CrowdStrike, Zscaler and Okta beat quarterly revenue forecasts

Revenue at three security-related companies came in higher-than-expected in their latest quarterly earnings reports today, but it was a mixed bag in terms of how investors responded.

Of the three, CrowdStrike Holdings Inc. saw the highest share increase, while Zscaler Inc. remained mostly flat. Okta Inc. saw its share price plunge before recovering in late trading.

CrowdStrike

For the quarter ended Oct. 30, CrowdStrike reported a profit before costs such as stock compensation of 17 cents a share, up from eight cents in the same quarter of fiscal 2021. Total revenue in the quarter came in at $380.1 million, up 63% year-over-year. Analysts had been predicting an adjusted profit of 10 cents per share on revenue of $363.6 million.

The better-than-expected revenue was driven by subscription revenue, which came in at $357 million in the quarter, up 67% year-over-year. The increase in subscriptions also helped CrowdStrike report a 67% increase in annual recurring revenue to $1.51 billion.

Quarterly highlights included CrowdStrike adding 1,607 net new subscription customers, bringing the total number of subscribers to 14,687, representing year-over-year growth of 75%.

The company also announced today that it had acquired SecureCircle LLL, a software-as-a-service-based cybersecurity service that extends zero trust security to data on, from and to the endpoint. The terms of the acquisition were not disclosed.

Looking forward, CrowdStrike predicted an adjusted profit of between 19 cents and 21 cents on revenue of between $406.5 million to $412.3 million in the fourth quarter. Analysts had projected $400 million in revenue. For the full fiscal year 2022, the revenue guidance was $1.4271 billion to $1.4329 billion and an adjusted profit of 57 cents to cents per share.

Investors like the numbers. CrowdStrike shares rose almost 4% in after-hours trading.

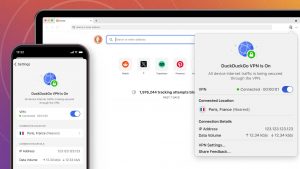

Zscaler

Zscaler reported an adjusted profit of 14 cents per share on revenue of $230.5 million, up 62% year-over-year. Analysts had been predicting an adjusted profit of 12 cents per share on revenue of $212 million.

Calculated billings drove revenue growth, increasing 71%, to $247.7 million, while deferred revenue grew 74%, to $647.8 million.

“CISOs and CIOs are looking to phase out legacy network security in favor of zero trust architecture, due to increasing cyber and ransomware risks and accelerating digital transformation,” Jay Chaudhry, chairman and chief executive officer of Zscaler, said in a statement. “This architecture shift continues to drive strong demand for our Zero Trust Exchange platform.”

Zscaler is predicting an adjusted profit of 11 cents per share on revenue of $240 million to $242 million in its second fiscal 2022 quarter. Analysts had expected 12 cents per share on revenue of $224.8 million.

While beating analyst expectations, the numbers didn’t particularly excite investors, with Zscaler’s share price up less than 1% after the bell.

Okta

Okta reported an adjusted loss of $11 million, or seven cents per share, on revenue of $351 million, up 61% year-over-year. Analysts had been predicting a loss of 23 cents per share on revenue of $327.48 million.

Subscription revenue drove the better-than-expected revenue figure, up 63% year-over-year, to $337 million, while remaining performance obligations rose 49% to $2.35 billion.

In an interview with SiliconANGLE, co-founder and Chief Operating Officer Frederic Kerrest said the company’s adjusted operating margin was 3%.

“We generated $33 million of free cash flow and so you can add that to the growth and it’s the rule of 70,” Kerrest said, referring to Okta’s growth rate. “There are tens of billions of dollars in this market and our revenue is $350 million X 4. Q4 is our biggest quarter and next year is looking very strong.”

Okta also predicted an adjusted loss of 24 to 25 cents per share on revenue of $358 million to $360 million. Analysts had been predicting 27 cents per share on revenue of $355.09 million.

For the full fiscal year, the company says, it expects an adjusted loss of 52 to 53 cents per share on revenue of $1.275 billion to $1.277 billion.

Despite the strong numbers, Okta shares initially plunged after the earnings release at 4 p.m., dropping as much as 8% before recovering the lost ground by 6 p.m. As of 8 p.m. EST, Okta’s share price was up 1.5%.

With reporting from Paul Gillin

Image: CrowdStrike

A message from John Furrier, co-founder of SiliconANGLE:

Your vote of support is important to us and it helps us keep the content FREE.

One click below supports our mission to provide free, deep, and relevant content.

Join our community on YouTube

Join the community that includes more than 15,000 #CubeAlumni experts, including Amazon.com CEO Andy Jassy, Dell Technologies founder and CEO Michael Dell, Intel CEO Pat Gelsinger, and many more luminaries and experts.

THANK YOU