CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Avis Budget Car Rental LLC popularized the phrase, “We’re number two. We try harder.” But what do you do when you’re number four?

That’s the challenge facing Google LLC in its drive to overcome a late start, a once questionable commitment and two dominant competitors in the market for public cloud services. With a market share that has languished in the sub-10% market range for a decade, the Google Cloud Platform has a steep hill to climb.

International Data Corp. estimates that Google’s 2020 public cloud market share was 4.6%, placing fourth behind Amazon Web Services Inc. with 43.6%, Microsoft Corp.’s Azure with 14.3% and Alibaba Group Holding Ltd.’s cloud with 7.6%. The good news is that GCP’s 49.3% growth in 2020 as estimated by IDC was faster than either of its two North American rivals, although not nearly enough to threaten either of them anytime soon.

That isn’t stopping the search giant from trying even harder, however. Google is now moving ahead with a strategy that observers say is at last coherent, distinctive and in line with where much of the enterprise market is going.

The company can take some heart from trends like the one recently documented by managed service provider Ensono LP. Its survey of 500 cloud decision-makers found that 41% use or currently plan to use GCP services – although most likely as a second or third cloud – behind only Microsoft’s 58%.

“They’re doing better but still need to get their message out,” said Dave McCarthy, a vice president in IDC’s infrastructure practice. “The conversation with enterprises still tends to revolve around AWS and Azure.”

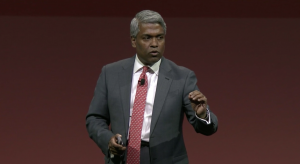

With the appointment of former Oracle Corp. executive Thomas Kurian as chief executive of the cloud division in January 2019, Google indicated it’s serious about capturing enterprise business. The company had struggled for years with the perception that it was arrogant and disconnected from the needs of enterprise customers.

It didn’t help that Google had a reputation for losing interest in products and abandoning them, sometimes abruptly, leaving customers in the lurch. Executives at parent company Alphabet Inc. reportedly even considered abandoning the cloud business as recently as early 2018. Google has called that report “simply not accurate.”

By all accounts, Kurian has brought discipline and focus to Google Cloud. Photo: Robert Hof

But the arrival of Kurian and a slate of veteran executives from enterprise information technology giants such as SAP SE, Oracle and Microsoft has left little doubt that Google is now serious about the business. Lacking Amazon’s shock-and-awe product portfolio and Microsoft’s 30 years of enterprise relationships, Kurian has focused his business on being what the other guys aren’t.

The new strategy can be boiled down to a few essential elements: a commitment to open-source platforms and standards, playing nicely with other cloud providers and making GCP the easiest to use and most secure platform for companies just beginning their cloud journey.

Kurian has also taken steps to make Google the easiest company for software partners to work with by undercutting rivals on commissions, stepping up co-marketing and joint sales efforts, and pledging not to compete with them.

Nearly three years into Kurian’s term, there are signs that the strategy is bearing fruit. The company has recently signed multiyear deals and extensions with some major business and consumer brands, including Home Depot Inc., Scotiabank, Deutsche Bank and Ford Motor Co. At the Google Cloud Next conference that kicks off Oct. 12, the company is expected to announce new deals with several other multinational firms.

Partners say the change is tangible. “The volume, frequency and breadth of requests from people wanting to run on GCP is clearly increasing,” said David Meyer, vice president of product management at Databricks Inc.

“Customers are willing to have conversations about Google in accounts we never thought they would be talking to,” said Boone Quesnel, head of worldwide cloud alliances at Starburst Data Inc.

In advance of Cloud Next, SiilconANGLE interviewed more than a dozen cloud partners and industry analysts to assess the company’s performance in living up to its promises of openness and flexibility. Several customers were contacted but all declined to be interviewed, with several citing company policies. However, several companies have issued endorsements in conjunction with recent deals.

“Our choice of Google Cloud at this stage in Symphony’s journey confirms our confidence in their architecture, the way they conduct their business and the trust in the relationship we’ve established,” said Brad Levy, CEO of Symphony Communications Services LLC, which said in July that it will move its entire communications services platform to Google Cloud.

The consensus: Google’s momentum is real, and its message is resonating with customers that are increasingly looking to adopt multiple clouds and workload portability. The company’s engineering prowess and leadership in artificial intelligence and data analytics are appealing to enterprises looking to adopt more data-informed decision-making. And it’s establishing a reputation as a trusted partner. However, Google remains a secondary or tertiary choice for most enterprises, which are not yet comfortable casting their lot with a company grounded in consumer markets and a not entirely proven record in consistently providing cloud infrastructure.

