CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

After a tough 2022, the first half of 2023 has shown impressive strength paying off earlier technology bets.

For sure, investors in the so-called Magnificent Seven — Apple, Alphabet, Amazon, Microsoft, Meta Platforms, Nvidia and Tesla — have been rewarded. But sharp investors have sought alpha beyond these names, riding the wave of secular trends in artificial intelligence, cybersecurity, cloud infrastructure and software as well as other emerging spaces such as cleantech and robotics.

As we enter the second half of 2023, the run up in tech combined with macro uncertainty has many investors taking a cautious posture. But prudent earnings guidance sets up for a positive outlook in the mid-term, especially for those companies that can capitalize on the AI wave.

In this Breaking, Analysis we’re pleased to have back Spear Invest founder and Chief Investment Officer Ivana Delevska to assess the current state of the market and explore how this investor is playing AI’s rising tide. We’ll also analyze Enterprise Technology Research data to drill deeper into semis, cloud infrastructure, generative AI, cybersecurity and Snowflake Inc.

Before we get into the conversation, we want to share some performance data on the Spear ETF.

During a difficult 2022, Spear added risk. Earlier this year we had Ivana on and she looked at the semi rebound as a leading indicator of a tech run. Her premise was correct and she made some bets on key sectors that we’re going to talk about. As you can see above, the Spear Alpha ETF YTD is up over 60%, significantly outperforming the Nasdaq and the S&P 500.

