sales increased 14%.

Charles King, an analyst with Pund-IT Inc., told SiliconANGLE that Dell’s PC unit helped it deliver excellent results.

“Along with double-digit growth in orders for its Latitude, Precision and Inspiron solutions, orders for Dell’s XPS line grew 21% and those for its Alienware gaming systems jumped by a whopping 76%,” King said.

On a conference call with analysts, Dell Chief Financial Officer Thomas Sweet said desktop sales were improving too, as orders for commercial systems return to growth.

Dell’s PC sales signal a much bigger trend that has seen millions of people across the world replace their computers with something more modern, either for work or for entertainment. Another PC maker, Hewlett-Packard Inc., displayed similar strong sales today as it beat expectations in its fiscal second-quarter results.

HP also raised its outlook for the second half of the year, even though it remains hampered by a global shortage of semiconductor chips.

Clarke told analysts on the call that Dell was in a good position to navigate those supply chain shortages.

“As we have mentioned, the pandemic accelerated the adoption of digital technology in every industry,” he said. “And when coupled with an improving global economy with greater demand for everything, there is an overall shortage of semiconductors. We are executing our strategy as we work through this environment.”

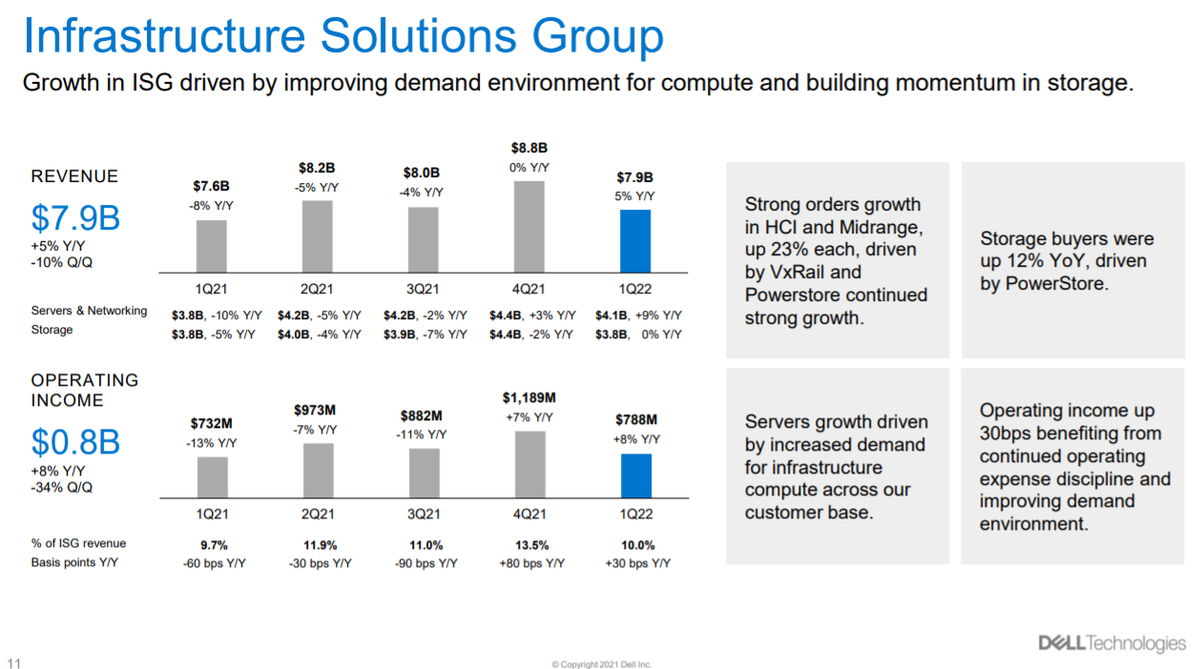

Dell appears to be executing well on its strategy in infrastructure sales too. The company’s Infrastructure Group, which includes computer servers, storage and networking gear among other things, reported sales rose 5% from a year ago, to $7.9 billion in the quarter. Within the segment, server and networking revenue was the biggest achiever, with revenue growing 9%. Operating income from the unit came to $788 million.

Moor Insights & Strategy analyst Steve McDowell told SiliconANGLE that midrange storage and hyperconverged infrastructure were the bright spots, growing by a combined 23% year-over-year. “HCI has been a continuing strength for Dell, and its vxRail is a very strong performer,” he said.

Dell has high hopes for its Infrastructure Group going forward. During the company’s Dell Technologies World conference earlier this month, it outlined Project Apex, with which the company will shift all of its enterprise products to an as-a-service business model.

The company is following the lead of industry rivals such as Hewlett Packard Enterprise Co., Cisco Systems Inc. and IBM Corp. that have already committed to subscription-based pricing and delivery, a model sometimes called composable infrastructure.

In that scenario, the provider installs and maintains computer, storage and networking equipment on customer sites or in colocation facilities and charges based on usage. Infrastructure providers are responding to customer demands to even out expenses by shifting from a variable capital expense model to one that treats technology as an operating expense.

“Dell saw strong growth in orders for its infrastructure and business offerings,” King said. “That places the company in an enviable position to pursue the Apex as-a-service strategy and solutions.”

The Apex business model is likely to benefit Dell in the long run, since the costs to customers are often greater over the long term, analysts say. The advantage for customers is that they gain the benefit of more visibility and control over those costs.

“It is smart for companies to go in this direction, even if they have no choice, in my opinion,” David Vellante, chief analyst at Wikibon, SiliconANGLE’s research affiliate, said at the time. “Customers demand it and over time it could be more profitable.”

McDowell said Dell is making its storage and HCI offerings the cornerstone of its new Apex as-a-service strategy. This is a smart move because it gives Dell an advantage over HPE’s GreenLake, which doesn’t yet have an HCI component, he said. The only caution for investors, he warned, is that revenue from service-based offerings is spread out across the life of the service contract.

“It’s a financial model that builds over time, but it’s where the industry is headed, so I take it as a positive that Dell is investing heavily here,” McDowell continued. “Delivering storage and HCI first plays to Dell’s strengths and allows it to differentiate.”

Dell’s business also gained a boost from VMware Inc., the virtualization software maker that will be spun off from Dell later in the year. For the quarter, VMware contributed revenue of $2.99 billion, better than Wall Street’s estimates.

Overall, Dell deserves a pat on the back for finding a growth path across its entire business portfolio, the first time it has done that in a very long time, said Constellation Research Inc. analyst Holger Mueller.

“Only storage was flat, but the Infrastructure Solutions Group grew by 9% and that is a good result,” he said. “PC demand helps the Client Solutions Group to a record result, and though growth at VMware was a bit lackluster it remains the key contributor to profit for Dell overall. The key to the successful quarter was good cost management, with operating expenses up just 2%, being far outpaced by revenue.”

Earlier this month Michael Dell appeared on theCUBE, SiliconANGLE Media’s livestreaming studio, where he talked more about Project Apex and the decision to spin off VMware:

THANK YOU