“AWS beat Google and everyone else to the public cloud market and Google doesn’t have the same entrenched enterprise customer base to cross-sell to like Microsoft has with Windows and Office,” said Dan Elman, research manager at Nucleus Research Inc.

“They’re up against a competitor in AWS with 15 years in the cloud and Microsoft with 30 years in the enterprise,” said Thomas Galizia, global chief commercial officer at Deloitte LLP. “It’s hard to make up for 10 years of lost ground.”

Deloitte’s Galizia: “It’s hard to make up for 10 years of lost ground.” Photo: Deloitte

Last November Kurian outlined an “open cloud” vision rooted in open-source software, workload portability and a willingness to work with competitors. The strategy clearly plays to the company’s strength as well as its weakness in market share. Google has nurtured more than 2,000 open-source projects and was the principal author of such mainstream platforms as the TensorFlow machine learning library and the wildly popular Kubernetes cloud-native development platform. The company is consistently among the top contributors to projects hosted by the Cloud Native Computing Foundation.

“One of Google’s greatest strengths is its commitment to the open-source community,” said IDC’s McCarthy.

How much that matters to customers is debatable. Although open source is now ubiquitous in the enterprise, “customers also value proprietary capabilities,” said Craig Lowery, a Gartner Inc. analyst. “It’s important but not a make-or-break.”

Where Google’s open-source track record has arguably had the most impact is within its partner ecosystem. Microsoft’s historical animosity toward open source continues to haunt the company despite its recent receptivity. Amazon has been criticized for co-opting open-source projects and selling them as branded services, in some cases undercutting partners.

In contrast, Google’s track record endears it to open-source advocates. “They see it as a value to their ecosystems and opposed to something they can deploy themselves,” said Starburst’s Quesnel.

MariaDB Corp., which sells products and services based on the open-source MariaDB database management system, chose GCP to launch the enterprise version of its flagship product as a managed service.

The choice of Google “really came down to a commitment to open source and a true partner-first business model,” said Kevin Farley, MariaDB’s director of strategic alliances. “While other major clouds try to create a moat, GCP is all about building bridges.”

Databricks’ Meyer: “At an engineering level it’s different with Google.” Photo: Databricks

Data analytics mega-unicorn Databricks has partnerships with all major cloud vendors but chose to integrate fully with the Google Kubernetes Engine for the first cloud-native version of its platform. Google’s open-source track record and engineering-centric culture were key factors in the decision, Meyer said. “We have great collaborative relationships with all the clouds, but at an engineering level it’s different with Google,” he said.

The openness pitch also works to Google’s advantage with companies looking to leverage Kubernetes for cross-platform portability. Although the code is freely available and supported by numerous providers, an aura of invention still accrues to the search giant.

“It’s not who has the most commits. It’s who has the actual expertise that matters,” said Richard Seroter, director of outbound product management at Google Cloud. “We’ve operationalized it better than anybody else.”

Google’s open-source embrace also addresses one of its most entrenched deficits, which is the lack of developers and administrators who are familiar with its platform. “I can find many engineers who are comfortable with AWS and Azure but fewer who are familiar with GCP,” said Anu Subramanian, chief technology officer at CloudCheckr Inc., a cloud optimization firm that’s in the process of being acquired by NetApp Inc. “How you engage that community is through open source.”

Cloud platforms have the flywheel effect of driving the use of third-party applications, which is why marketplaces are so essential to all cloud infrastructure providers. IDC has estimated that every dollar spent on GCP infrastructure generates $5.32 in ancillary services, a number that will rise to $7.54 by 2025.

Every independent software vendor that wants to be in the cloud is already partnered with Amazon, so Google has had to differentiate by being better at the practice. According to ISVs who were interviewed, it has done a pretty good job.

“They let us partner with them our way without a lot of hoops to jump through,” said Kelly Silva, strategic business partner development manager SIOS Technology Inc., a cloud operations management and business continuity firm. “We are building our business with Google the way we want to build it.”

Amazon, which has a history of competing with partners in its retail business, has exhibited some of the same behavior in the cloud. Its tactics stick in the craw of open-source competitors.

Two years ago, AWS launched a NoSQL document database built on the MongoDB open-source platform that’s also sold by AWS partner MongoDB Inc. A few months later it launched a streaming service based on the open-source Apache Kafka project in 2019 and nearly a year after that a DBMS based on Apache Cassandra. In all cases, the AWS service competed directly against partners in its marketplace.