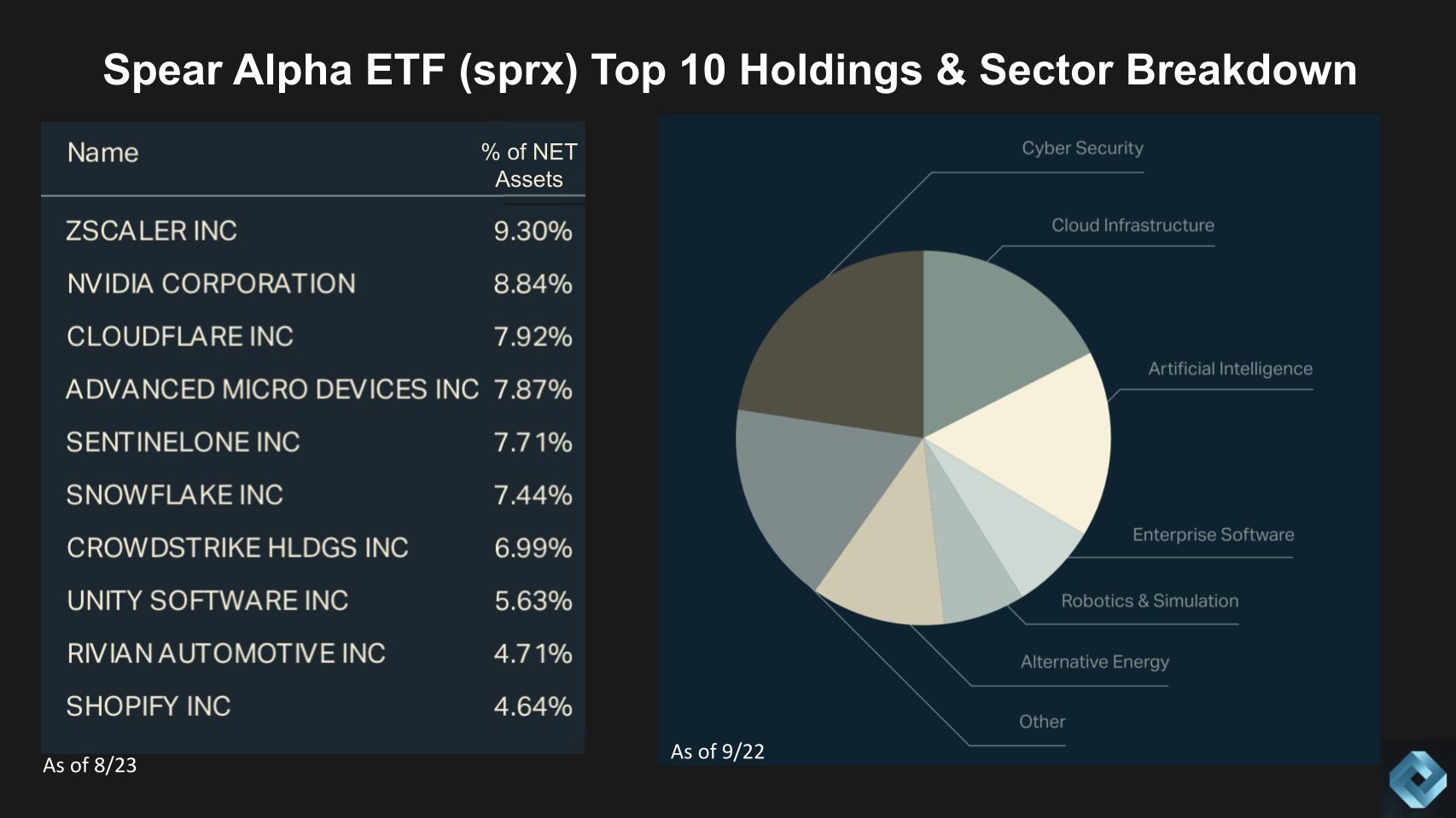

Below we show the top 10 holdings and the key sectors comprising the Spear ETR.

Q. Ivana, please explain your investment thesis.

Our fundamental thesis is based on the fact that consumer technologies drove the prior tech cycle and now we’re seeing technology embedded in every industry. Whether you’re looking at manufacturing, autos, life sciences, we believe the next cycle will be technology impacting every industry and transforming a lot of these traditional industries. We are looking to play a lot of these tech trends through the value chain. So trying to find undervalued opportunities; for us, valuation is very important. So we’re trying to find good entry points and trying to find the winners for the next tech cycle.

Let’s start with semis and then move to cloud, generative AI, cybersecurity and drill deeper into Snowflake.

Q. Spear owns Nvidia, AMD and Marvell. You were in Nvidia well before the phrase Magnificent Seven was coined and your fund has been rewarded this year. Obviously the AI heard ‘round the world has been a tailwind. In your view, Ivana, does Nvidia have a moat and how do you see the competition to Nvidia evolving?

Well, David, we still love Nvidia going into the next cycle. We believe we’re in the early innings of data center spending. So you’re just starting to see companies like Microsoft, Meta and Google expand their CapEx budgets going into next year. So we believe Nvidia is going to benefit from that. They’re uniquely positioned in that they were very early on. So 10-plus years ago they started investing in AI and now they’ve built a leading position that it’s not just the GPUs, it goes beyond that. They’ve built ways to use the GPUs better and they’ve built ways to sit on top of the GPUs that customers can use to build applications easily. They’re not going to be the only player in in AI and in GPUs. So you will see other competitors like AMD introduce products and you are going to see the hyperscalers develop their own products as well. However, it’s very important for investors to understand that because AI is coming so strong, the fact that this cycle is coming so quickly, it does give Nvidia an advantage. So basically instead of you taking time to develop your own product, you really do have to step up and use Nvidia’s products just to not lose that tech advantage during the next cycle.

Q. What do you like about AMD? Is it AI potential or their ability to compete and take share from Intel? Please elaborate.

I think it’s both and and what I think people don’t appreciate about AMD currently is that it’s not just going to be spending in GPUs. And that’s something we heard from Microsoft and Meta during this earning season they’re spending across the board. So even demand for CPUs, like newer generation ones that run faster, it’s going to be pretty strong going into next year. And I think that’s something that’s missed by investors. Then early feedback on their MI, the new GPU that they’re introducing has been very positive. We have yet to hear deal announcements. So I think that’s going to be coming in the second half, but that’s basically the thesis. I think people don’t appreciate enough that this is not just a GPU game, it’s a broader data center spend cycle coming.

OK, let’s pivot to cloud. Amazon announced Amazon Web Services’ earnings Thursday after the close and its growth came in almost exactly on our $22.1 billion number with a 12% annual growth rate. We thought the number could come in even better as we think we’re seeing the backend of the cloud optimization cycle. That said, customers are still being cautious about launching new projects that aren’t AI-related.