MongoDB’s Chhabra: “They’re best-in-class on leveraging the marketplace.” Photo: MongoDB

In contrast, GCP has pledged to avoid competing with its partners, which say so far it’s walking the walk. “They’re best in class on leveraging the marketplace,” said Alan Chhabra, MongoDB’s senior vice president of worldwide partners, public sector, Asia and ISV sales.

Google’s partner policies have “been instrumental in successfully co-selling our product on their platform and garnering the right attention across our sales teams,” said Logan Smith, director of global cloud and ISV partnerships at graph database maker Neo4j Inc. “It’s much easier to broker the idea of a solution with Google Cloud and to get in front of their sales teams.”

Partners said there’s also a sense that Google’s underdog status makes it a more aggressive partner. “They’re super-hungry, as we are,” said Starburst’s Quesnel.

Improving partner relationships probably isn’t going to launch Google into second place in the infrastructure-as-a-service market, though. “I’m not aware of any cloud provider that doesn’t treat partners well,” said Gartner’s Lowery. But it can create tighter partnerships with ISVs that fear that their cloud partners will become competitors or that they will be lost in the crush of thousands of other marketplace choices. Lowery’s recent research found that “partners do see Google as being very supportive,” he said.

In its early days, Google’s legendary technology prowess was sometimes a hindrance. The company was prone to looking down on customer infrastructure as outdated and inefficient, sometimes expressing incredulity that enterprises weren’t more eager to build their IT the Google way.

Under new leadership, the company has attempted to turn its vaunted technology chops into a virtue. “They have a thirst for innovation unlike anything I’ve ever seen before,” said Deloitte’s Galizia.

Google’s engineering-centric infrastructure appeals to partners who are building on its platform. “Our data scientists are very comfortable working and building in the GCP ecosystem,” said David Skinner, chief strategy officer at Acxiom Corp., a database marketing and identity management firm. “This is the biggest differentiator of working with GCP.”

Google has clearly staked out a leadership position in data analytics with its machine learning frameworks and BigQuery data warehouse. Last year it unveiled BigQuery Omni, a version of the product that works on data stored on multiple cloud platforms, a move that underscored its platform agnosticism.

Cloud economist Quinn: “GCP makes the experience of using the cloud simpler and more accessible.” Photo: SiliconANGLE

The company has also invested in making its platform the simplest to use in an effort to court customers just getting started in the cloud as well as impatient developers. “GCP makes the experience of using the cloud simpler and more accessible,” said Corey Quinn, cloud economist at cloud consultancy firm The Duckbill Group.

“As the other providers grow more complex and fall deeper into a monetization strategy, they’re adding more and more services,” said Rick Kilcoyne, chief technology officer at CloudBolt Software Inc., a maker of a hybrid cloud management platform. “The complexity that grows from that gives Google an opportunity to be the ‘easy button’ of public cloud.”

There is perhaps nothing more distinctive about Google’s cloud strategy than its oft-stated commitment to play nicely with competing cloud platforms. Although the approach is to some degree necessary given the company’s small market share, it has followed through with initiatives such as BigQuery Omni and its commitment to maintaining cross-cloud capabilities for the Looker business intelligence platform it acquired two years ago.

Google separated itself from the cloud pack with its 2019 introduction of Anthos, a fully compatible version of its cloud platform intended to be run on customers’ premises and in managed service and telecommunications environments. Unlike similar offerings such as AWS’ Outposts, Microsoft’s Azure Stack and Oracle’s Cloud@Customer, Anthos is a software-only offering that doesn’t require customers to buy Google hardware.

“You don’t have to wheel a big rack into your data center,” said Google’s Seroter. “You can run it on extra servers or on a server in the backroom.”

Google is betting that customers have grown comfortable enough with cloud platforms to expand their reach and seek to match workloads to the best infrastructure. It also hopes to address what IDC’s McCarthy called “unintentional multicloud” environments that are created when companies acquire other firms that are using a different cloud.

Anthos is also based on Kubernetes, which is lauded for its portability. As the number of developers and administrators skilled has Kubernetes has grown, Google is hoping that familiarity with the platform will also blunt its competitors’ advantage in the skills arena. “Learning a new cloud provider is a massive undertaking,” said Duckbill’s Quinn. “If you get people into the ecosystem early, that is what they tend to stay with.”

By most accounts, the strategy is well-timed. A Google-commissioned survey of 2,000 IT decision-makers released last spring reported that 77% said hybrid or multicloud support is a “must have” when choosing a vendor. “There are very few Fortune 2000 companies today that don’t at least have a primary and secondary cloud strategy,” said MariaDB’s Farley.

Whether organizations really want to spread workloads across multiple clouds is debatable. Multicloud “is often talked about and then when it comes down to a decision it’s not that important,” said Gartner’s Lowery. One reason is that moving data back and forth between multiple platforms is expensive and time-consuming. Platforms such as BigQuery and Looker are intended to address that problem.

Nearly everyone says the strategy resonates with customers that increasingly want to at least have the option of a second or third cloud for feature availability or backups. “That’s the direction we’re seeing customers going,” said Ben Gitenstein, vice president of products and solutions at Qumulo Inc., a data storage provider.

Enterprise IT markets generally follow one of two paths. Either they come to be dominated by a single large player — as is the case in database management, networking and desktop software — or they fragment among many smaller players that each stake out their own niches, as is the case in personal computers and security.

Google’s Seroter: “It’s not us or nothing; it’s us and other things.” Photo: Richard Seroter/Twitter

The cloud infrastructure market started out along the former path, but its more likely trajectory is toward the latter. That trend favors Google’s approach of playing the long game and growing its share over time.

Five years from now, the cloud infrastructure market won’t be the same, said Gartner’s Lowery. He sees platform providers increasingly diversifying into vertical markets and software, with intermediaries making the underlying platforms all but invisible. “It’s going to be less important who’s got the infrastructure market share and more important who’s got the application market share,” he said.

With offerings in data analytics, artificial intelligence and several vertical markets that are considered best-of-breed, Google stands to score some points in those growth markets.

AWS’ market share has been steadily eroding as a natural consequence of new competition and customers diversifying their cloud portfolios, but no one sees its lead being threatened. “Clouds are pretty sticky, so people don’t move between them very quickly,” Lowery noted.

Google says it’s in the game for the long term and that it has the “best future-looking cloud,” in Seroter’s words. Although he said the goal is “to make GCP the premier destination,” he also acknowledged “that’s not going to be practical all the time. It’s not us or nothing; it’s us and other things.”

SIOS’s Silva: “We are building our business with Google the way we want to build it.” Photo: Kelly Silva/LinkedIn

Also working in Google’s favor is the fact that enterprises are increasingly choosing cloud providers based on factors other than infrastructure alone. Microsoft derives a lot of cloud infrastructure business from customers of its Microsoft 365 and Dynamics applications. AWS’ sheer throw weight and success in the government sector is a powerful barrier to competition.

But Google has some trump cards as well. Its search analytics prowess has been successful at scoring deals with customers looking to streamline operations and improve knowledge of their customers. In signing a multiyear agreement with Google early this year, The Bank of New York Mellon Corp. said it would use Google’s data analytics tools to train AI models on millions to dramatically improve advance detection of transaction failures. “This prediction model could be a game-changer for market participants,” said Brian Ruane, chief executive of BNY Mellon Clearance & Collateral Management.

Google parent company Alphabet’s other ventures in areas such as autonomous vehicles, life sciences, financial technology and e-commerce are attractive to players in those vertical industries, said Deloitte’s Galizia. Recent multiyear deals with large enterprises such as Bell Telephone Co. of Canada, General Electric Appliances Inc., HCA Healthcare Inc. and Ford were driven as much by those customers’ interest in leveraging other Alphabet assets as in the cloud platform itself.

For example, Google partnered with the Mayo Clinic and others on the development of its Healthcare Data Engine, which uses BigQuery analytics and artificial intelligence to process extremely large datasets of patient data. “We were hitting a wall with our ability to innovate on-prem,” said Jim Buntrock, vice-chair of information technology at Mayo Clinic. “By moving to the cloud we’re able to build tools more easily, at scale.”

“These are big, transformative deals,” Galizia said. “Execution is critical.”

Google’s head start in areas such as machine learning and deep learning have brought it “some of the best AI talent in the market,” said Acxiom’s Skinner, adding “I think this could come out more strongly in their messaging.”

And nearly all of the partners who were interviewed for this story said the future of their relationship with GCP is up and to the right. “I expect the volume of business we do with Google Cloud Platform to grow significantly over the next 12 months,” said SIOS’ Silva.

“We expect to roughly double our business volume with GCP [over the next 12 months] building on impressive numbers this year,” added Neo4j’s Smith.

Galizia noted that Google managed to dominate the search market despite a late start and competition from more than a dozen search engines that preceded it. It won because it delivered a user experience that was hands-down better than anyone had ever seen.

Lightning is unlikely to strike twice in the cloud. But for a company with nearly a $1.9 trillion valuation and one of the world’s most iconic brands, there’s plenty of time to make up for lost ground.

THANK YOU