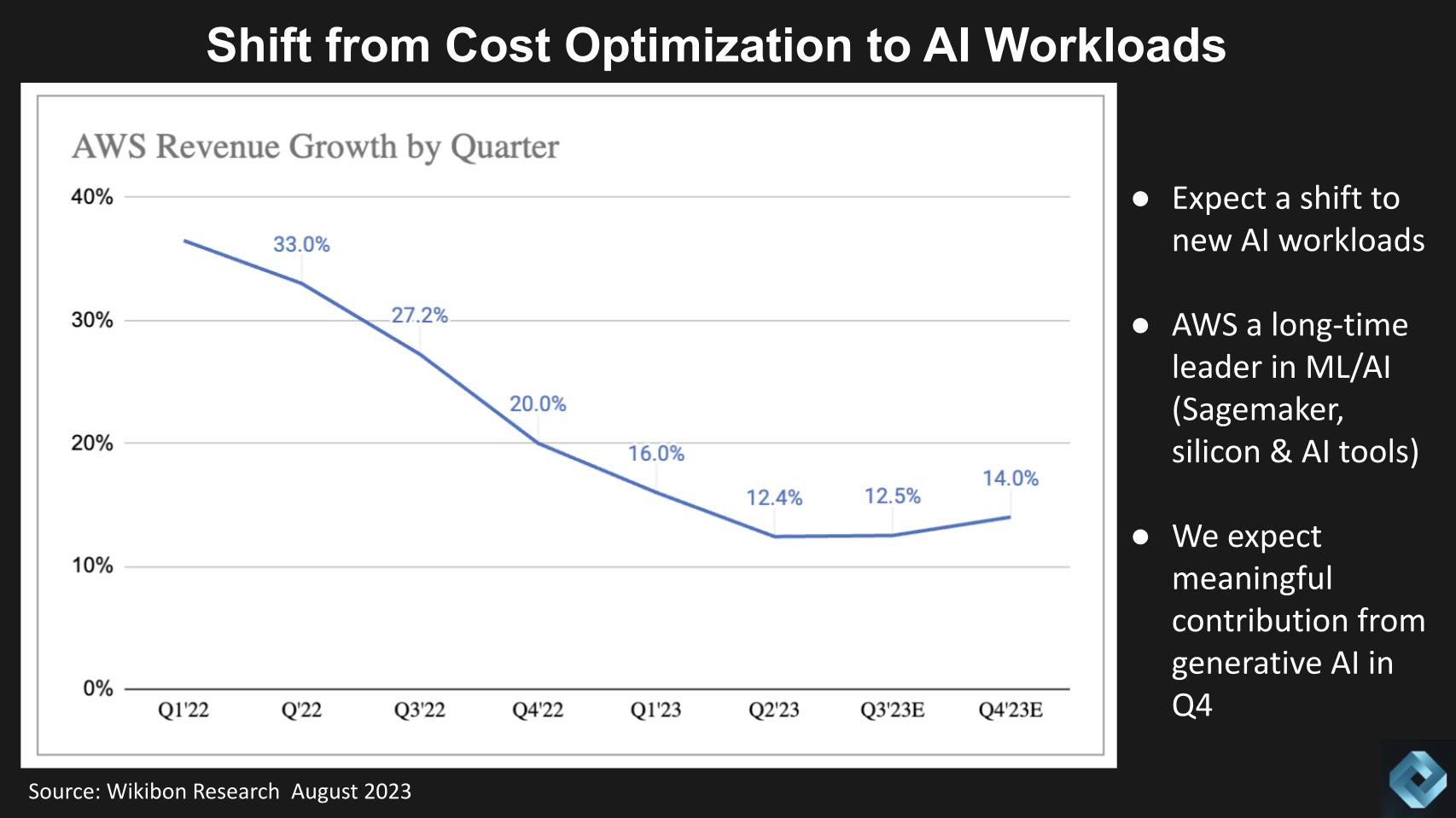

Above we show the deceleration of AWS revenue growth rates by quarter. Our forecast shows the rate decline bottoming and we expect that gen AI spend will benefit AWS and other cloud providers and kick up growth in Q4.

Q. Ivana, you own Amazon and look at cloud as a platform that supports other names in your portfolio that we’ll talk about in a moment. But what was your take on Amazon’s quarter and what’s the investment thesis on the stock?

For Amazon specifically, expectations were very low going into the quarter. I think people were expecting below 10% growth for AWS and the fact that it came out above that was really the upside surprise. So I think the company did a very good job on this call explaining their positioning in AI. They explained how there is not just one layer of opportunity, which is what most people are focused on – the application layer. But it’s really three: the hardware, the infrastructure and then applications.

And they’re really positioned in all three. So I think if you look at them compared to Microsoft, Microsoft may be slightly ahead, but Amazon is also well-positioned and I think a lot of people did not appreciate a AWS’ positioning in AI. I think that’s why the stock is reacting positively going forward.

I think there is going to be more value across the value chain, so smaller cap companies are going to benefit as well. I think that’s where we see a lot of the opportunities where this optimization trend has really affected everybody across the value chain. A lot of stocks that we cover are barely off their lows even with this AI hype. So I think it’s going to be interesting to see how second half develops, but the fact that companies like AWS and Microsoft with Azure are saying that basically they’re seeing bottoming in this optimization, that’s a pretty positive sign for the entire value chain.

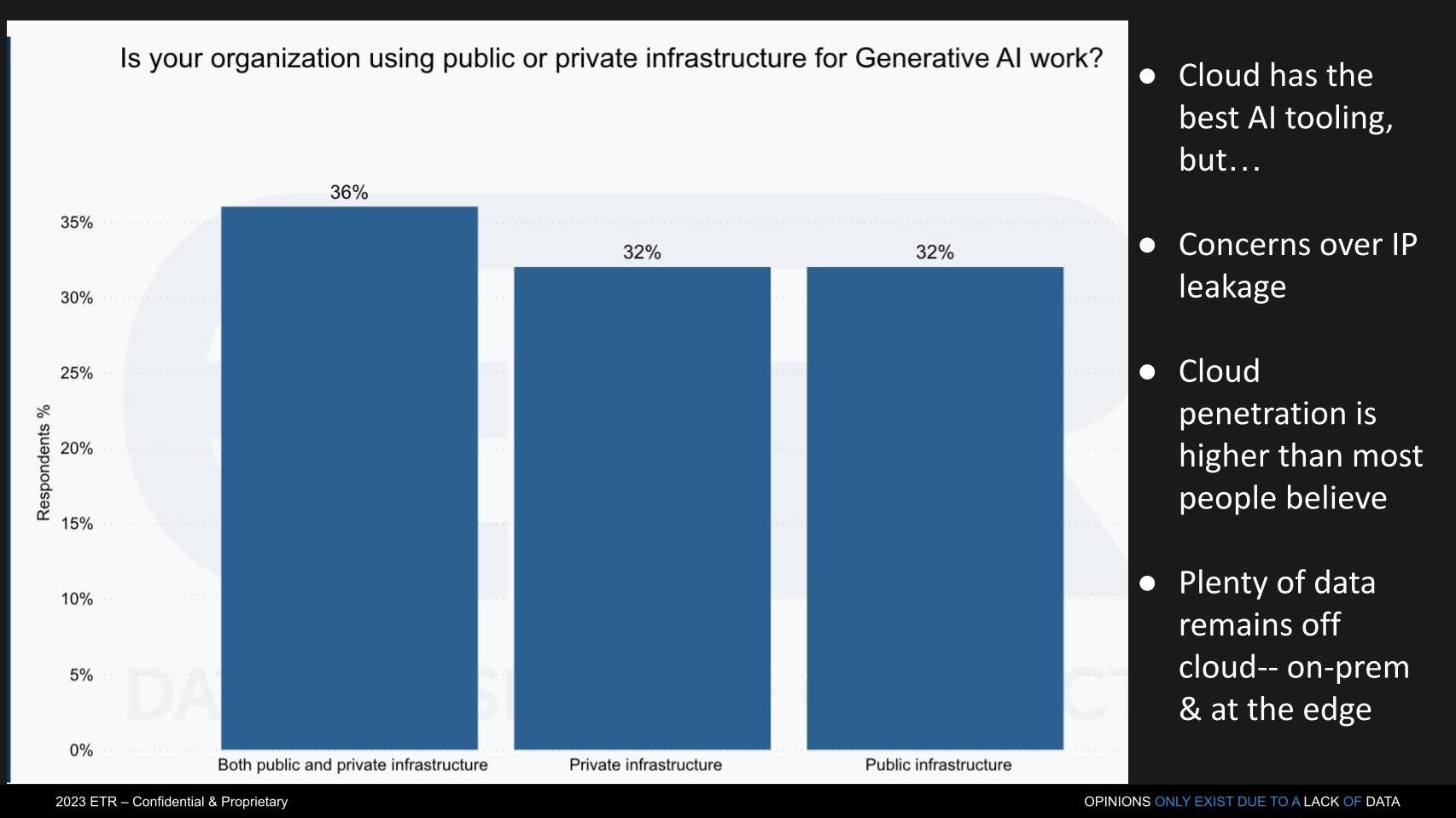

There’s a lot of discussion about whether generative AI will get done in the cloud, in data centers, inference at the near edge such as retail stores and at the far edge. Our take is yes, it will take place in all of those – model training in the cloud and on-premises, inference in low-latency situations such as autonomous vehicles and out on the network where latency needs to be lower but not real-time. This ETR survey data below underscores the all of the above premise.

The data is from a recent ETR drill down survey that shows a mixed picture to the question where will generative AI work get done. The cloud has the best tooling but organizations are concerned over intellectual property leakage. We don’t believe the narrative that only 10% of work has moved to the cloud, we think it’s more like 40% to 45%, nonetheless we agree there’s lots of data outside of the cloud which are candidates for bringing AI to the data.

Q. Ivana, data is everywhere and bringing AI to the data means that not only will the cloud benefit but also there are other opportunities. Nvidia will be in many places, Cloudflare can benefit… EVs at the edge. How do you think about this idea that data is distributed and AI will be done in many places? Is there an investment opportunity there?

Oh yes, absolutely. So I do think model training will generally take place in the cloud, but all of this other inference where you do need the decision making to be closer to the action is really going to be either on the edge or the network. So I think that’s going to be something where we’re going to see a lot of companies benefit and I think Cloudflare is particularly well positioned here with their large network. They’re going to be able to benefit from companies trying to use compute closer to where they’re trying to make the decision. Like you mentioned retail is one example, automotive is another example where you’re not going to be waiting for data to come from the cloud. It’s going to be key to have speed and low latency.

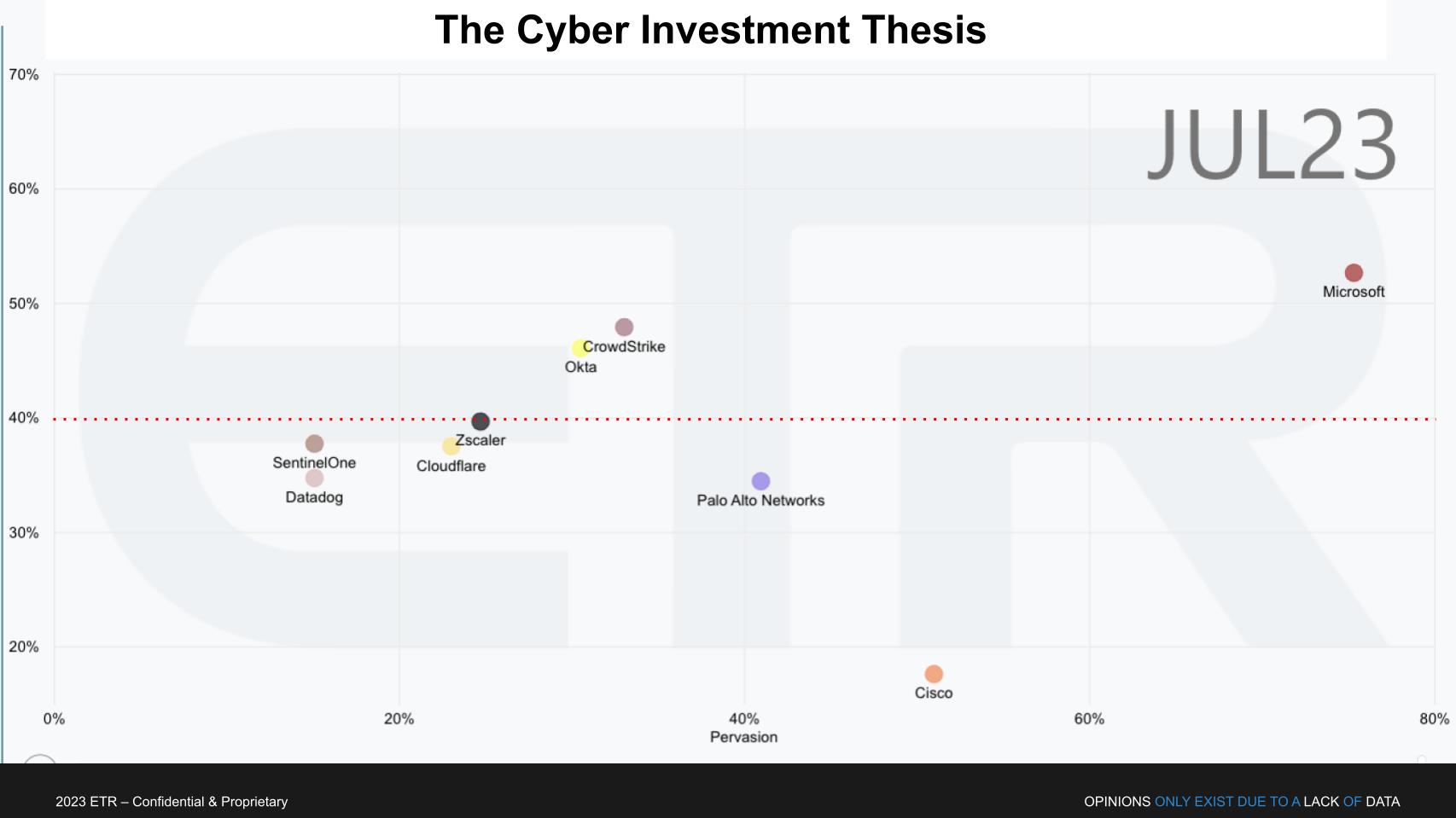

In the ETR chart above, we show Net Score on the vertical axis which is a measure of spending momentum and the horizontal axis shows penetration in the data set. The 40% dotted line indicates extremely elevated momentum. All the cyber stocks Spear owns are solidly above 30%, which indicates market momentum.

Here’s the rub. Last month we saw Microsoft announce new products that the street thought would threaten Zscaler and Palo Alto Networks – and those stocks got hit. Microsoft is shown as the dominant force in security on this chart so it’s understandable – but we saw this as an overblown reaction. Fortinet announced earnings after the close last Thursday and signaled weaker demand, which dragged the sector down.

Q. Ivana, what’s your thesis on cybersecurity generally and specifically let’s talk about Zscaler, CrowdStrike, SentinelOne, Palo Alto Networks, Cloudflare and Datadog – you own all of them.

I think cybersecurity is going through a similar cycle, like cloud, it’s just delayed by maybe three months. Decisions are made and are driven by sentiment. So we believe there are a lot of companies facing extended deal cycles, a lot of deal scrutiny. So there is clearly a down cycle that’s taking place, but this is creating a lot of attractive opportunities and with AI we believe there’s going to be a next cybersecurity wave where like now the threats are going to be AI based as well as the defenses versus currently we have a lot of companies that are using AI to prevent threats. So I think as we see that shift, you’re going to see the next cycle for cybersecurity and different areas are going to benefit in in different patterns.

You mentioned Microsoft entering the space. We believe it’s going to take time for them to enter the network security space. There is a lot of data that’s gone into companies like Zscaler, for example, they’ve been compiling this for for a long time. Similarly, Cloudflare similar situation. I think you’re spot on with your comment. So these companies have a leg up and we heard from Zscaler, for example, a lot of their innovation on their end is allowing customers to train language models using the security data that Zscaler owns.

So everybody’s is developing pretty quickly here. It’s not going to be so easy for a new entrant to catch up. And I think you’re spot on with CrowdStrike being able to effectively compete against Microsoft. Microsoft is really well-positioned on the low end where they can basically serve their installed customer base. But anytime you’re looking for something better or you’re looking for a top-tier cybersecurity solution, you’re likely not going to go with Microsoft. So we believe that while this is a new entrant, they’re probably going to capture some part of the market. I don’t see it as a big threat to Zscaler, Palo Alto, CrowdStrike, they all have their own niches and they all have their own strengths and weaknesses in each particular end market.

We don’t own Okta currently. We basically got involved in the company late last year when it had that big leg down. When they missed numbers, I went out and met with them and I did think the go-to market strategy was fundamental and is still not resolved. Even though they have a great product, you can’t really have a company that can’t really sell their product. So until they resolve that, I think it’s going to be a little bit in the penalty box. They have a really good product. Everything I heard about at that investor day was pretty positive except for the go-to market. And shortly after they hosted the investor day, one of the presenters that was leading the go-to market effort quit basically a month after. So I was like, OK, let’s take a break here.

OK, lastly we want to drill into Snowflake. When we first had Ivana on, the topic was buy the dip on Zscaler, Snowflake and Coupa. Spear has exited its Coupa position but Zscaler is its top holding, as we just discussed, and Spear has always been positive on Snowflake.

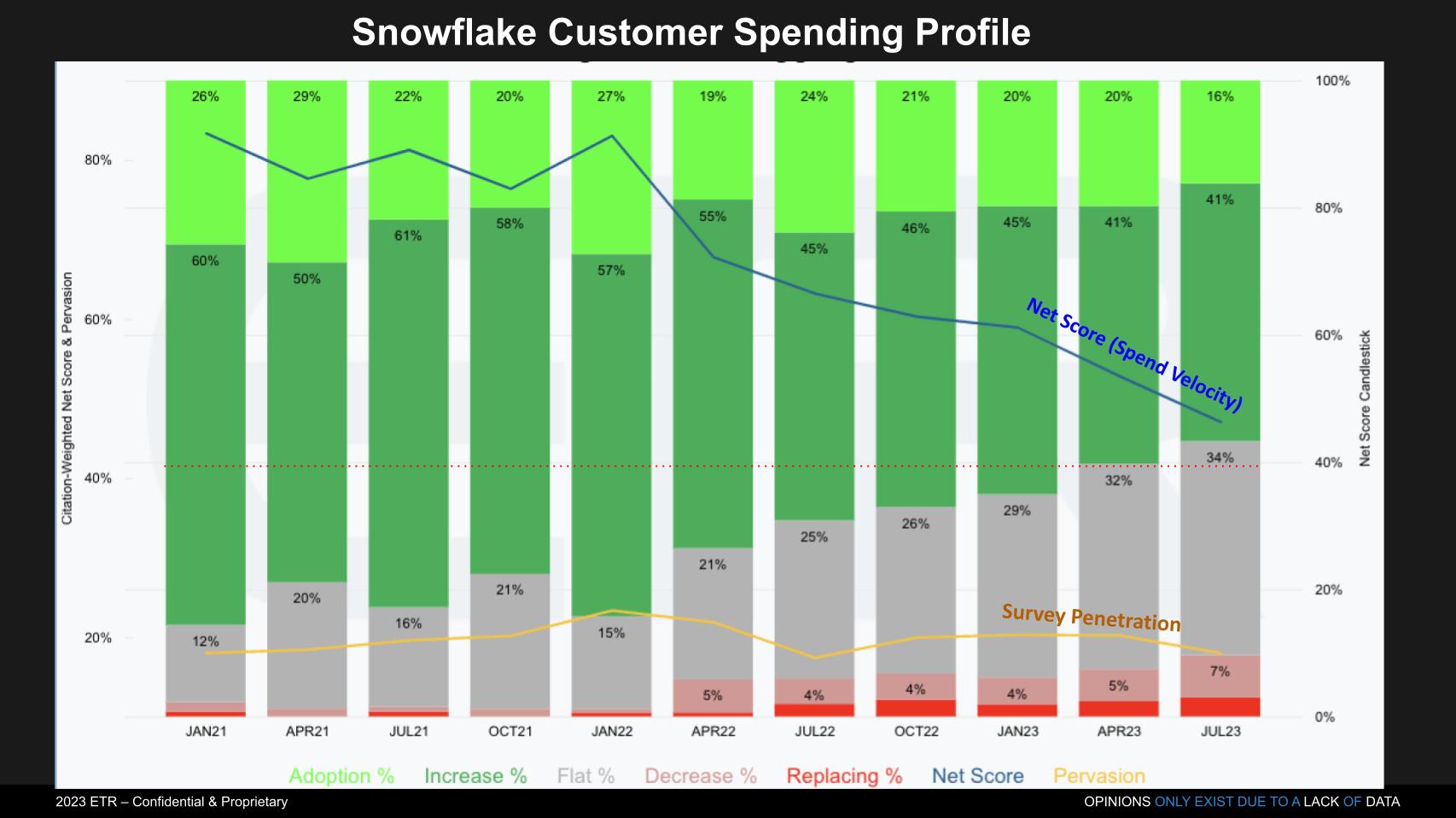

The chart above shows the breakdown of Snowflake’s Net Score, which is ETR’s proprietary measure of spending momentum. The lime green represents the percentage of customers in the survey adding Snowflake as a new platform. It’s contracting over time as is the forest green, which represents the percentage of customers spending more than 6% relative to last year. The gray bars are growing – that’s flat spending. The red is also growing. The pink portion of the red bars is spending down 6% or worse and the bright red is churn – which is still small but visible. Subtract the reds from the greens and you get Net Score which is the blue line that is declining. Even though it’s above 40% it’s sill decelerating pretty dramatically.

The yellow line shows the penetration in the survey which is the number of responses for Snowflake divided by the total survey responses (N~1,700). You can see that line is flattening which we’ve seen previously prior to an uptick.

So look… we still like Snowflake a lot. They are smack dab in the middle of the data trend. They’re moving fast in AI with M&A and partnerships. They’re making big moves to dominate the build out of data apps. But the survey data has been consistent and generally moving with cloud data. The combination of cloud optimization, competition from not only the cloud vendors but Databricks, the macro economy and shifting budget priorities have pressured the company’s performance. And it’s an expensive stock.

Q. Ivana, given the still rich valuation of Snowflake and these other factors, have you changed your outlook on the company? Or do you still see massive opportunities ahead and are you sticking with the story?

We still see massive opportunities ahead. And you attended the investor day as well and you had some great insights coming coming out of there. There is a lot of innovation going on and a lot of new product introduction for this company specifically. There’s still in the very early early innings, so we are not going to be able to see that flow-through to the bottom line or show up in revenues. But these new introductions, I think a lot of them are are breakthrough and a lot lot of them are going to get pretty wide adoption. Snowpark is one example with a lot of innovation there. So we’re pretty positive on the new product announcement. I think they’re going to play a critical role in the AI as as companies try to build out their own language models or they want to use cloud vendors’ language models.

I think they’re going to the Snowflake business model and given that they’re consumption-based, they’re really the hardest-hit out of everybody we focus on. So they’re the most cyclical company in our coverage universe. People buy credits, they don’t have to consume them, they can scale down, they don’t have to buy another set of large block of credits. They can buy them slowly. So there is a lot of ways where companies can reduce their credit usage for Snowflake, which is what your data shows and it’s spot on.

Now if you look at the commentary from the cloud vendors, like AWS is particularly important for Snowflake. Once you see those bottom, I think that’s the next leg would be to see Snowflake’s numbers bottom.

So I’ll be curious to see this data next quarter, how it’s tracking. I think there was also some one-offs there, with a few customers changing their data retention policies and one-offs can really shift the numbers on a quarterly basis and really make the quarter appear much worse than it actually was. I don’t think companies are broadly changing data retention policies. I think people are trying to retain more data if anything. So I think this was also exacerbating already a pretty bad environment for the stock. So I think expectations are very low right now and I think that it’s pretty well-positioned for the second half. It’s actually one of our higher-conviction ideas here as we go into second half.

Let’s end with the outlook for tech in the near and long term.

There’s a mix of good and bad news. The Fitch downgrade finally came. There doesn’t appear to be a looming recession, but that might mean the Fed tightening will continue. Wage growth is moderating but wages are higher, which raises costs. The Federal Trade Commission wants to handcuff big tech and you’ve got an election year ahead with mixed reviews of the candidates, to say the least.

All that said, the markets have shrugged off bad news and when there’s positive news, the market runs. Look at today (Friday). Apple misses but tech is up on Amazon’s news.

Generally earnings estimates have been met and exceeded, but much of that is from conservative guidance and relatively easy compares from a softer 2022.

And then there’s the AI, which is lifting tech and giving us the promise of productivity gains.

Q. Ivana, the market has run up a lot so are you adding risk in this inflated cycle because the best of AI is yet to come? Or are you waiting for better entry points?

We’re fully invested generally and I think we’re looking at it historically, we are on a pretty “risk-on” setup going into second half. What gives us confidence is earnings. So once earnings bottom, stocks bottom and depending on the trajectory of earnings, that will determine the slope of the recovery. But I do believe we’re in a recovery. So this earnings season, companies have reported pretty strong numbers overall. Some of the stocks reacted more positively like Amazon where expectations were low. Some were already priced in, like Microsoft was a good example of that. But you’re still looking at the second half and the earnings trajectory and surprises is still levered more to the upside than the downside in my opinion. So we think basically now that valuations have reset lower post this tech bust, right? I think the key will be which companies will surprise on earnings and which ones will have downside going into second half. But broadly we see more upside than downside.

For our part we are generally optimistic, but spending from tech buyers remains tepid with a forecast of under 3% budget growth for 2023 relative to last year. As well, it appears AI initiatives are stealing budget from other projects and, though that could be a positive, the timing of AI monetization for customers remains a question and AI enthusiasm could backfire.

As such we could see a continuance of what we’ve called the seesaw economy in tech, where it appears the road ahead is clear but then the market shifts. The amplitude of the swings is becoming more compressed and less unpredictable as evidenced by earnings meets and beats. But the new abnormal brings unchartered waters that will require experienced managers toto anticipate and respond.

If AI lives up to its promise, it will be a big factor in enhancing response times, reducing disappointments and creating massive upside for those that get it right.

Many thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

Now for the CYAs…

Spear disclosures: For up-to-date fund holdings and prospectus visit spear-funds.com

The performance data quoted represents past performance. Past performance does not guarantee future results. The investment performance and principal value of an investment will fluctuate so the investor’s shares when sold or redeemed may be worth more or less than their original cost and current performance may be lower or higher than the performance quoted. For performance current to the most recent month-end please call 1-833-340-7222.

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.